Comparative Study of Defense Industries -Autonomy, Priority, and Sustainability- (Executive Summary)

The Issues

This report aims to provide a comparative study of the defense industries in Japan and other countries. Despite the Japanese public’s positive reception of efforts to strengthen its defense capabilities, discussions about strengthening the defense industry, which is the basis of defense itself, have not received as much attention as the former.

Based on the three strategic documents announced in December 2022, including the National Security Strategy, Japan has decided to strengthen its defense capabilities fundamentally and is planning to increase its defense expenditures continuously. Combined with the fact that defense expenditures have been growing over the past decade, this trend should, on the surface, strengthen the basis of the defense industry.

Nevertheless, the Japanese defense industry has yet to foster excitement over the unprecedented increase in demand. On the contrary, the challenges surrounding the defense industry remain, as several suppliers, mainly small and medium-sized enterprises (SMEs), are withdrawing from the industry, and there are concerns about the sustainability of the business due to low-profit margins.

Despite the ongoing growth in defense spending, why is there simultaneously an expression of crisis within the domestic defense industry? What measures is the government taking to address this factor/problem? Are these policies effective and sufficient? If not, what further policies are needed? While interest in the defense industry is gradually growing, little research in Japan comprehensively addresses these issues.

On the other hand, an awareness for the need to strengthen the defense industry is not unique to Japan. Countries such as the United Kingdom and Australia, having the similar level of domestic demands in defense procurement to Japan, encounter similar challenges. The United States has by far the largest defense industry of any major country, but the business environment surrounding the U.S. defense industry is far from secure.

If so, what are some common backgrounds and differences in the cases of defense industries and defense industrial policies in other countries? Are there any examples or policies that Japan can refer to for its own policies?

Based on this awareness of the above issues, this report aims to draw lessons for Japan’s defense industry policy. It will achieve this by identifying recognized issues in Japan’s defense industry, examining proposed solutions, and comparing and referencing similar methods in overseas cases that address these shared concerns.

In addition to Japan, the survey covered the following countries: the United States, which has a defense budget and defense industry of a different size from that of Japan but is involved in several advanced initiatives; The United Kingdom, with a domestic defense demand roughly comparable to Japan’s previous years defense spending; Australia, which, like Japan, has a strong security presence as a US ally but lacks a sufficient domestic defense industry base; South Korea, which has been successful in recent years in overseas exports; and Israel, which has successfully developed advanced weapons systems through innovation.

International Overview of Defense Industrial Policy

In the report’s introduction, we first discussed the historical trends that run through the global defense industry before describing cases specific to each country. A common thread running through the cases in this report underscores the crucial role of the government in shaping the defense industry’s business strategy and restructuring. Unlike general commodities, the buyers of defense equipment are limited to the government and military, which means that defense policy and equipment procurement plans directly impact corporate activities. However, the extent of this impact varies from country to country. Even in the case of civilian goods, there are industrial sectors where the government strongly intervenes through license systems, regulations, and subsidies, such as those related to strategic materials and critical technologies. However, defense equipment is a unique industry in which end-users and procurement volumes are limited, and thus, the degree of freedom in the market is severely constrained.

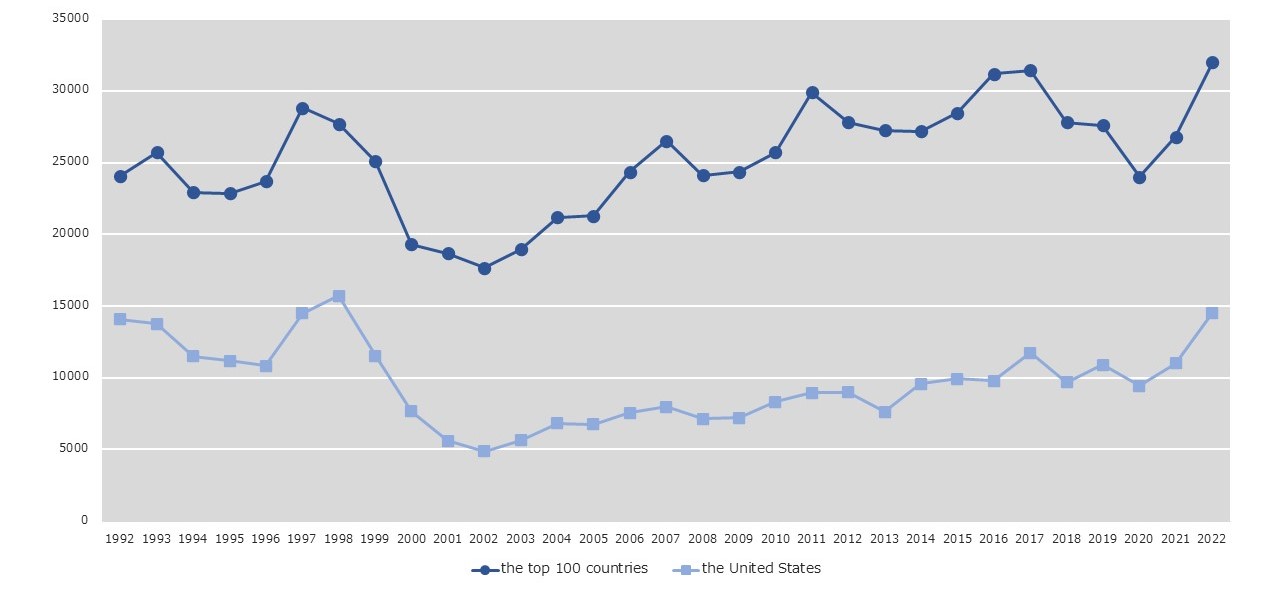

Moreover, U.S. products and military technology, which have an overwhelming competitive edge in the international defense equipment market, significantly impact each nation’s defense industrial policy. The global competitiveness of U.S.-made weapons (weapon systems) has more and more increased in recent years, forcing other countries, even allies, to respond to U.S. technological superiority.

Source:created by the author, based on SIPRI Arms Transfers Database, https://www.sipri.org/databases/armstransfers. unit: one million TIV (trend indicator value) base.

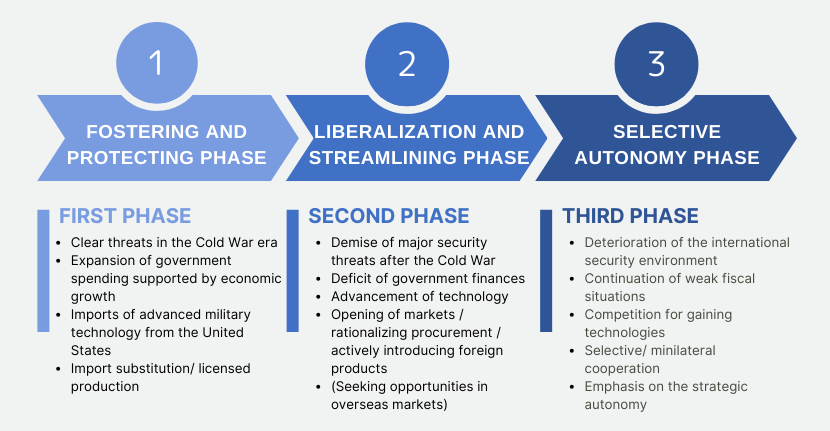

In the countries we studied for this research, other than the United States, their defense industrial policies can be generally discussed in the following three chronological phases after World War II. The first phase is the fostering and protecting phase, driven by the expansion of fiscal power supported by economic growth and the defense needs of the Cold War era. In this period, the government imports advanced military technology from the United States through measures such as licensed production or technology transfer. It then adopts import-substitution policies for manufacturing defense equipment domestically. However, in some cases, like Australia, the weak domestic industrial base made it challenging to implement an import substitution policy.

In the second phase that followed, the economic and technological difficulties of maintaining this import-substitution model were recognized. This was due to the decline in security threats and changes in the regional security environment after the end of the Cold War, the deterioration of government finances as economies matured and societies aged, and the relative decline in the technological level and price competitiveness of domestically produced weapons compared to U.S.-made weapons. In light of these perceptions and practical constraints, these countries moved towards opening their markets and rationalizing procurement by actively introducing foreign products, marking the beginning of the liberalization and streamlining phase.

The countries we researched took diverse approaches during this phase. The first type, exemplified by the United Kingdom, Israel, and South Korea, involves opening domestic markets while actively expanding strong domestic companies, products, and systems overseas. The second type, represented by Japan, does not pursue overseas expansion due to policy constraints. In the third type, illustrated by Australia, liberalization has resulted in the acquisition of prime domestic firms by foreign manufacturers, creating a supplier-centered industrial structure.

Today, the third phase, the selective autonomy phase, is emerging in response to the deteriorating international security environment. It reflects the recognition that reinforcing the domestic defense industry is essential in line with strengthening defense capabilities. This phase is characterized by the fact that it does not necessarily revert to the first phase because it recognizes the need to strengthen the infrastructure supporting defense capabilities without resolving the deteriorating fiscal base and technology gap with the United States, which were the leading causes of the second phase of liberalization and efficiency improvement. In other words, while assuming liberalization and efficiency in defense procurement, government support and investment in companies and strengthening of public-private partnerships are being sought by limiting their focus to targeted technologies, fields and measures to address vulnerable supply chains. And, given the current trend where innovative technologies are emerging from the civilian sector rather than the military sector, incorporating advanced dual-use technologies into the defense sector through government funding is at the core of public-private partnerships.

This pursuit of selective autonomy, with its focus on specific areas such as the maritime and air domain, missiles, and emerging technologies, is sometimes accompanied by functional cooperation (such as AUKUS by Australia, the United Kingdom, and the United States; the Global Combat Air Program (GCAP) by Japan, the United Kingdom, and Italy), and the areas that promote free competition, mainly in older technologies, to be developed in a more mixed manner. One exception is Israel, which, rather than producing defense platforms domestically, seeks to strengthen its industry’s indispensability within the international market by developing specific technologies and systems with proprietary strengths and integrating them into platform products made by the United States and other countries.

The common dilemma for these countries is that while they all need a wide range of defense equipment that uses the latest technology to respond to the security challenges and threats they face, producing and procuring all assets from domestic industry is financially, technologically, and economically challenging. On the other hand, relying entirely on imports would leave defense equipment, a fundamental element of defense capability, to other countries, and unforeseen circumstances and risks may undermine their strategic autonomy. The difficulty of defense industrial policy lies in constantly dealing with the trade-offs between security requirements and economic sustainability, and between autonomy and international cooperation. Deliberately selecting areas to focus resources to use limited resources effectively has been required in overcoming this dilemma.

Source:created by the author

Challenges for Japan’s Defense Industry: The Pitfall of Investment without Prioritization

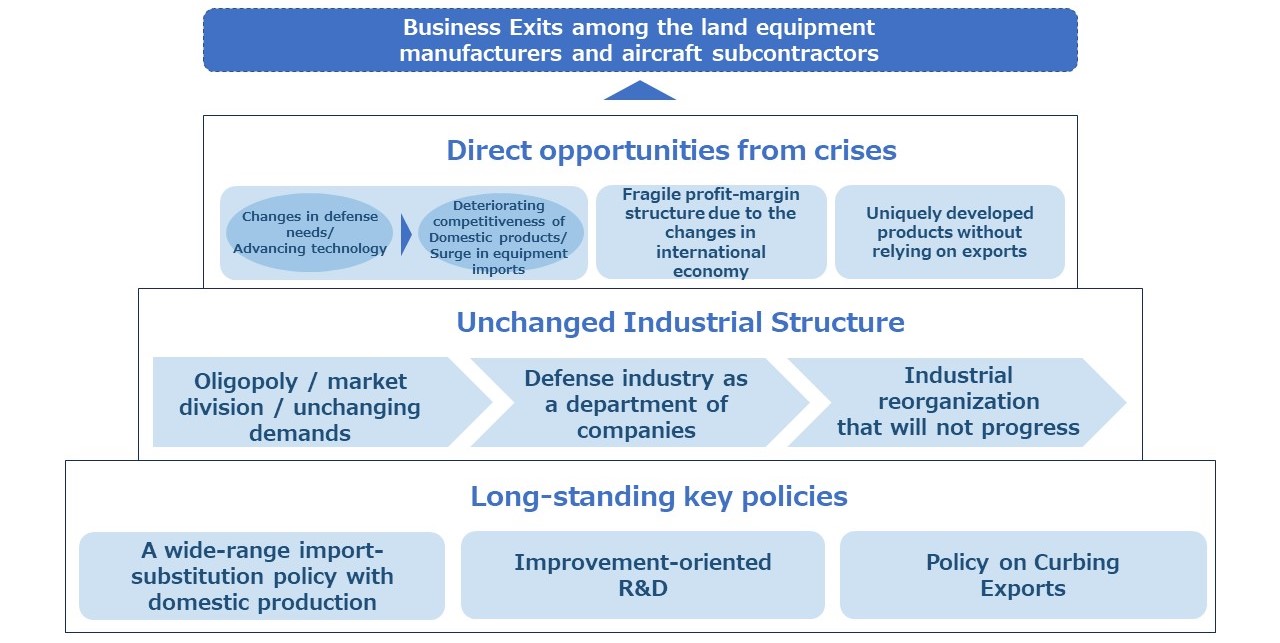

In light of these international trends, Chapter 1 analyzes the challenges facing Japan’s defense industry policy at three levels: the government’s underlining policies, the industry structure based on these policies, and the direct causes of the industrial crisis in recent years. At the first level, we identify the underlining policies contributing to the continuation of wide-ranging yet small-scale demand: import-substitution policies and improvement-oriented (Kaizen-type) R&D, which aim to increase indigenous production. Strict foreign export curbs have also contributed to this policy trend. At the second level, we pointed out the characteristics of the defense industry’s structure as oligopoly and market division with no competition that have stayed the same for a long time due to the above policies. Finally, at the third level, we discussed a rapid increase in imported equipment as a result of the shift in defense requirements and a fragile profit structure due to the changes pushed by international economy (such as those in prices and exchange rates) that have surfaced rapidly in recent years while demand aggregation and increase in the industry’s competitiveness are absent. We argued that the impact of these changes has resulted in businesses leaving the industry, notably land equipment manufacturers and aircraft subcontractors. The perceived crisis in the domestic defense industry, even as defense spending continues to increase, is mainly attributable to these emerging business withdrawal trends.

To make the defense industry sustainable, we must understand these structures, and not only address the immediate challenges we see, but also change the underlying policies that determine the structure of the industry. From this perspective, the government’s measures appear generally appropriate in addressing the emerging direct crises. They have thoroughly reassessed the price calculation system for defense equipment, enabled flexible responses to rising costs, and attempted to understand the structure of subcontracting contracts comprehensively. In addition, new efforts are being made to go beyond traditional improvement-oriented R&D to identify new capabilities needed for future warfare and to incorporate advanced civilian technologies. However, implementation issues remain. These include the lack of a framework for the private sector to propose new projects and concepts independently of government requirements/specifications and the lack of a method for appointing hybrid human resources with expertise of both private-sector technologies and government requirements.

On the other hand, the government’s measures to strengthen the defense industry, which focus on keeping the existing industrial structure intact, neither necessarily encourage structural changes in response to changing defense requirements nor contribute to strengthening the profitability and competitiveness of companies over the medium to long term. The ‘Basic Policy’ based on the Defense Production Base Reinforcement Act is a partly reverted policy emphasizing the return to domestic production of defense equipment. It has also muted the voices inside and outside the government calling for industrial restructuring and corporate integration. As a result, the government’s various support measures are fraught with the “investment without prioritization” trap.

Considering these persisting challenges, Chapter 1 emphasizes economic rationale. Rather than preserving sectors with low demand through fiscal support, the aim should be to consolidate domestic defense demands across sectors and products by integrating various products as well as promoting overseas exports and international expansion, leading to empowering companies to voluntarily make decisions regarding integration and restructuring. In order to make the defense industry sustainable, it is necessary to choose a self-sustaining industry foundation, consolidate its strengths, and incorporate civilian technologies.

Source:created by the author

Although the circumstances the countries surveyed face differ, they share some common structures with Japan and provide lessons from their successes or failures in their leading initiatives. In Chapters 2 through 6, based on the awareness of the issues identified in Chapter 1, we analyzed and evaluated each country and made specific policy recommendations based on the findings.

Recommendations Based on a Survey of the Defense Industry in Each Country

(Chapter 2 The United States: Gains and Burdens as the ‘Arsenal of Democracy’)

The U.S. military industry, which became the “arsenal of democracy” through both World Wars, grew into a massive industry during the Cold War with substantial annual budgets and led the defense equipment and technology policies of allied countries and others with the advent of Soviet nuclear weapons. After the Soviet Union collapsed, the Government decided to reduce the defense budget drastically, which resulted in the shrinkage of the defense industry’s manufacturing capacity, forcing the companies to consolidate and depend more on foreign countries to sustain the supply chains. Under strategic competition with China today, the United States faces the challenge of maintaining its military technological superiority and domestic industrial base. In addition, the war in Ukraine has led to a surge in demand for arms and ammunition, raising concerns that the U.S. “arsenal” will be depleted. The Unites States is working on various measures to address these challenges and seeking cooperation with its allies. Understanding these trends is essential in considering measures to strengthen Japan’s defense production and technology base.

(Chapter 3 The United Kingdom: The Pursuit of Selective Autonomy and Overseas Demand)

After World War II, the United Kingdom, which suffered from weak defense demand and declining competitiveness of the industry, gained international competitiveness in the defense sector through government-led mergers, restructuring and expansion into the U.S. market through acquisitions of U.S. companies and other measures, and international joint development projects with European countries. These policies enabled her to sustain a stable domestic production base in response to the intensified market liberalization. Moreover, the partial privatization of government R&D organizations triggered by the fiscal crisis resulted in the transfer to the private sector of human resources, who can make proposals to the government with expertise in both the public and private sectors. These human resources and companies have played a vital role in incorporating advanced dual-use technologies into the defense sector, as the tendency to retain a domestic industrial base around innovative technologies selectively has arisen in recent years.

(Chapter 4 Australia: The Agony of the Middle Power Defense Industry)

Australia’s postwar force development has long been impacted by external factors such as its allies, the U.S. and the U.K. As a result, it has failed to create consistent domestic demand and sufficient incentives to improve the defense industrial base, resulting in a downward spiral that further weakens the industry. To change this circumstance, the Australian government conducted various policy reviews and strategy formulations around 2015, selected defense sectors to nurture and concentrate the budget, and took steps to improve the profitability of SMEs to strengthen the industrial base. In addition to these efforts, the Australian Department of Defense is increasing the defense industry’s technological capabilities and international competitiveness by building export strategies to expand sales channels.

(Chapter 5 South Korea: The Gap-Filler of Defense Supply and Demand)

During the Cold War, South Korea sought technology transfers from the United States. It fostered its defense industry by taking advantage of its inferior military balance with North Korea and its strategic inferiority regarding the withdrawal of U.S. forces from South Korea. However, when domestic demand, especially for land-based equipment, slowed down since the end of the Cold War, it took this as an opportunity to turn to aggressive overseas exports. As a latecomer to arms exports, South Korea has adopted an export strategy of positioning itself as a ‘gap filler,’ focusing on trade with countries that, due to international political dynamics, have yet to be able to import arms from major countries despite their demand. In addition, vital government initiatives and close cooperation between the public and private sectors are promoting the entry of companies with innovative technologies into the defense industry.

(Chapter 6 Israel: Innovation Power and Indispensability in the International Marketplace)

Until the late 1980s, Israel pursued a munitions independence policy, emphasizing domestic production of defense equipment to ensure its strategic autonomy. However, after realizing this policy was unrealistic and made them vulnerable to influence from the United States and other countries, Israel began to specialize in fields in which it excelled, such as electronic warfare systems that extensively use dual-use technologies and incorporate them into many Western weapons. This policy change allowed the Israelis to create indispensability within the West and obtain high-level strategic autonomy. Israel continues to excel in developing superior weapons systems today, thanks to strategic investments in its defense industry, including cultivating talented human resources, substantial R&D funding, and establishing a profitable innovation ecosystem.

Policy Recommendations

(Direction of the Defense Industry Policy and Strengthening of the Production Base)

1. 1. Identify and selectively invest in technologies and industrial infrastructure critical for indigenous production.(UK, Australia)

2. As domestic production policy has limits in establishing strategic autonomy, it is essential to promote the development of sustainable and effective international interdependence.(Israel)

3. To address supply chain and profit margin issues, focus on removing barriers for new companies.This policy will also encourage the entry of innovative businesses into the market.(UK, Australia)

(Research and Development)

4. Create a mechanism to facilitate new entries into the defense industry, drawing inspiration from the Defense Innovation Unit (DIU), Other Transaction Authority (OTA), and Adaptive Acquisition Framework (AAF).(US)

5.Integrate advanced dual-use technologies into the defense sector by adjusting budgets and frameworks and through public solicitation of proposals, personnel exchange between sectors, and fostering an environment for innovative equipment.(UK)

6. Begin promoting the entry of new venture companies with innovative technologies by developing a new framework.This might include establishing a competitive system to select SMEs as subcontractors for prime companies while also understanding the technological strengths of these SMEs.(South Korea)

7. Establish an innovation ecosystem by creating a method to monetize outputs through talent acquisition, venture capital investment for R&D, exports, and acquisitions and mergers by major companies.(Israel)

8. Establish a system for early retired defense practitioners to innovate in defense technology and dual-use technology, leveraging their experience and skills gained while in office.。(Israel)

(Promotion of Exports and International Expansion)

9. Analyze trends in U.S. defense industrial policy and evaluate their impact on Japan.(US)

10. Provide support for acquiring qualifications necessary for entry into the U.S. defense industry; publicize and disseminate the system.(US)

11.Strengthen the structural international competitiveness of the domestic defense industry through government-led international joint development projects and investment in and alignment with overseas companies.(UK)

12. Promote weapons exports not only at the finished product level but also at the parts and components level. (Australia)

13. Contemplate a comprehensive regional strategy for defense equipment exports,instead of limiting them to bilateral relations strategy.(South Korea)

14. Strike a reasonable balance between pros and cons on technology transfer associated with the exportof defense equipment instead of general restraints on technological transfer.(South Korea)

Conclusion: Encourage Dynamism and Consolidate Demand

At the core of these recommendations lies the acknowledgment that maintaining the current structure of the Japanese defense industry is no longer feasible. To change the existing defense industry’s structure, new companies with innovative technologies must enter the industry. The government should also actively promote human resources possessing knowledge of both defense requirements and the companies’ strengths, thereby bolstering their technological and proposal capabilities, and facilitating the establishment of a new, dynamic supply chains. Efforts such as the OTA, AAF, and DIU in the United States, which invest in R&D and rapidly introduce products in non-traditional companies, the frameworks for nurturing innovative technologies, as exemplified by the open solicitation approaches of the Defense and Security Accelerator (DASA) in the United Kingdom, or practices like the Defense Innovation Hub (DIH) in Australia or Defense Innovation 100 projects in South Korea, align with the concerns discussed. In addition, tailored approaches such as the Regional Defense Industry Clusters in the United Kingdom and the Defense Venture Center in South Korea, which work with municipalities in each region of the country to identify technologies possessed by SMEs, also contribute to the promotion of entrants.

However, to foster a competitive defense industry, it is necessary to not only make new efforts in the R&D phase but also make them sustainable at the manufacturing stage of defense equipment. In this regard, unlike the United States, which can cover all sectors, many countries have selectively invested in specific domestic manufacturing based on their priorities. For example, the United Kingdom has put forth a “strategic approach” to selectively possess critical manufacturing infrastructure from two perspectives: “strategic imperatives” and “operational independence.” Australia has also established the Sovereign Industrial Capability Priorities (SICP), which focuses the defense budget on specific areas.

The Japanese government should learn from the Australian and the British approach to the selection and concentration of the budget because fiscal constraints will remain even though Japan is increasing its defense budget. Therefore, under the Defense Production Base Reinforcement Act, financial support requires a strategic focus on specific areas before deciding on individual subsidies based on company applications that do not specify the areas of defense equipment. Such a strategy must be formed in a two-way dialogue between government and industry, considering the economic incentives and profitability of the companies. The crucial aspect of this process is to align the identification of priority areas and the steering of companies’ investment behavior using the purchasing power of the government with the direction of industrial policy, including subsidies. The aim is to ensure a seamless alignment between these two tools without discrepancies.

In addition, overseas exports are essential for a country with a medium-sized defense industry like Japan to increase demand and rationalize production. Furthermore, rather than limiting itself to the export of finished products such as platforms, Japan should explore various avenues for international expansion, drawing inspiration from practices such as British investments in the U.S. market, Korean engagement in local production and technology transfer combined with product exports, and the participation of Australian and Israeli entities in overseas markets at the component and system levels with essential properties. In this context, the government should actively support companies by promoting awareness of the requisite systems for entry into foreign markets, such as the United States, and by advocating for deregulation. Unlike the surveyed countries, Japan faces restrictions on exporting certain products overseas under the Implementation Guidelines of The Three Principles on Transfer of Defense Equipment and Technology. Rather than restricting to the export of internationally co-manufactured products and defense equipment of the so-called “five categories,” such as transportation or rescue equipment, products that can strengthen Japan’s defense industry and contribute to security cooperation, including those with lethal effects, must be allowed to be exported widely.

If the Japanese government intends to gradually encourage voluntary integration and restructuring decisions among defense firms by aggregating demand, it must ensure a mutually consistent direction of the three lines of efforts: (1) prioritization of investment and financial support, (2) a focused procurement policy, and (3) seeking opportunities for overseas expansion such as export. As each country aims to maintain a sustainable indigenous defense industry amid a severe security environment and fiscal constraints, Japan needs to accept and take advantage of this trend as an opportunity to promote strategic autonomy and international cooperation selectively. Given this cross-cutting assessment, two final points must be made for the policy recommendation.

15. The Japanese government must coordinate the procurement policies on the ‘buyer’ side, as guided by the ‘Defense Buildup Program,’ and the industrial policy based on the Defense Production Base Reinforcement Act, as well as the government direction regarding exports/expansion to international markets through establishing a mechanism for regular assessments. These assessments should be primarily carried out within the government; however, when necessary, external experts should be invited to participate in the discussion, and the results should be published to foster interest and discussions nationwide.

16. The defense products that can strengthen Japan’s defense industry and contribute to security cooperation, including those with lethal effects, should be allowed to be widely exported.

Comparative Study of Defense Industries -Autonomy, Priority, and Sustainability-

Disclaimer: Please note that the contents and opinions expressed in this report are the personal views of the authors and do not necessarily represent the official views of the International House of Japan or the Institute of Geoeconomics (IOG), to which the authors belong. Unauthorized reproduction or reprinting of the article is prohibited.

Authors

Sadamasa Oue(Group Head, International Security Order, Institute of Geoeconomics)

General Oue was born in 1959 in Nara Prefecture, Japan. He graduated from the National Defense Academy in 1982.LTG OUE earned his Master of Public Administration from J. F. Kennedy School of Government, Harvard University in 1997, and Master of National Security Strategy from the National War College, National Defense University of the U.S.A. in 2002. He retired in August 2017 as a Commander of Air Materiel Command, responsible for logistic operations of all Air Self Defense Force activities. Between July 2019 and June 2021, he served at the Harvard Asia Center as a Senior Fellow. He currently serves as a company advisor and a special fellow of the Strategic Studies Institute.

OGI Hirohito(Senior Research Fellow)

Before joining the API/IOG in 2022, Mr. Ogi had been a career government official at the Ministry of Defense (MOD) and Ministry of Foreign Affairs (MOFA) for 16 years. In his early career, he drafted the domestic act to implement the Japan-Australia Acquisition and Cross-Servicing Agreement (ACSA) which enables Japanese Self-Defense Forces and Australian Forces to mutually provide logistics support in various occasions.From 2014 to 2016, he was transferred to the MOFA. As a Deputy Director at the International Legal Affairs Division, he reviewed drafts of the Peace and Security Legislation in 2015 in light of international law on the use of force. From 2016 to 2021, he was the Deputy Director for Strategy & Legal Affairs, the Equipment Policy Division at the Acquisition, Technology and Logistics Agency (ATLA). During the service of this position, he drafted the provision of the Self-Defense Forces Act which enables the MOD to grant developing states unused military equipment, and led the implementation of policy for strengthening defense industrial base as well as catalyzing defense equipment export. From 2019 to 2021, he served as a Deputy Director of the Defense Planning and Programming Division at the MOD. As the Chief of the section, he was in charge of defense strategy planning and procurement planning of the Ground Self-Defense Force (GSDF). From 2021 to 2022, he served as the Principal Deputy Director for the Strategic Intelligence Analysis Office, the Defense Intelligence Division at the MOD, where he led MOD’s defense intelligence analysis including on the recent Ukrainian War. He holds a Master’s degree in international affairs from the School of International and Public Affairs (SIPA), Columbia University and a Bachelor’s degree in arts and sciences from the University of Tokyo.

Rintaro Inoue(Research Assistant)

Rintaro Inoue is a Research Assistant at the Asia Pacific Initiative (API) & the Institute of Geoeconomics (IOG) International Security Order Group. He received his BA and MA in law from Keio University and is now a PhD student. he focuses on U.S. security policy, the U.S.-Australia alliance, Japanese defense policy. Prior to assuming his current position, he joined the Asia Pacific Initiative (API) as an intern and contributed to multiple projects including the Japan-U.S. Military Statesmen Forum (MSF). He is currently researching defense industrial policies of other countries in the International Security Order Group.

(Photo Credit: Ministry of Defence)

Senior Research Fellow

Hirohito Ogi is a senior research fellow at the Institute of Geoeconomics (IOG) studying military strategy and Japan’s defense policy. Before joining the IOG, Mr. Ogi had been a career government official at the Ministry of Defense (MOD) and Ministry of Foreign Affairs (MOFA) for 16 years. From 2021 to 2022, he served as the Principal Deputy Director for the Strategic Intelligence Analysis Office, the Defense Intelligence Division at the MOD, where he led the MOD’s defense intelligence. From 2019 to 2021, he served as a Deputy Director of the Defense Planning and Programming Division at the MOD. He holds a Master’s degree in international affairs from the School of International and Public Affairs (SIPA), Columbia University, and a Bachelor’s degree in arts and sciences from the University of Tokyo. He is the author of various publications including Comparative Study of Defense Industries: Autonomy, Priority, and Sustainability (co-authored, Institute of Geoeconomics, 2023).

View Profile-

Takaichi’s Twin Challenges: Economic Growth and Security2026.01.13

Takaichi’s Twin Challenges: Economic Growth and Security2026.01.13 -

It’s Now or Never: India’s Ambitious Reform Push2026.01.09

It’s Now or Never: India’s Ambitious Reform Push2026.01.09 -

Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07

Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07 -

Analysis: Ready for a (Tariff) Refund?2025.12.24

Analysis: Ready for a (Tariff) Refund?2025.12.24 -

China, Rare Earths and ‘Weaponized Interdependence’2025.12.23

China, Rare Earths and ‘Weaponized Interdependence’2025.12.23