How Japan and its businesses should respond to U.S. economic security policies

In such a situation, new challenges have emerged regarding how to balance economics and national security in advanced technologies and how to coordinate economic interests with those of its like-minded countries.

This article will discuss such challenges by looking into the export control rules announced last October, as well as the Chips and Science Act of 2022 and the Inflation Reduction Act of 2022, both of which went into effect last August, while also taking into account industry’s point of view.

Washington’s new chips export rules

On Oct. 7, the U.S. Department of Commerce issued new rules to strengthen export controls on advanced computing chips and semiconductor manufacturing equipment to China.

The rules are particularly strict, using significantly newer tools than past export controls, such as restricting exports of items for development of advanced chips in China, not allowing any exceptions in principle, and restricting “U.S. persons” from supporting the development or production of semiconductor fabrication facilities in China. U.S. persons include citizens, residents as well as entities in the U.S.

The intention of the U.S. is reportedly to slow China’s development of military technologies by restricting its access to high-end chips, which is China’s supply-chain weaknesses.

The U.S. Department of Commerce’s export control rules are applied extraterritorially to third-party countries for items containing U.S. technologies. In the global semiconductor manufacturing market, the U.S., Japan and the Netherlands hold dominant positions. Dutch firm ASML Holding, which holds the second largest share in the market, and Japanese firm Tokyo Electron, which holds the third largest share, could reportedly complete most of their products without using U.S. technologies.

The Biden administration, therefore, has called on the governments of Japan and the Netherlands to align with the U.S. export control rules to restrict areas that cannot be covered by the regulations.

The response from global companies has been mixed: Tokyo Electron has indicated its intention to align with the U.S. industry while ASML is strongly opposed to restrictions due to the potential negative impact on its profits.

The U.S. Semiconductor Industry Association (SIA) expressed strong concerns over the new export rules by referring to the profit loss forecast announcement from U.S. firms Applied Materials and Lam Research, which occupy the largest and fourth largest share, respectively, in the global semiconductor production equipment market. SIA pointed out that if the U.S. government could not agree on the same export rules with like-minded countries, only U.S. companies would be negatively impacted.

As of mid-January, three months after the announcement of the new export control rules, Japan and the Netherlands have not yet announced any specific measures, indicating the difficulty of coordination between the three countries and the fact that the U.S. implemented the rules without sufficient prior coordination with the two nations.

From the industry’s perspective, export control rules could result in changes to global market shares among companies because the items that will be subject to controls are directly linked to each firm’s business performance.

It will be necessary for like-minded countries to not only coordinate on the Oct. 7 export control rules but also to coordinate on future rules and policies with medium- and long-term perspectives.

U.S. supply-chain resilience

Last August, the U.S. signed into law the Chips and Science Act of 2022 and the Inflation Reduction Act of 2022.

To bolster U.S. leadership in its competition with China, the Chips Act has committed $280 billion for the research and development of advanced technologies, including $52.7 billion in funding for domestic semiconductor manufacturing.

With the Chips Act in mind, U.S. companies such as Intel and Micron Technology, as well as South Korean firm Samsung Electronics and other companies, have announced plans to build new advanced plants in the U.S.

Taiwan Semiconductor Manufacturing Co. is already constructing a new plant in Arizona to provide its chips to Apple. All of these companies have expectations of receiving funding from the U.S. government under the Chips Act.

On the other hand, the act includes a clause prohibiting companies that take the federal funding from expanding semiconductor manufacturing capabilities in “countries of concern,” including China, for the next 10 years.

The other piece of legislation, the Inflation Reduction Act, includes $499 billion of new spending, of which $391 billion will be dedicated to climate change and energy security.

The act includes a clause offering up to $7,500 in tax credits for individuals who buy new electric vehicles, but the tax break comes with strict eligibility criteria, such as the percentage of battery components that are manufactured or assembled in North America and the percentage of critical minerals extracted or processed in the U.S. or countries with which the U.S. has a free-trade agreement.

In addition, EVs with battery components or materials sourced from “foreign entities of concern,” including China, are excluded.

The two laws are intended to improve U.S. economic competitiveness through high-tech innovation and to prevent the outflow of advanced technologies by reviving a full-blown reindustrialization policy, which had been absent since the administration of President Jimmy Carter in the 1980s.

The Inflation Reduction Act in particular has been met with concern from other countries, with the European Union hinting at the possibility of adopting its own preferential treatment policies as a countermeasure and South Korea saying it is considering filing a complaint with the World Trade Organization, and both strongly urging the U.S. to revise the requirements. Japan, which has not signed a free-trade agreement with the U.S., has also raised strong concerns over the tax credit requirements.

U.S. measures to strengthen supply chains differs from semiconductor export control rules designed to counter national security threats in the sense that in addition to addressing national security, the measures to strengthen supply chains are also aimed at boosting the domestic labor market, a key initiative under Biden’s goal of achieving a “foreign policy for the middle class.” This makes it even more difficult for like-minded countries to align policies.

As Kazuto Suzuki discussed in an earlier article in this series, we must also be aware that the notion of economic security differs between Japan and the U.S.

Economic security rules among allies

Challenges are arising in the field of high-end technologies over how to balance economics and national security and over how to coordinate economic interests among countries. Why is this happening?

It is because while countries have become highly conscious of economic security — or something similar to the concept — amid the growing significance of geopolitics and geoeconomics in recent years, there are no clear rules on economic security and intentions differ even among partner countries.

To cope with such challenges, it is becoming even more important to consider the often-proposed idea of creating a plurilateral or minilateral framework among a small number of like-minded countries and conduct comprehensive rule-making in the medium to long term.

For example, under the Wassenaar Arrangement on Export Controls for Conventional Arms and Dual-Use Goods and Technologies, the existing multilateral regime on export controls, policies are determined by the unanimous approval of 42 member states, including Russia.

But it can easily be assumed that even if Japan and the Netherlands joined U.S. efforts to restrict semiconductor exports, the restrictions would face opposition under the Wassenaar framework and it would be unrealistic to think the member states would agree on something similar to the current U.S. export controls on China.

Therefore, it will be necessary to create rules to complement the Wassenaar regime in a new framework of like-minded countries by identifying national security threats and deciding which advanced technologies should be restricted and what criteria should be adopted in applying the restrictions.

While like-minded countries have to handle these questions on a case-by-case basis for now, a more comprehensive approach is needed in the medium to long term to implement policies smoothly.

From the standpoint of industries, new frameworks and rules could lead to increased costs for companies, but they will also bring about the merit of avoiding uncertainties — something that companies dislike the most.

It is also important to create a new framework for strengthening supply-chain resilience to discuss which technologies should be managed as being under national security threats. Industrial associations — such as the U.S. Chamber of Commerce, the Semiconductor Industry Association and the Japan Business Federation among others — should be allowed to take part in the framework as observers, so that the public and private sectors can cooperate to create policies that are acceptable to like-minded countries.

What is important here is not to deny the existing international framework that has been supported by many countries for a long time since World War II, but to launch a supplementary framework to deal with issues that cannot be resolved under the current framework.

It will also be necessary to apply a “small yard, high fence” approach — imposing strict controls on a narrow area.

The role of Japanese companies

In the U.S., Republicans won a majority in the Congress in midterm elections last November, and Kevin McCarthy, a China hawk, was elected to become speaker of the House after gaining the support of party hardliners.

Many in Washington believe the U.S. economic security policy against China will be strengthened even further.

There will be more chances for Japan this year to be affected by Washington’s economic security policy, whether it likes it or not.

On the other hand, it can be said that Japan is in a good position to contribute to rule-making in restricting advanced technologies and deal with issues such as how to balance economics and national security or how to coordinate economic interests among like-minded countries.

This is because Japan enacted a law to promote economic security ahead of other countries and has experience of conducting dialogue between the public and private sectors to come to a consensus on how to make economics and national security work together.

Japanese high-tech companies also need to proactively contribute to constructive proposals through industrial associations rather than just waiting for rules to be determined, so that restrictions that work to their disadvantage won’t be set.

We have entered a new era in which contributing to rule-making is becoming ever more important for Japanese companies.

Visiting Senior Research Fellow

Satoshi Yamada has been a visiting senior research fellow at the Institute of Geoeconomics (IOG) since 2022. He has over 25 years’ experience in the Japanese private sector. From 2018 to 2022, Mr. Yamada was stationed in Washington, D.C., where he worked to establish a government relations and public policy team. During that time, he also worked with U.S. industry associations and think tanks engaging the U.S. government (both the Trump and Biden administrations) and the Congress. Prior to 2018, he worked on various social infrastructure projects in emerging economy countries, collaborating with multilateral development banks and development aid agencies. He holds an MBA from the Sloan School of Management at the Massachusetts Institute of Technology, and also studied at The Fletcher School of Law and Diplomacy at Tufts University.

View Profile-

From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 -

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 -

Harnessing China’s tech giants: The case of Jack Ma2025.06.11

Harnessing China’s tech giants: The case of Jack Ma2025.06.11 -

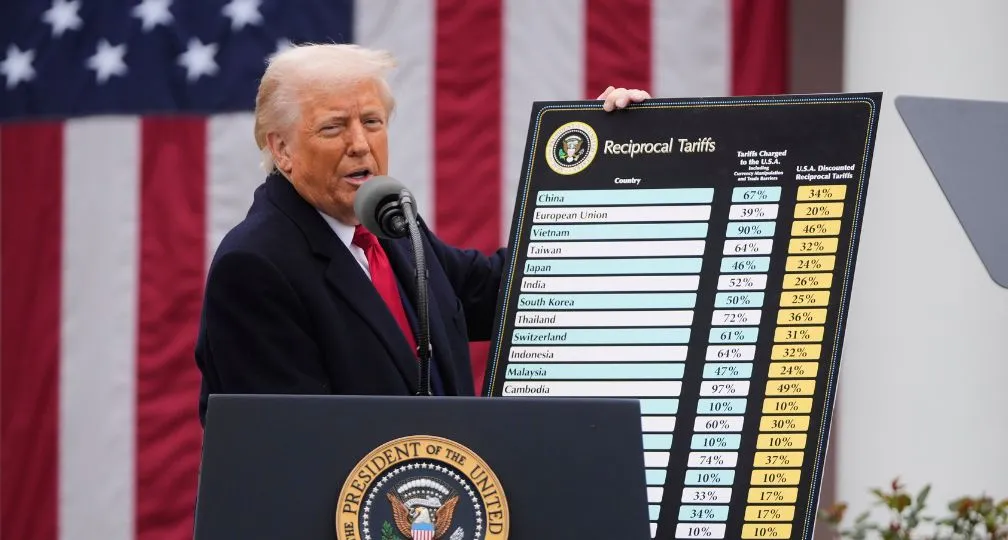

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31 -

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

The Big Continuity in Trump’s International Economic Policy2025.06.11

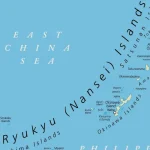

The Big Continuity in Trump’s International Economic Policy2025.06.11 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27 After tariffs: Is there a plan to restructure the global economic system?2025.04.03

After tariffs: Is there a plan to restructure the global economic system?2025.04.03