IOG Economic Intelligence Report (Vol. 2 No. 7)

The latest regulatory developments on economic security & geoeconomics

UK in CPTPP: The United Kingdom reached an agreement on March 31 to join the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), becoming the group’s 12th member, just over two years after its initial application. Its ascension is notable because it is the first non-founding member to apply for membership under the agreement’s ascension process, in this case chaired by Japan. China and Taiwan are the next two economies in line to have applied to join CPTPP, followed by Ecuador, Costa Rica, and Uruguay.

(French) Farm to (Chinese) Table: French President Emmanuel Macron visited China from April 5 to 8 and met with Xi Jinping, where they discussed, among other things, a trade agreement that would be called “from French farm to Chinese table.” Macron traveled to China with a delegation of 50 business leaders, including the CEOs of Airbus and EDF, and several commercial deals were reached during the course of the visit. At the same time, European Commission President Ursula von der Leyen, who had joined Macron on the visit, expressed concern that Europe’s trade relations with China were becoming increasingly imbalanced. There were also concerns in the United States and elsewhere that Macron was prioritizing French economic relations with China at the expense of concerns over the future of Taiwan or China’s potential support for Russia’s invasion of Ukraine.

Going to Congress: U.S. Trade Representative Katherine Tai doubled-down on the administration’s resistance to negotiating “traditional” free trade agreements featuring tariff cuts, saying that those agreements are “part of the problem that we are trying to correct.” She specifically blamed tariffs for creating the “vulnerabilities that we’re facing today” but added that she could support tariff liberalization if can be used to promote “resilience, sustainability and inclusiveness”. Additionally, she encouraged Congress to enact new rules on digital trade, arguing that the current rules are out of date and there are limits to how much negotiators can accomplish without updated legislation from Congress.

Guidance Issued: The U.S. Treasury Department issued its guidance on the electric vehicle tax credits offered in the Inflation Reduction Act that was passed last summer, and uses a more expansive definition of “free trade agreement” in order to allow EU and Japanese auto manufacturers to qualify for the credits.

Members of Congress have expressed their displeasure with the guidance, believing that the administration has redefined the intent of the legislation while also circumventing Congress’s role in regulating international trade. Senate Finance Committee Chair Ron Wyden (D-OR) and Ranking Member Mike Crapo (R-ID) both said that the guidance does not remove the Biden administration’s obligation to submit the agreement on critical minerals with Japan to Congress for their approval. Meanwhile EU trade chief Valdis Dombrovskis said that EU negotiators are seeking clarity on the proposed guidance , specifically on the extent of minerals covered and its compliance with the rules set out in the IRA, before signing any agreement on critical minerals.

EU Anti-Coercion Tools: The European Union is in the process of creating a new “anti-coercion” instrument that would be designed to counter efforts at economic coercion, like China’s towards Lithuania last year. Negotiations are ongoing within the EU with a final package expected later this year. Among the possible countermeasures under discussion are increased tariffs, intellectual property restrictions, or export controls.

Analysis: Is U.S. Protectionism a Feature or a Bug?

When Joe Biden replaced Donald Trump in 2021, was an audible sigh of relief in the capitals of U.S. allies and partners if their concern was economic policy. While a U.S. return to the Trans-Pacific Partnership might have always been beyond the realm of possibility, maybe at least the incoming Biden administration would abandon the coercive tariffs or stop the noise about prioritizing U.S. jobs or let multilateral institutions like the World Trade Organization do their work again.

Those people have probably been disappointed, or at least underwhelmed. While the Biden administration has not been as willing to use economic coercion against allies and partners the way the Trump administration was, it’s not easy to find many differences between Biden’s economic strategy and Trump’s – the intentions might be different, but the outcomes are similar. The Trump administration’s tariffs on steel imports remains in place despite a WTO ruling against them, the WTO’s appellate body remains understaffed and functionally crippled, administration officials speak first about prioritizing U.S. jobs rather than economic integration, and both administrations seem to think that economic interconnectedness, represented by free trade agreements, was largely a mistake that hurt U.S. workers and made the economy more vulnerable.

In other words, U.S. retreat from the multilateral trading system is now a “thing” rather than a one-off aberration from a populist president. Even so, there could still be the chance that the multilateral system got incredibly unlucky by having two administrations in a row that wanted to retrench from the economic order. Small sample sizes are always an issue when thinking about U.S. presidencies, and there could be every possibility that the next administration, of whichever party, decides to go in a different direction from its predecessors and reinvest in economic interconnectedness. Right?

It’s possible. Members of congress are likely getting frustrated with an approach to international economics that keeps their companies shut out of the world’s markets, while U.S. regional partners are certainly growing frustrated the Biden administration’s half-in-half-out approach to economic architecture. Even if there’s merit to Ambassador Tai’s argument for a new model of trade agreements, sooner or later the realization will hit that something more enduring is needed that meets the demands of domestic stakeholders and international partners.

But there’s also every chance that the U.S. approach to the international economy is now a feature, not a bug. For one thing, negotiating with Congress is never easy, but it’s especially difficult when the parties are locked in polarized politics as they are now (doubly so with a presidential campaign upcoming in just over a year). In the abstract, Republicans won’t want to give a Democratic president a win, and a Democratic administration won’t want to expose vulnerable members to votes that might be contentious with the party’s base (even if majorities of Americans support free trade). Politically, it’s simply safer to avoid Congress on these issues and seek out agreements that don’t need congressional authorization, like IPEF or the recent agreement with Japan on critical minerals. Agreements like IPEF, APEP, the agreement with Japan on critical minerals can all be meaningful projects that make important contributions to the international trading order, but they can also be voided on a whim in the absence of congressional approval. Congressional ratification is still possible (the U.S.-Mexico-Canada Agreement was ratified by Congress in 2019) but it’s much easier under Trade Promotion Authority/“fast-track” ratification procedures – but these expired in July 2021 and there’s been no sign the Biden administration will seek renewed fast track authority.

The second reason is that U.S. workers are far more exposed to economic dislocation from trade liberalization than their counterparts in other countries. Lots of social benefits like pensions and health care are linked to keeping a job while worker adjustment programs have been anemic – not surprisingly, trade tends to get more support in Japan and the European Union and research has shown that domestic institutions can distribute the benefits of liberalized trade more evenly. As CSIS Scholl Chair Bill Reinsch says , trade creates benefits but it’s up to governments to distribute those benefits. Successive U.S. administrations are doing neither, and it’s hurting their own workers and their relationships with some of their most important international partners.

If there’s a lesson that Washington needs to understand from all this, it’s that the region isn’t going to wait for them. It isn’t just a question of whether Washington can write the rules (though it can certainly contribute), it’s whether the United States can simply be involved. On a practical level, this makes it more complicated for the United States to join any possible agreements at a future point. The United Kingdom’s ascension to CPTPP took more than two years, largely reflecting the existing members’ insistence that the UK meet the standards of the agreement – while a U.S. application to join CPTPP would certainly be welcome, there’s no reason to expect that existing members would not again insist on maintaining the existing standards (nor should they).

On a more general level, the United States is undermining its own geostrategy and hurting its own workers the longer it sits on the sidelines. The problem is that the two reasons the United States is staying out of the game – political polarization and weak distributive policies – probably aren’t going to change anytime soon. It’s a feature, not a bug.

Disclaimer: The views expressed in this IOG Economic Intelligence Report do not necessarily reflect those of the API, the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

API/IOG English Newsletter

Edited by Paul Nadeau, the newsletter will monthly keep up to date on geoeconomic agenda, IOG Intelligencce report, geoeconomics briefings, IOG geoeconomic insights, new publications, events, research activities, media coverage, and more.

Visiting Research Fellow

Paul Nadeau is an adjunct assistant professor at Temple University's Japan campus, co-founder & editor of Tokyo Review, and an adjunct fellow with the Scholl Chair in International Business at the Center for Strategic and International Studies (CSIS). He was previously a private secretary with the Japanese Diet and as a member of the foreign affairs and trade staff of Senator Olympia Snowe. He holds a B.A. from the George Washington University, an M.A. in law and diplomacy from the Fletcher School at Tufts University, and a PhD from the University of Tokyo's Graduate School of Public Policy. His research focuses on the intersection of domestic and international politics, with specific focuses on political partisanship and international trade policy. His commentary has appeared on BBC News, New York Times, Nikkei Asian Review, Japan Times, and more.

View Profile-

From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 -

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 -

Harnessing China’s tech giants: The case of Jack Ma2025.06.11

Harnessing China’s tech giants: The case of Jack Ma2025.06.11 -

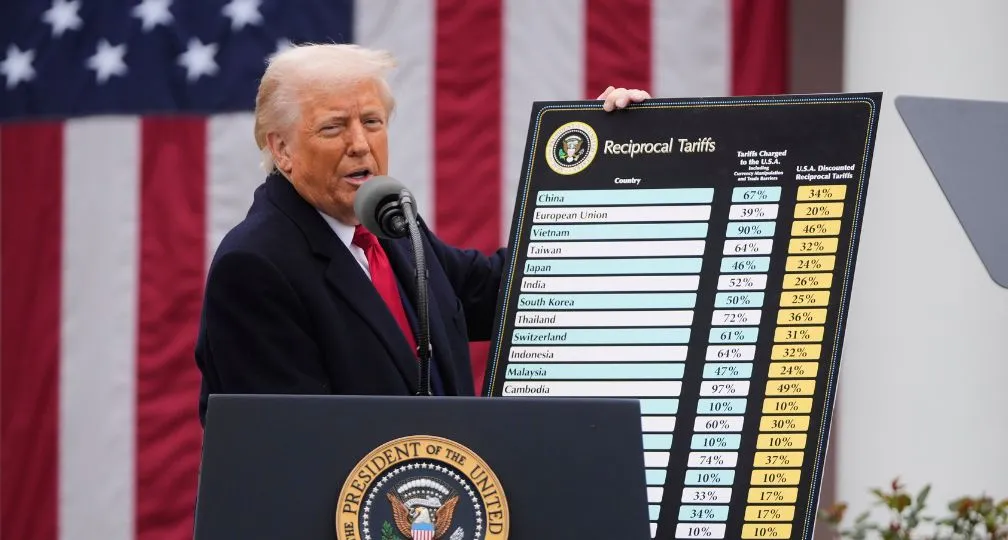

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31 -

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27 After tariffs: Is there a plan to restructure the global economic system?2025.04.03

After tariffs: Is there a plan to restructure the global economic system?2025.04.03