IOG Economic Intelligence Report (Vol. 2 No. 10)

The latest regulatory developments on economic security & geoeconomics

G7 Leaders Tackle Economic Coercion and More: In a joint statement released on May 19, leaders at the G7 Summit in Hiroshima, Japan agreed to launch the “Coordination Platform on Economic Coercion” intended to improve the G7’s “collective assessment, preparedness, deterrence and response to economic coercion”, particularly on critical goods like semiconductors and minerals. The group also agreed to promote cooperation with partners beyond the G7, particularly on digitization, infrastructure, and trade. The initiative is part of the group’s intention to “de-risk” and “diversify” away from overdependence on China and Russia. They also emphasized that any response to disruptions would be grounded in maintaining the multilateral trading system with the World Trade Organization at its center. Leaders at the meeting also announced efforts to expand sanctions to target Russia’s energy exports and transshipments from third countries.

[NOTE: The IOG organized a list of “Nine Check Items for the G7 Summit” in collaboration with think tanks from across the G7 states that the IOG submitted to the Japanese government in advance of the summit in Hiroshima].

Australia-U.S. Cooperation on Critical Minerals: On May 20, Australia and the United States signed the Climate, Critical Minerals and Clean Energy Transformation Compact, designed to facilitate trade and investment in critical minerals between the two countries through the creation of a bilateral task force on critical minerals. Biden also plans to ask Congress to designate Australia as a “domestic source” under Title III of the Defense Production Act, which could also encourage U.S. investment in Australia’s critical minerals industry.

Japan-U.S. Cooperation on Supply Chains: U.S. Secretary of Commerce Gina Raimondo and Minister of Economy, Trade, and Industry Nishimura Yasutoshi convened the second Ministerial meeting of the Japan-U.S. Commercial and Industrial Partnership (JUCIP) on May 26. According to the readout from the U.S. Commerce Department, they discussed resilient semiconductor supply chains, cooperation on export controls, emerging technologies, economic security, and improving industrial competitiveness.

APEC Trade Ministerial: In Detroit, Michigan on May 26, trade ministers of the APEC member states met in advance of the leaders summit in San Francisco this November. While no joint statement was issued due to Chinese and Russian objections to language condemning the invasion of Ukraine, a chair’s statement issued by U.S. Trade Representative Katherine Tai summarizing the discussions. The statement reaffirmed the group’s commitment “a free, open, fair, non-discriminatory, transparent, inclusive and predictable trade and investment environment”.

An Agreement in IPEF: Also in Detroit, Michigan, representatives of the 14 member states of the Indo-Pacific Economic Framework (IPEF) met on May 27 and agreed to strengthen supply chains for critical minerals and other essential goods to reduce dependence on China. This is the first agreement that the group has reached since discussions were launched in May 2022, and discussions were also held on the trade, fair economy, and free economy pillars. The proposed agreement on supply chains would create an emergency communications channel to facilitate support during a supply chain disruption, as well as improve information sharing and collaboration among IPEF members. The United States also announced several new technological and capacity building steps, such as digital shipping pilot projects, a STEM exchange program, public-private partnerships, and more.

Micron Fails Security Review in China: The Cyberspace Administration of China, China’s top cyberspace regulator, announced on May 22 that products made by U.S. chipmaker Micron had failed a security review and operators of internet infrastructure in China would no longer be able to buy Micron products. The CAC did not provide details on the reasons Micron failed the review or the specific products subject to the ban. Analysists speculate the business impact on Micron may be limited given that its products are mostly used in consumer goods like smartphones instead of critical infrastructure used by the government. The announcement came in the midst of the G7 Summit in Hiroshima, Japan, and amongst efforts, led by the United States, to restrict the availability of advanced chipmaking equipment in China.

New AD/CVD Rules Proposed: The U.S. Commerce Department proposed new regulations on May 9 to strengthen antidumping/countervailing duty (AD/CVD) rules. The proposal would ban the “transnational subsidy regulation” which prevents the United States from imposing tariffs on a nation if the products under question benefited from subsidies provided by another country. This would allow the Commerce Department to impose tariffs against programs like China’s Belt and Road Initiative.

Revoke Most-Favored Nation Status?: Congress is considering legislation that would revoke permanent normalized trade relations (PNTR, also called “Most Favored Nation” or “MFN” status) with China. Passed in 2000 to facilitate China’s entry into the World Trade Organization, but Senators Josh Hawley (R-MO) and Tom Cotton (R-AR) have both put forward bills that would revoke PNTR status for China. Described by a trade lawyer as a “legitimate policy threat” and a potential “kill shot” in the China-U.S. relationship, the White House has said that any legislation revoking PNTR would have a “catastrophic” effect on China-U.S. relations.

Analysis: What We Have Is a Failure to Communicate

One of the biggest challenges for the Biden administration to “de-risk” from China is convincing its allies and partners to do the same. In a way, the steps that were made at the G7 represented the steps which achievable and could find consensus. It was result of more than a decade of experience understanding economic coercion from China and Russia, and vividly brought home by the experience of supply chain disruptions during the COVID-19 pandemic and by Russia’s invasion of Ukraine. Going beyond what was reached in Hiroshima is going to be a bigger challenge.

The problem is that getting partners on board depends on those partners sharing U.S. alarm over China because they often don’t. What’s often treated as matter-of-fact by American interlocutors frequently finds a circumspect audience when those concerns are brought to Asia. To be sure, there’s wide concern about the direction of China under Xi Jinping’s rule, especially following the crackdown in Hong Kong and overtures toward Taiwan – but these concerns are tempered by the fact that China’s economy and market still presents an opportunity and because, simply, China’s extremely large and not going away, so better to deal with it as it is.

Of course, dealing with China as it is also means responding to its economic coercion, avoiding overdependence, and drawing certain red lines over human rights concerns. The Biden administration is almost certainly genuine when it says that it doesn’t want full decoupling with China and that they want competition to be limited and manageable – the message is repeated too often and too consistently to be half-hearted. To that end, they insist – also genuinely – that export controls like those on advanced semiconductors are meant to be targeted and limited to achieve a specific purpose.

But they also need to be prepared to accept that the message won’t always get across. No matter how earnest the Biden administration might be about its goals, it’s not hard to understand how “de-risking” can easily be confused with “decoupling” or even “containment.” More specifically, “run faster” needs to be reconciled with “narrow and targeted” because it’s not obvious how the Biden administration intends to institutionalize a technological edge over China while also insisting that the United States is not trying to hold down China’s economic development. While decision makers in the Biden administration may see no contradiction, much of the world, including partners the United States will need to make their initiative successful, sees this as two sides of the same coin.

Not least of all this applies to China, and opens up the certainty of retaliatory action, even possibly leading to security dilemma where each side views the other’s moves as escalatory, even if that’s not necessarily the intention. A recent example is the case of U.S. chipmaker Micron, who failed a security review in China and whose products are now banned for use in critical infrastructure in China – what China will claim is a step towards securing its infrastructure has already been described as economic coercion by U.S. officials. While China would always retaliate against U.S. actions, when “de-risking” is joined with growing military spending across the region it becomes harder to make the argument that competition isn’t the goal and raises the risk of escalation.

Part of this can be resolved by making the case for controls more clear and more explicit – what might seem self-evident to decision makers in Washington and elsewhere who have been following these issues for years is not always obvious to observers elsewhere. If there’s a case to be made against China on security or human rights grounds, that case needs to be made consistently and clearly across different forums.

The other way to resolve this is through a tighter, more coordinated a strategy, an approach that is more complicated but will ultimately go farther in achieving U.S. goals. Whatever the reasons, announcing the export controls on advanced semiconductors unilaterally and before Japan and the Netherlands had the opportunity to participate caught important stakeholders off guard and created unnecessary diplomatic friction. Even now, companies are still scrambling to figure out how to comply with the new rules only four months before they go into effect. Whether it’s fair or not, collaboration is going to be more complicated if important stakeholders keep feeling blindsided by U.S. announcements.

Finally, it also requires an acceptance that de-risking won’t be able to accomplish everything. Not only do economic countermeasures have their limits, but not every partner will be able to see eye-to-eye with U.S. perceptions of China or be willing to go as far as it might. That needs to be accepted, and it might even have the benefit have pulling the United States back from more extreme options and might ensure that de-risking doesn’t evolve into efforts at containment. Ultimately, there are even worse things – like a security dilemma that raises the risk of armed escalation – than overdependence on China.

Disclaimer: The views expressed in this IOG Economic Intelligence Report do not necessarily reflect those of the API, the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

API/IOG English Newsletter

Edited by Paul Nadeau, the newsletter will monthly keep up to date on geoeconomic agenda, IOG Intelligencce report, geoeconomics briefings, IOG geoeconomic insights, new publications, events, research activities, media coverage, and more.

Visiting Research Fellow

Paul Nadeau is an adjunct assistant professor at Temple University's Japan campus, co-founder & editor of Tokyo Review, and an adjunct fellow with the Scholl Chair in International Business at the Center for Strategic and International Studies (CSIS). He was previously a private secretary with the Japanese Diet and as a member of the foreign affairs and trade staff of Senator Olympia Snowe. He holds a B.A. from the George Washington University, an M.A. in law and diplomacy from the Fletcher School at Tufts University, and a PhD from the University of Tokyo's Graduate School of Public Policy. His research focuses on the intersection of domestic and international politics, with specific focuses on political partisanship and international trade policy. His commentary has appeared on BBC News, New York Times, Nikkei Asian Review, Japan Times, and more.

View Profile-

From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 -

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 -

Harnessing China’s tech giants: The case of Jack Ma2025.06.11

Harnessing China’s tech giants: The case of Jack Ma2025.06.11 -

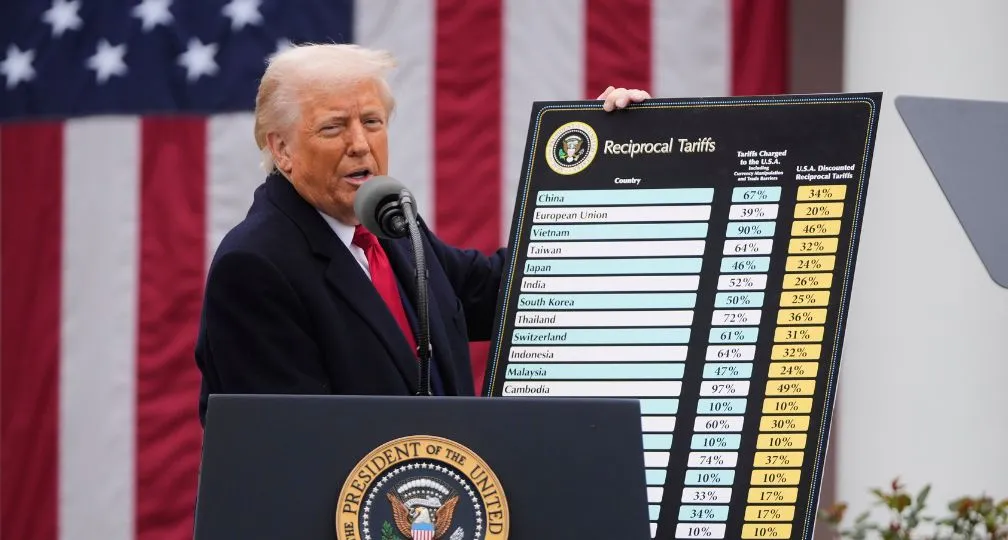

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31 -

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27 Trump’s Major Presidential Actions & What Experts Say2025.02.06

Trump’s Major Presidential Actions & What Experts Say2025.02.06 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25