IOG Economic Intelligence Report (Vol. 3 No. 9)

The latest regulatory developments on economic security & geoeconomics

TikTok Divestment Demand Signed into Law: U.S. President Joe Biden signed into law a bill that would, among other things, force TikTok’s parent company ByteDance 270 days to sell the video platform in order to continue operations in the United States, with the possibility of a 90 day extension if it’s determined that progress is being made towards a sale. TikTok CEO Shou Chew called the bill “unconstitutional” and said his company would challenge the measure in the courts, a measure which may delay a potential divestment by years. As a Chinese company, ByteDance is subject to Chinese law and the Chinese government has opposed a potential sale of TikTok because of export controls covering algorithms, which include those used in TikTok that have been critical in the app’s popularity.

Time to Triple China Tariffs? U.S. President Biden called to triple the section 301 tariffs on steel and aluminum imported from China. At a campaign stop in Pennsylvania on April 17, Biden announced that the Office of the U.S. Trade Representative would begin an investigation into “unfair trade practices” in China’s shipbuilding and logistics industries, citing what it calls a “uniquely aggressive set of interventions in these sectors.” The investigation was prompted by calls from the United Steelworkers (USW) union who alleges unfair competition from China’s maritime Belt and Road initiative.

China Hits Back? China announced a tariff of 43.5 percent on U.S. imports of propionic acid, a chemical used as a preservative, after a dumping investigation was launched last July to determine if U.S. imports were harming Chinese domestic production. The announcement is believed to be in response to President Biden’s comments and U.S. Trade Representative Katherine Tai’s comments on April 17 that the Biden administration is considering tripling the current Section 301 tariff on Chinese steel and aluminum imports.

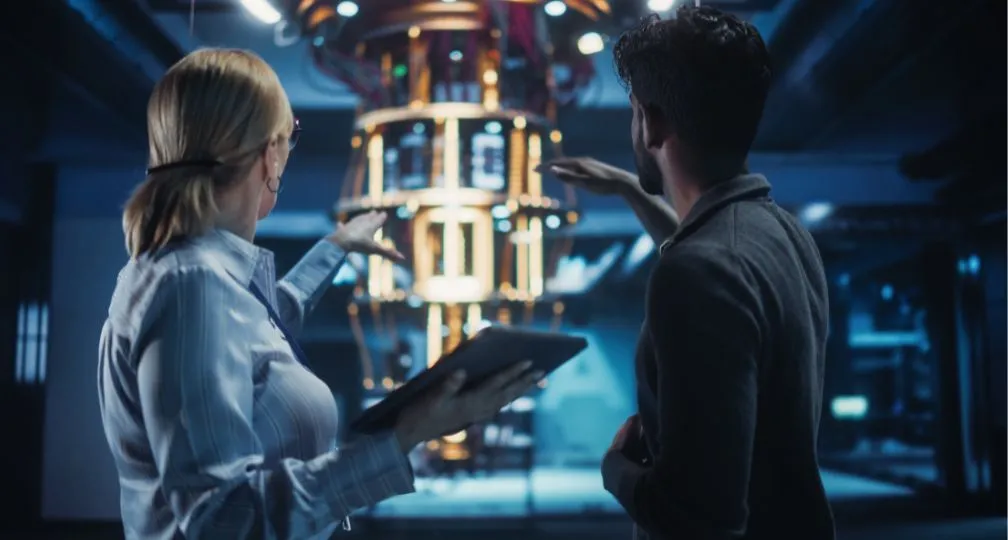

Japan Strengthens Export Controls on Advanced Technologies: Japan’s Ministry of Economy, Trade, and Industry announced new export controls on four technologies (scanning electron microscopes, gate-all-around transistors, cryogenic CMOS circuits, and quantum computers) relevant to semiconductors and quantum computing. Licenses signed by export control officials will be required for shipping any of these technologies abroad. There will be a public comment period until May 25 and the rules are expected to go into effect in July.

U.S. Strengthening Advanced Technology Funding in UAE: The Financial Times reported that the Biden administration is “proactively encouraging” U.S. technology companies to develop deals and collaborations in the United Arab Emirates. An example is Microsoft’s recent $1.5 billion investment in G42, a UAE-based artificial intelligence firm, which the Financial Times reports was the product of a series of meetings over the past year facilitated by the Biden administration. The motivation for such high-level involvement is technological competition with China concern about UAE’s use of Chinese technology and how it might create a vulnerability to access the data of U.S. citizens – one of the preconditions for the Microsoft deal was for G42 to remove Chinese hardware and other technology.

New U.S. Subsidies for TSMC, Samsung: The U.S. Commerce Department announced $6.6 billion in subsidies for Taiwan’s TSMC and $6.4 billion for South Korea’s Samsung to expand their advanced semiconductor manufacturing facilities in Arizona and Texas, respectively, along with training and talent development. The funding is drawn from the 2022 CHIPS Act.

White House Signals Future Climate Trade Agenda: White House climate advisor John Podesta said that “existing trade policies and the international rules that govern them don’t pay enough attention to the emissions embodied in tradable goods” in a speech at Columbia University’s Global Energy Summit on April 16, signaling that Biden administration will emphasize climate-focused trade rules in upcoming discussions. Podesta recently announced the creation of the White House Climate and Trade Task Force, whose remit is to focus on developing climate and trade policy toolkit, data and research into the relationship between trade and climate policies, and identifying ways to help support U.S. domestic producers.

New Restrictions on Russia Metals: On April 12, the United Kingdom and United States announced a joint action to target Russian exports of aluminum, copper, and nickel. The measures prohibit metal-trading exchanges from accepting new sales of these metals from Russia and bars the import of such metals from the United Kingdom and United States, though the measures will not impact existing stocks or bilateral contracts. As Russia is a major exporter of these metals, the move is intended to disrupt a significant source of income for the Russian state as it continues its invasion of Ukraine.

Analysis: Another Step for CFIUS

Nippon Steel’s proposed acquisition of U.S. Steel and recently-signed legislation requiring ByteDance sell off TikTok in order to continue operations in the United States have something in common – the Committee on Foreign Investment in the United States (CFIUS), a somewhat obscure government body which has been gaining a higher profile in recent years because of its central role in these cases. In the case of Nippon Steel, a CFIUS review is necessary to clear the Japanese company’s purchase of U.S. Steel; in the case of TikTok, the Committee’s decision to not require ByteDance to divest TikTok to continue operations in the United States led Congress to pass the recent legislation that forces divestment if the popular video app is to continue U.S. operations

CFIUS is an interagency body chaired by the Treasury Secretary and with members from the Commerce, Energy, Justice, and State Departments. It is charged with overseeing the potential national security implications of foreign investment into the United States and it may review, clear, or condition any such transaction. It may also refer transactions to the President for a final determination, at which point the President may prohibit the transaction or compel divestiture (sale of specific assets) that present a national security risk. While filing an acquisition with CFIUS is voluntary, the Committee nonetheless monitors all transactions for possible national security concerns that require CFIUS review. In recent years, the agency has received additional powers and authorities under the Trump administration and Biden administration, first with the Foreign Investment Risk Review Modernization Act of 2018 and later when President Biden expanded the Committee’s scope to consider risks to supply chains and personal data with an executive order in 2022.

The proposed rules announced by the Treasury Department on April 11 seem to be an effort to tighten the earlier updates. Primarily, they allow CFIUS to collect more information on transactions and by trying to better incentivize compliance and more strongly penalize noncompliance. The proposed rules will improve the ability of CFIUS to monitor non-notified transactions (and thereby incentivizing companies to file proactively), strengthens its ability to punish violations, compresses the timeline for parties to reach mitigation agreements, expands the scope of information it may request to cover “national security considerations” and gives CFIUS the ability to compel responses by subpoena. Penalties will increase from $250,000 per violation to $5,000,000 per violation. As John Carlin, a former Justice Department national security chief and now a partner at the law firm of Paul Weiss said, “It really makes CFIUS more of an enforcement agency”.

At the same time, the proposed rules do not expand the scope of national security concerns it may address during review (as FIRRMA and the 2022 executive order did), nor do they otherwise expand the Committee’s jurisdiction, nor does it alter the timetable for the Committee’s review process. As a result, the practical impact for most businesses involved in CFIUS transactions may only be slight, but impactful nonetheless as companies can expect to be asked for more information by the Committee. Last September, Paul Rosen, undersecretary for investment security at the Treasury Department, suggested what may be coming when he said that companies “can expect more compliance checks, questions, and site-visits… We have been working to expand the number of monitor and auditor firms engaged in this work, including those who have not traditionally been active in the CFIUS space.” There is now a comment period on the proposed rules until May 15, at which point a timeline for enactment and the content for the final rules will become clearer.

The proposed rules are the latest indication that investment screening and economic security more broadly is a space where the federal government is determined to stay. The relevant agencies in this space are now better staffed, able to secure information more efficiently, and armed with stronger tools to pursue enforcement, while companies are faced with more complex requirements and steeper penalties for violations. J. Philip Ludvigson, a partner at the law firm King & Spalding and former director for monitoring and enforcement in CFIUS, said the proposed regulations “are yet another indicator of an increasingly aggressive posture in protecting national security”.

It’s worth paying attention to how the Treasury Department’s counterparts in governments across the world respond. Given the extent to which U.S. officials in this space collaborate with their foreign counterparts, other countries may similarly update their FDI screening rules to seek more information from companies or increasing penalties for violators – already, Mexico and the United States signed a memorandum of intent in December to assist Mexico in developing its own foreign investment screening regime like CFIUS and the European Union is in the process of strengthening its FDI screening regime. The proposed rules for CFIUS and the moves that will follow show once again how governments are refocusing on economic security and companies will need to plan accordingly.

Disclaimer: The views expressed in this IOG Economic Intelligence Report do not necessarily reflect those of the API, the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

API/IOG English Newsletter

Edited by Paul Nadeau, the newsletter will monthly keep up to date on geoeconomic agenda, IOG Intelligencce report, geoeconomics briefings, IOG geoeconomic insights, new publications, events, research activities, media coverage, and more.

Visiting Research Fellow

Paul Nadeau is an adjunct assistant professor at Temple University's Japan campus, co-founder & editor of Tokyo Review, and an adjunct fellow with the Scholl Chair in International Business at the Center for Strategic and International Studies (CSIS). He was previously a private secretary with the Japanese Diet and as a member of the foreign affairs and trade staff of Senator Olympia Snowe. He holds a B.A. from the George Washington University, an M.A. in law and diplomacy from the Fletcher School at Tufts University, and a PhD from the University of Tokyo's Graduate School of Public Policy. His research focuses on the intersection of domestic and international politics, with specific focuses on political partisanship and international trade policy. His commentary has appeared on BBC News, New York Times, Nikkei Asian Review, Japan Times, and more.

View Profile