IOG Economic Intelligence Report (Vol. 3 No. 18)

The latest regulatory developments on economic security & geoeconomics

Canada’s Turn for EV Tariffs Canada announced it will impose a 100 percent tariff on electric vehicle (EVs) imports from China and a 25 percent tariff on steel and aluminum imports from China. Tariffs will be imposed beginning October 1 and follow similar tariffs on EV imports from China by the European Union and United States. Like the EU and U.S. tariffs, Canadian Prime Minister Justin Trudeau said that Canada’s tariffs are in response to China’s overproduction of EVs, adding that Canada will continue to work with allies and partners to coordinate measures to counteract non-market practices of countries like China, and adding that his government is also considering tariffs on chips and solar cells.

UN Reaches Agreement on Global Tax Convention On August 16, 110 United Nations member states approved a framework which will define the scope and intent of an international tax convention. The text would commit to advancing fair taxation of multinational companies; tax evasion and avoidance by high-net-worth individuals across the globe, illicit financial flows, and the effective resolution of tax disputes. The UN General Assembly is expected to vote on final adoption in September.

China Launches Anti-Subsidy Probe of EU Dairy China opened an anti-subsidy investigation into dairy imports from the European Union, examining 20 subsidy schemes from Austria, Belgium, Croatia, Czech Republic, Finland, Italy, Ireland, and Romania. The investigation is believed to be in retaliation for the EU’s planned tariffs on EV imports from China. The EU was China’s second-largest source of dairy products, behind New Zealand, and exported 1.7 billion euros ($1.84 billion) in dairy products to China in 2023. China has launched similar investigations into imports of pork from the EU (specifically impacting Denmark, the Netherlands, and Spain), and imports of brandy (specifically targeting France).

More CHIPS Funding On August 16, the Biden administration announced it will award up to $1.6 billion in grants from CHIPS Act funding to Texas Instruments to build three new semiconductor plants in Texas and Utah. To date, the Biden administration has allocated about $33 billion in CHIPS Act awards with approximately $6 billion to allocate by the end of the year.

U.S. Miners’ Anxiety Over Trump Election A report by Reuters described how U.S. miners and battery recyclers are hurrying to secure government loans out of concern that the programs may be canceled if Donald Trump is elected and takes office in January 2025. The U.S. Department of Energy’s Loan Programs Office (LPO) has awarded nearly $25 billion in conditional loans to 21 companies under the Biden administration. Domestic manufacturers are concerned their projects may not be viable without government support given depressed prices resulting from what many see as China’s market manipulation.

Taiwan Gets Agreement with Pacific Islands Group Taiwan signed a cooperation agreement with the Pacific Islands Forum (PIF) at the conclusion of the annual PIF leaders’ summit from August 26-30 in Tonga. The agreement came over the objections of China, who demanded that the initial communique be republished without language about Taiwan, and an effort by the Solomon Islands to remove Taiwan’s “development partner” status which may have removed Taiwan from future meetings. Taiwan’s level of financial support for the PIF following the cooperation agreement was not announced.

Analysis: Allies and export controls: The wider impact of US-China semiconductor competition

By Andrew Capistrano, Visiting Research Fellow, Institute of Geoeconomics (IOG)

Rapid advances in semiconductors, with their ever-increasing computing power, drove a technological revolution in the first quarter of the 21st century. Modern life would be impossible without them, or the worldwide value chains that enable their mass production. But as the second quarter of the century dawns amid heightened US-China competition, semiconductors and their value chains have become perhaps the most important geoeconomic battleground, in part because both Washington and Beijing anticipate that the military applications of advanced integrated circuits could determine the outcome of future wars.

Since asymmetries in computing power will be closely tied to national power, the semiconductor value chains constructed in an earlier era of deepening economic integration and low geopolitical risk have been shaken by the US-China rivalry. And the private sector firms that built these complex, globe-spanning chains are witnessing their ‘weaponization’ in the name of national security, impacting profit margins, market share, and access to key inputs.

In an inversion of the ‘comparative advantage’ logic that led to specialization in semiconductor production, the US government is leaning on allies in an attempt to limit China’s ability to import the most advanced chips or the machines used to produce them. This is because out of 10 critical chipmaking stages, the US is only the key equipment provider in five, with the other five dominated by the Netherlands and Japan. China, for its part, has retaliated in areas where it has the advantage, particularly in rare earth mineral exports and access to its vast domestic market for lower-end chips. The net effect is a race to produce cutting-edge semiconductors in China, and to locate sources of rare earths outside China, both designed to undermine each others’ comparative advantages.

Companies have not had much time to adapt. In October 2022, the Biden Administration restricted US firms from exporting advanced semiconductors and equipment able to manufacture chips smaller than 14nm to China. Regardless of whether this move was justifiable from a national security perspective, it immediately reduced US companies’ market share and created opportunities for their rivals, since at that time China accounted for just over 30 percent of all semiconductor purchases and American companies had a 53 percent share of the Chinese chip market. Cut out of this key market, US semiconductor manufacturers have struggled to find non-Chinese buyers to make up for their losses.

This was compounded by China’s response to US export controls. In May 2023, China banned US firm Micron’s chips from critical infrastructure and IT uses, and the following month imposed its own export controls on gallium and germanium, two rare earths essential for semiconductor manufacturing. China’s dominance in mining and refining these rare earths (90 percent of gallium, 60 percent of germanium) caused their prices to soar, making non-Chinese chips even more expensive.

But the US controls could not be effective in the absence of coordination from allied governments. One particular chokepoint is the sophisticated ultraviolet lithography systems China needs to make the smallest and most powerful chips, which are produced by Dutch industry leader ASML.

ASML’s deep ultraviolet (DUV) lithography systems can only carve electric circuits on silicon wafers with processes greater than 7nm, whereas its most advanced extreme ultraviolet (EUV) systems can carve processes approaching 2nm. ASML’s EUV technology, like other cutting-edge semiconductor manufacturing equipment, has never been sold to China; however, the importance of the China market to US and allied firms meant that less advanced chips and production systems like DUV had been allowed to bypass the 2022 export controls.

When the US became worried that extant controls were not effectively slowing China’s domestic chip industry, the Biden Administration began to take more drastic action. In October 2023, after imposing further export restrictions on US semiconductor tool manufacturers Lam Research and Applied Materials, it began to lobby the Netherlands to adopt similar controls for ASML. Under US pressure, the Dutch government approved regulations that limited ASML’s sales to China in January 2024, then expanded licensing requirements for newer DUV systems in June. This followed the Japanese government’s March decision to align its export control policy with the US, requiring firms like Tokyo Electron to get permission before selling China any systems able to produce chips under 14nm.

A key weapon in the US’s arsenal is the Foreign Direct Product Rule (FDPR), which allows Washington to unilaterally stop foreign firms from selling products containing any US-made technology—thereby covering most semiconductor manufacturing equipment. The US invoked the FDPR to prevent ASML’s DUV systems from being exported to certain entities in China, including domestic industry leader SMIC, but in July it offered some relief to companies from allied nations (such as ASML, Tokyo Electron, and South Korean powerhouses Samsung and SK Hynix) in the form of an ‘ally exemption’ to continue sales of less advanced technology. This was intended to help form a united front against China by preventing economic frictions from dividing the emerging coalition.

Yet the US now seeks to prevent ASML and Tokyo Electron from servicing or repairing machines that have already been sold to China; simultaneously, it aims to limit China’s access to high-bandwidth memory chips that are essential for powering AI. Anticipating export controls to be tightened, Chinese firms have been stockpiling chips and semiconductor manufacturing equipment, which has had the effect of boosting sales for US, European, and Asian suppliers. None want to see their market share reduced in this competitive environment.

The Biden Administration will not rule out using the FDPR’s powers against companies based in allied nations, although prefers to use diplomatic pressure and positive inducements to what is essentially a coercive threat. Still, for the US strategy to work, its allies must be incentivized to maintain a united front and not compete to expand their businesses in China at their rivals’ expense. And China has a parallel incentive to break the coalition of US allies and ensure its access to vital equipment for its domestic semiconductor push.

As the Dutch and Japanese governments decide whether to continue to align with the US before the FDPR is invoked, China is stepping up its own diplomatic pressure. One option is for Beijing to retaliate by cutting off access to rare earths. New regulations to be applied from October reiterate that all rare earths belong to the Chinese state, and export licenses for gallium and germanium could potentially be withheld from chipmaking countries that further tighten their export controls. Other critical minerals needed to produce goods from batteries to automobiles could also be restricted.

US-China technology competition therefore has externalities that risk spilling out of the bilateral rivalry, impacting US allies and damaging their domestic industries. Governments with companies operating in the semiconductor value chain are now presented with a choice: to follow the US lead in imposing harsher export controls, lose market share, and face potential Chinese retaliation; or follow the interests of their firms, risk greater reliance on the Chinese market, and be subject to FDPR enforcement. How they choose will shape the next phase of the technological revolution, this time playing out in the era of geoeconomics.

Disclaimer: The views expressed in this IOG Economic Intelligence Report do not necessarily reflect those of the API, the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

API/IOG English Newsletter

Edited by Paul Nadeau, the newsletter will monthly keep up to date on geoeconomic agenda, IOG Intelligencce report, geoeconomics briefings, IOG geoeconomic insights, new publications, events, research activities, media coverage, and more.

Visiting Research Fellow

Paul Nadeau is an adjunct assistant professor at Temple University's Japan campus, co-founder & editor of Tokyo Review, and an adjunct fellow with the Scholl Chair in International Business at the Center for Strategic and International Studies (CSIS). He was previously a private secretary with the Japanese Diet and as a member of the foreign affairs and trade staff of Senator Olympia Snowe. He holds a B.A. from the George Washington University, an M.A. in law and diplomacy from the Fletcher School at Tufts University, and a PhD from the University of Tokyo's Graduate School of Public Policy. His research focuses on the intersection of domestic and international politics, with specific focuses on political partisanship and international trade policy. His commentary has appeared on BBC News, New York Times, Nikkei Asian Review, Japan Times, and more.

View Profile-

From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 -

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 -

Harnessing China’s tech giants: The case of Jack Ma2025.06.11

Harnessing China’s tech giants: The case of Jack Ma2025.06.11 -

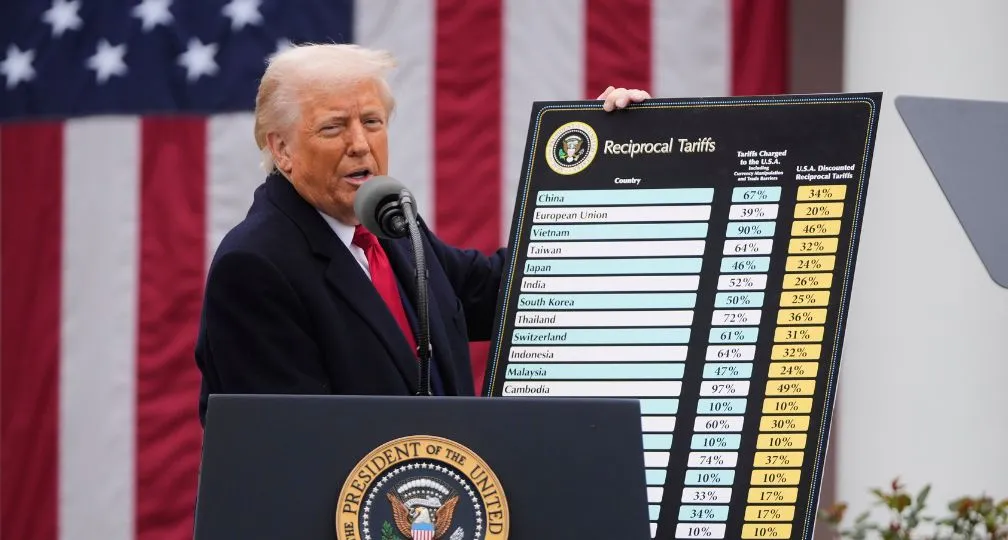

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31 -

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27 After tariffs: Is there a plan to restructure the global economic system?2025.04.03

After tariffs: Is there a plan to restructure the global economic system?2025.04.03