The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?

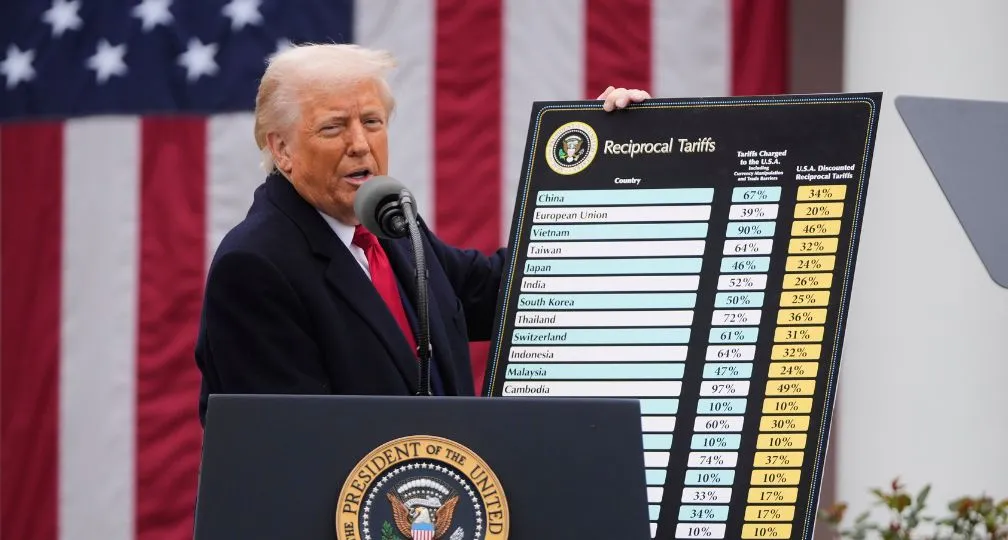

Donald Trump’s tariff program was dealt a body blow on May 28 when two U.S. courts ruled that Donald Trump overstepped his authority by implementing his April 2 tariffs and those imposed on Canada, China, and Mexico under the International Economic Emergency Powers Act of 1977 (IEEPA) and ordered that the tariffs be lifted. While a federal court of appeals has suspended the initial decision which allows the tariffs to continue, the rulings have introduced significant uncertainty into a situation that was already uncertain and alters the calculations in front U.S. negotiating partners and firms, with final clarity still a long way off.

On May 28, the Court of International Trade (CIT), a U.S. federal court based in New York that rules on issues related to U.S. trade laws and other trade-related issues, ruled that Trump’s tariffs imposed under the International Economic Emergency Powers Act, which include the tariffs announced on April 2 as well as the tariffs announced earlier this year on Canada, China, and Mexico, overstepped his presidential authority and ordered the tariffs to be lifted. The following day, a district court in Illinois ordered the Trump administration to stop collecting tariffs, also ruling that the Trump administration had exceeded its authority in ordering the tariffs (in this case, the court exempted the toy company that brought the suit from the tariffs). For now, the tariffs remain in place after the U.S. Court of Appeals temporarily paused the CIT’s decision following the Trump administration’s appeal of the CIT decision, leaving the IEEPA tariffs in place while the appeal is heard through the judicial system. While questions should be asked as to why the Trump administration utilized a statutory authority that was always likely to draw a legal challenge, the administration has said that it’s determined to challenge the rulings all the way to the U.S. Supreme Court.

The decisions are significant because while Trump still has many options for implementing tariffs, none of those options offer him a similar opportunity for a broad-based tariff program like the one he has tried to implement under the IEEPA. Presumably, Trump’s fundamental concerns about trade imbalances remain, so the administration will likely look for new vehicles to address these concerns through tariffs. The most immediate tool to this end (and one specifically cited in the CIT’s decision) is Section 122 of the Trade Act of 1974 which allows the President to impose tariffs of up to 15 percent on countries with whom the United States has a “large and serious” trade deficit for up to 150 days or possibly longer with the input of Congress. Yet while Section 122 may address the administration’s proximate concerns with trade imbalances, it would not go nearly as far as the April 2 tariffs and so would create much less leverage in negotiations with foreign partners. A more arcane measure would be Section 338 of the Tariff Act of 1930, which allows the President to impose tariffs of up to 50 percent ad valorum on products from countries that discriminate against U.S. products. While not directly addressing the issue of trade imbalances, this would seem to allow Trump to impose tariff rates like those he attempted on April 2.

At the same time, some tariffs will not be affected by the courts’ decision, specifically tariffs imposed under Section 232 of the Trade Expansion Act of 1962, which allows the President to restrict imports on a particular good or set of goods to protect national security, and Section 301 of the Trade Act of 1974 which allows the President impose tariffs or withdraw from agreements with countries engaging in unfair trade practices or violating trade agreements with the United States. Section 232 tariffs are now in place on steel & aluminum and automobile imports, and similar tariffs may be imposed under this authority on timber, copper, pharmaceuticals, semiconductors, and critical minerals at the conclusion of various ongoing investigations into these sectors, while Section 301 tariffs may be imposed on digital services taxes. Although tariffs under these authorities are on solid legal standing and have been used by Presidents without significant challenge for decades, their scope is much more limited, targeting specific products and sectors rather than broader U.S. trading relationships which the April 2 tariffs seemed to target and consequentially would not be a like-for-like replacement for the IEEPA tariffs.

Beyond the future of tariffs, the question now turns to the fate of the court challenge to IEEPA tariffs. The Trump administration appealed the CIT decision almost immediately, ensuring the legal dispute will continue almost certainly all the way to the Supreme Court. The CIT’s decision on the IEEPA tariffs was fairly comprehensive, rejecting both the mechanism for implementing tariffs (IEEPA) and the justification (fentanyl trafficking and trade imbalances), arguing that the administration significantly overstepped the authority granted to it under IEEPA and more broadly in the division of powers between Congress and the Executive Branch by assuming authorities that are reserved for Congress.

For the Supreme Court to overturn this week’s rulings and allow Trump’s April 2 tariffs to proceed, it would have to allow that the President has a much wider ability to infer implicit powers than previously and would effectively say that “the Executive Branch can have whatever powers it wants”. This would amount to a massive expansion of Executive power that even conservative Supreme Court justices may balk at. The Court could attempt to limit the scope of the President’s power in this regard and decide that, for whatever reason, the national emergencies used to impose the April 2 tariffs constitute a special situation that requires a unique response, circumscribing the President’s powers as a general principle but permitting those powers in a specific context. This would be similar to a recent Court decision on the President’s powers over independent government agencies but explicitly prevented those powers from extending to the Federal Reserve Bank, arguing that the Bank has a unique need for operational independence. This would also be a stretch because the CIT decision was fairly clear that trade imbalances and drug trafficking are not emergencies that are best addressed through IEEPA tariffs, so creating a special case for emergencies like these would effectively allow the possibility that IEEPA tariffs could be imposed in response to any national emergency.

There’s also a strong possibility that the Court upholds the lower court decisions, relying on either the issue of division of powers, as the lower courts determined, or by relying on the “major questions” doctrine which stipulates that Congress must clearly state its intent to give the Executive Branch authority on especially significant regulatory actions, and by extension, that the Executive Branch cannot infer authorities from ambiguous laws as the basis for major regulatory initiatives. The major questions doctrine has been recently used by the Supreme Court in 2022 to strike down the Biden administration’s interpretation of the 1970 Clean Air Act to allow the Environmental Protection Agency to regulate greenhouse gas emissions and its 2023 attempt to forgive student debt. The major questions doctrine would seem to apply to the IEEPA tariffs since the original IEEPA mentions nothing about tariffs and the scale of the April 2 tariffs would seem be significant enough to make the major questions doctrine relevant – the revenue collected from the tariffs was intended to replace the tax revenue used to fund the entire federal government.

Finally, the Supreme Court could interpret the case as a political dispute between Congress and the Executive Branch rather than an issue over fundamental legal questions which would be the Court’s purview. In this case, the Court would decline to offer a clear decision on the case and instead effectively tell Congress and the Executive Branch to resolve the dispute on their own. This is how the Court has responded to similar disputes over the division of authority between Congress and the Executive Branch, such as disputes over presidential war powers.

For U.S. counterparts and private firms, the situation is still far from clear. The Trump administration negotiators may insist that the April 2 tariffs are still the key point of discussion in talks, but their foreign counterparts cannot ignore the fact that the ultimate outcome of the tariffs rests with the courts, not with U.S. negotiators. Negotiations will almost certainly continue because discussions go beyond tariffs into things like investment, non-tariff barriers, and more, but the talks will be much less high stakes without the April 2 tariff rates looming as a threat. That poses a more delicate situation than simply putting the talks on pause, because the Trump administration may look for other opportunities to extract concessions, possibly may making stronger links between security guarantees and economic cooperation which to this point have been more implicit than explicit. Business plans will also suffer from uncertainty while the fate of the tariffs is settled in the courts, a process that could take several months.

In the meantime, the Trump administration will almost certainly make further attempts to stretch its authority to its outer limits and possibly even beyond, as the courts have so far ruled in the case of IEEPA tariffs. As it does, there is a likelihood that the process that has played out over the last two months will continue where Trump tries to implement a policy as legal challenges proceed, rather than waiting for courts or Congress to grant him clear authority. This “move fast and break things” approach to economic governance will ensure that uncertainty remains a feature that U.S. counterparts and global firms will need to deal with.

Visiting Research Fellow

Paul Nadeau is an adjunct assistant professor at Temple University's Japan campus, co-founder & editor of Tokyo Review, and an adjunct fellow with the Scholl Chair in International Business at the Center for Strategic and International Studies (CSIS). He was previously a private secretary with the Japanese Diet and as a member of the foreign affairs and trade staff of Senator Olympia Snowe. He holds a B.A. from the George Washington University, an M.A. in law and diplomacy from the Fletcher School at Tufts University, and a PhD from the University of Tokyo's Graduate School of Public Policy. His research focuses on the intersection of domestic and international politics, with specific focuses on political partisanship and international trade policy. His commentary has appeared on BBC News, New York Times, Nikkei Asian Review, Japan Times, and more.

View Profile-

U.S. LNG and Japan's Sea Lanes: Towards Diversification and Stabilization of the Maritime Transportation Routes2026.03.03

U.S. LNG and Japan's Sea Lanes: Towards Diversification and Stabilization of the Maritime Transportation Routes2026.03.03 -

Attack on Iran: What Comes Next for the Gulf & The Oil Crisis?2026.03.02

Attack on Iran: What Comes Next for the Gulf & The Oil Crisis?2026.03.02 -

The Supreme Court Strikes Down the IEEPA Tariffs: What Happened and What Comes Next?2026.02.27

The Supreme Court Strikes Down the IEEPA Tariffs: What Happened and What Comes Next?2026.02.27 -

Fed-Treasury Coordination as Economic Security Policy2026.02.13

Fed-Treasury Coordination as Economic Security Policy2026.02.13 -

What Takaichi’s Snap Election Landslide Means for Japan’s Defense and Fiscal Policy2026.02.13

What Takaichi’s Snap Election Landslide Means for Japan’s Defense and Fiscal Policy2026.02.13

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04 Fed-Treasury Coordination as Economic Security Policy2026.02.13

Fed-Treasury Coordination as Economic Security Policy2026.02.13 India and EU Sign Mother of All Deals2026.02.09

India and EU Sign Mother of All Deals2026.02.09 Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07

Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07 When Is a Tariff Threat Not a Tariff Threat?2026.01.29

When Is a Tariff Threat Not a Tariff Threat?2026.01.29