How electric vehicles became subject to EU economic security

EVs in Europe are promoted because they run without burning petroleum and are thought to be friendly to the environment, and the promotion of EVs has been an environmental issue and one not subject to economic security.

But how should we define whether and when certain items, processing procedures, companies or industry sectors have fallen within the scope of economic security policy?

Concerning EV components — particularly batteries and electric motors — and their supply chains, the EU is attempting to regulate procurement of raw materials from the perspective of economic security. The EU had been taking the lead in promoting EVs from the perspective of environmental protection, but faced the rise of Chinese-made EVs and has subsequently added a new focus — economic security.

The EU rushed to deliberate legislative proposals closely related to economic security in September, including the Net-Zero Industry Act, the Critical Raw Materials (CRM) Act and the EU Chips Act.

One of the characteristics of the bloc’s economic security strategy is that it’s tied into policies of tackling climate change, as well as its green deal and circular economy policy packages. In contrast, the link between environmental policies and economic security is lacking in Japan.

Let us first review the latest moves regarding EV battery supply chains before coming back to the policy gap between the EU and Japan.

The Critical Raw Materials Act

On March 16, the European Commission proposed the CRM Act, a set of regulations proposal to reinforce the sustainable and secure supply of CRMs.

The commission is strongly concerned that, while demand for some of these CRMs is forecast to rapidly increase in the coming decades, the EU is dependent on imports from a small number of countries outside the bloc, especially China.

The CRM Act identifies a list of strategic raw materials (SRMs) — CRMs of particularly high strategic significance because they are facing potential supply risks due to difficulty in expanding production.

The listed SRMs are near equivalent to the specified critical products designated under Japan’s economic security promotion act.

The Council of the EU, the European Union’s policymaking body, endorsed its mandate on June 30, and the European Parliament proposed its amendments on Sept. 14. The proposal is now under negotiations.

In order to explain when and how EV batteries became subject to EU’s economic security policies, three target checkpoints are used in this article: targeted items, geographical areas and the timing factor.

Targeted items

The EU’s act does not only cover EVs but is aimed at safeguarding the bloc’s autonomy over strategic technologies and increasing its self-sufficiency in procuring key raw materials.

Strategic technologies are defined as those underpinning the green and digital transitions of economy, defense and space equipment.

Among EV components, strategic technologies are defined as high-performance batteries and electric motors.

The proposal specifically states that of the 16 materials identified as SRMs, four are used to manufacture EV batteries and one is used in permanent magnets for electric motors.

Items defined as SRMs and CRMs are listed in the annexes to the EU’s proposal, and the SRMs mostly match the list of 11 items — particularly those listed as metal minerals — designated by Japan’s Cabinet Order as specified critical products in December 2022. Those listed by the EU but not by Japan are copper, natural graphite and rare earth elements for permanent magnets.

Copper, for instance, is indispensable for building wiring harnesses — bundles of copper cables that run throughout the entire vehicle to deliver electric power and motion control signals to different components.

As for copper, the Ministry of Economy, Trade and Industry recognizes the risk of relying on imports from two countries — Chile and Peru — but did not include the metal into the list of specified critical products.

But the EU, which is also aware of the supply risk, included it in the list of SRMs in order to pursue a circular economy together with economic security goals by recycling scrap metals consisting of copper within the region and preventing them from being exported.

Demand for copper is expected to rise further in the coming decades, as EVs require more electricity and copper cables than cars with combustion engines.

The EU and Japan chose different paths on whether to include copper in the list of key materials due to the difference in how they link environmental protection and economic security.

Even for materials that are not designated as critical under Japanese law, from the moment they are listed in the U.S. or the EU, Japan must keep close tabs on them as potentially subject to regulation for economic security reasons.

The EU’s CRM Act aims to reduce the bloc’s dependence on a single non-EU country to less than 65% of its supply of any strategic raw material.

Geographical targets

The next checkpoint is where the regulations are targeted geographically.

The EU’s low self-sufficiency of EV batteries has been an issue within the region since 2015, when debates on decarbonization surged.

Efforts to improve the region’s self-sufficiency of lithium-ion batteries including those for EVs have been made under the European Battery Alliance, launched in 2017.

The group was concerned that the region’s battery supply had been heavily reliant on imports from Asian countries such as Japan, China and South Korea.

It aimed to improve the EU’s self-sufficiency in terms of battery production and supplies, including raw materials.

The European Commission and member state governments have provided assistance to boost private-sector investments.

The initiative on battery supply was more of a regional industrial policy than an economic security policy.

In January 2021, the European Commission approved €2.9 billion in public support for the European Battery Alliance’s new initiative, the European Battery Innovation (EuBatIn) project, which aimed to support research and innovation in all segments of the battery supply chain.

The group’s previous measures were intended to counter Japan, China and South Korea, but now it treats China separately.

While EU member states regard Japan and South Korea as countries to friendshore — the practice of relocating supply chains to countries that share common values and strategic interests — the European Parliament targets and names China as an outstanding threat to the EU’s strategic autonomy.

Although the EU’s policy documents do not directly name a specific country, the European Battery Alliance is shifting its focus more specifically to China.

The CRM Act indicates a change in geographical targets, which is the second checkpoint.

Timing factor

The timing factor is the most difficult to predict, because it requires a read on when China stepped on Washington’s or the EU’s toes.

In the case of EV batteries, the reveal of EV export and import statistics for the first half of 2023 served as the timing factor, which led to a surging sense of crisis within the EU regarding Chinese EVs.

Furthermore, Tesla launched an offense in the Chinese EV market in March with large discounts, leaving China’s emerging EV makers at risk. Even long-established German carmakers Volkswagen and Mercedes-Benz were caught up in the race.

Two months later, in late May, it was reported that China had overtaken Japan as the world’s top car exporter in the January-March period, leaving Japan in second place and Germany third.

The first half of 2023 saw a considerable shift occur in the automobile market, and Chinese-made EVs began to be recognized as a clear and direct threat for the EU.

The question remained: What made China and its EVs so competitive?

The answer can be found in trade statistics also revealed in May.

Among China’s exports of EVs in 2022, shipments to Europe — the EU, Norway and the U.K. — rose 89.4% from the previous year to 437,000 units, occupying 46.4% of China’s total car exports and representing their largest share.

This means that the driving force behind the advance of Chinese EVs was doubtlessly the EU market, and China took advantage of the bloc’s promotion of EVs.

Also in May, Allianz Trade released a report and warned that European imports of Chinese-made EVs could cost the EU economy €24 billion by 2030, and the automotive-dependent economies of Germany, Slovakia and the Czech Republic could each face a hit of between 0.3% to 0.4% of their GDP.

The report called on policymakers to strengthen assistance for Europe’s auto sector through measures such as increasing self-sufficiency in raw materials critical for battery manufacturing.

It was felt that even Germany, despite having the leading export competitiveness among the EU, is facing a serious threat from Chinese-made EVs, let alone the other member states.

The three checkpoints having been triggered, debate over the EU’s CRM Act has accelerated with clearer focus on economic security.

Japanese and European EVs

China overtook the U.S. in 2009 to become the world’s largest auto market. This was made possible by China heavily subsidizing its auto industry under a clear and consistent determination to rise as an automotive superpower, with EVs being the key.

The EU did not include EV supply chains as areas subject to economic security when EVs had dominated only the Chinese market. It was forced to take action when Chinese EVs rose as a threat to the EU market and its carmakers.

European Commission President Ursula von der Leyen announced in September that she would launch an anti-subsidy investigation into Chinese EVs.

German Chancellor Olaf Scholz voiced skepticism over the EU’s probe, saying that Europe and China should not deny free trade and fall into protectionism, but should stand firmly with global free trade.

While the European Commission’s investigation is aimed at checking “unfair” competition posed by Chinese EVs in the EU’s auto market and intending to bring the situation back to a “level playing field,” Scholz’s comments hinted that Germany is more concerned about the risk of retaliation and losing its share in the Chinese market.

The three checkpoints reveal that the CRM Act sees China as a threat and that the EU is beginning to replace its industrial policy with economic security policy, while maintaining the original concept of environmental protection at the same time.

Japanese companies operating in China would find some aspects of Scholz’s remarks laudable, especially the emphasis on global free trade. Japan and Europe have enjoyed the benefits of global free trade, but are gradually walking away from it in the long term as they enhance economic security policies.

In the short term, the EU’s joint procurement and information sharing with like-minded jurisdictions under the CRM Act will offer an opportunity for Japan to rethink raw materials procurement in Asia and Africa.

The EU’s economic security policy is closely related to policies of human rights due diligence and working conditions as well as environmental issues. Joint procurement in such developing countries will make the three checkpoints more complicated for Japan when collaborating with the EU and its member states, an issue that will be addressed in the future.

[Note] This article was posted to the Japan Times on November 7, 2023:

https://www.japantimes.co.jp/commentary/2023/11/07/world/european-union-electric-vehicles/

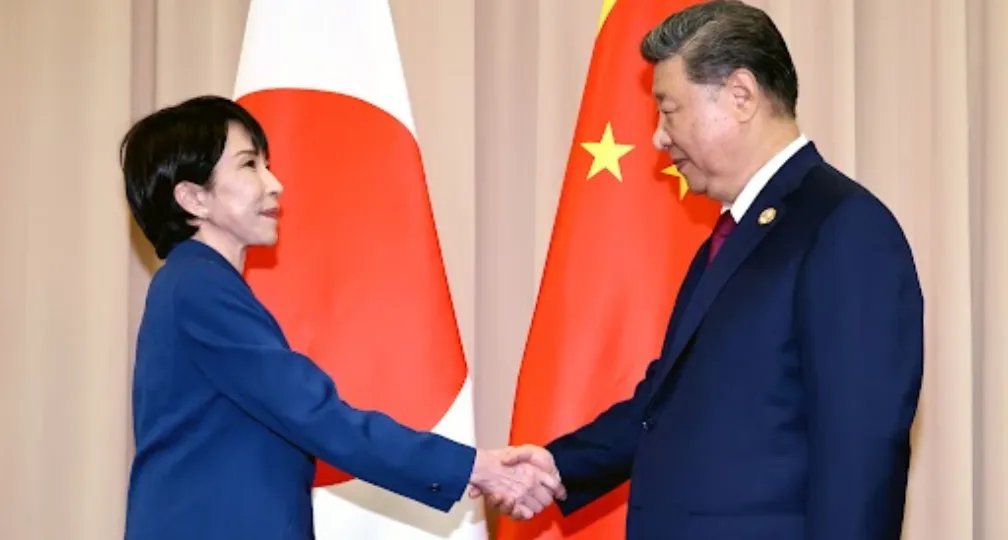

(Photo Credit: Reuters / Aflo)

Geoeconomic Briefing

Geoeconomic Briefing is a series featuring researchers at the IOG focused on Japan’s challenges in that field. It also provides analyses of the state of the world and trade risks, as well as technological and industrial structures (Editor-in-chief: Dr. Kazuto Suzuki, Director, Institute of Geoeconomics (IOG); Professor, The University of Tokyo).

Disclaimer: The opinions expressed in Geoeconomic Briefing do not necessarily reflect those of the International House of Japan, Asia Pacific Initiative (API), the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

Senior Research Fellow,

COO, LLC future mobiliTy research

Hitoshi Suzuki (PhD) was Associate Professor at the Graduate School of International Studies and Regional Development, University of Niigata Prefecture, Japan. He received his Ph.D. in History and Civilization from the European University Institute in December 2007 and has focused on Japan’s relations with the EC/EU, as well as Japan’s auto and aero-space industry in Europe. He was visiting fellow at the Monash European and EU Centre, the London School of Economics and Political Science. After serving as Deputy Director at the Economic Partnership Division, Economic Affairs Bureau of the Ministry of Foreign Affairs of Japan, and as a Research Committee Member of the Europe Study Group at the 21st Century Policy Institute of Keidanren (Japan Business Federation), he founded Mirai Mobility Research LLC in 2021. He currently serves as a Visiting Senior Research Fellow at the Makihara Laboratory, Research Center for Advanced Science and Technology (RCAST), the University of Tokyo, and as an Adjunct Lecturer at Ferris University. As of December 2021, he serves as a Visiting Fellow & Staff Director, CPTPP Project, Asia Pacific Initiative. His publications include "Thatcher and Nissan Revisited in the Wake of Brexit" (Palgrave Macmillan), “The New Politics of Trade: EU-Japan” Journal of European Integration 39(7), “Post-Brexit Britain, the EU and Japan” Europe and the World 4(1), and Suzuki et.al. “Japan and the European Union,” Oxford Encyclopedia of European Union Politics.

View Profile-

Fed-Treasury Coordination as Economic Security Policy2026.02.13

Fed-Treasury Coordination as Economic Security Policy2026.02.13 -

Challenges for Japan During the U.S.-China ‘Truce’2026.02.12

Challenges for Japan During the U.S.-China ‘Truce’2026.02.12 -

India and EU Sign Mother of All Deals2026.02.09

India and EU Sign Mother of All Deals2026.02.09 -

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04 -

Trump, Takaichi and Japan’s Strategic Crossroads2026.02.03

Trump, Takaichi and Japan’s Strategic Crossroads2026.02.03

Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07

Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07 Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04 When Is a Tariff Threat Not a Tariff Threat?2026.01.29

When Is a Tariff Threat Not a Tariff Threat?2026.01.29 It’s Now or Never: India’s Ambitious Reform Push2026.01.09

It’s Now or Never: India’s Ambitious Reform Push2026.01.09 A Looming Crisis in U.S. Science and Technology: The Case of NASA’s Science Budget2025.10.08

A Looming Crisis in U.S. Science and Technology: The Case of NASA’s Science Budget2025.10.08