Will China succeed in remaking Hong Kong in its own image?

Toru Kurata, Professor, Rikkyo University

Over the past five years, Hong Kong has seen its autonomy, freedom and democracy eroded. Despite this, Chinese leader Xi Jinping has repeatedly emphasized that "one country, two systems" is a "good" policy, committing to its long-term preservation.

While Xi wants to leverage Hong Kong’s economy as a tool to advance "modernization with Chinese characteristics," unlike political reforms, this goal cannot be achieved solely by using muscular state power. It requires the business community to come on board — but at a time when the space for economic development is tightening.

In Hong Kong, Beijing is free to impose the political system it wants. However, unlike coercive measures against Taiwan's economy, any attempt to harm Hong Kong in this sphere would amount to self-harm as the territory is an integral part of the mainland's economy.

Understanding the gap between Xi’s vision and Hong Kong’s reality provides crucial insights into the viability of Chinese-style modernization at large.

Chinese-style governance

Beijing’s idea of “patriots governing Hong Kong” signifies the collapse of democracy, a rapid curtailment of individual freedoms and suppression of human rights, with the central government dismissing criticism of these measures as outside interference.

Since the massive protests of 2019, Hong Kong’s electoral system has been overhauled and its Legislative Council, once a platform where pro-democracy lawmakers could oppose government policies and even block major bills, has been reshaped into a pro-establishment body.

Xi has nonetheless repeated his commitment to maintaining Hong Kong’s status as a global financial hub. With its currency pegged to the United States dollar, the territory’s economy remains critical to facilitating both the overseas expansion of Chinese firms and foreign investment in China.

But while Xi’s modernization prioritizes innovation-driven developments in advanced manufacturing industries such as electric vehicles and solar panels, Hong Kong’s laissez-faire economy has failed to foster strength in manufacturing. Despite being home to world-class universities and researchers, its innovation industries lag far behind those of Shenzhen, Singapore and even the Chinese cities of Suzhou and Hangzhou.

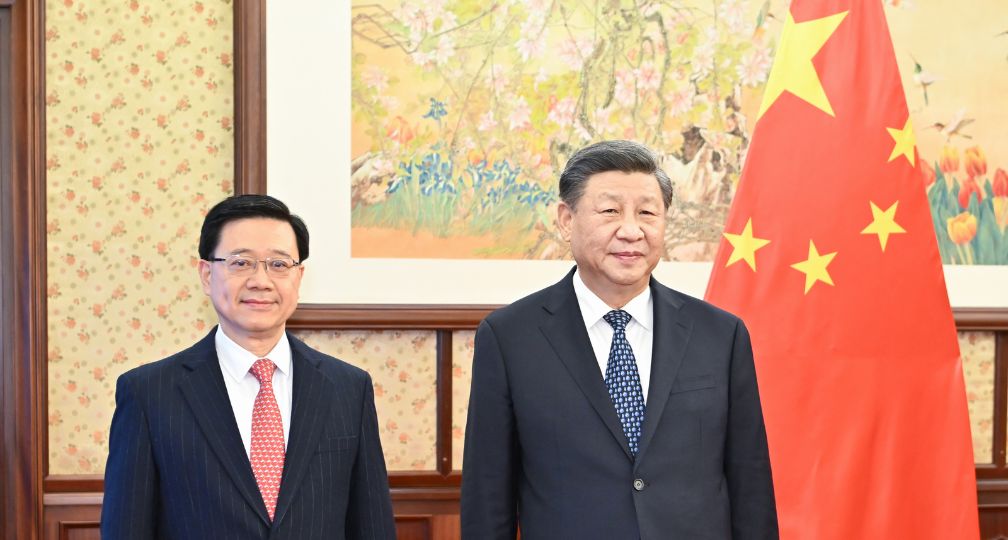

The central government is now on a mission to reshape Hong Kong’s economy. In November, Xia Baolong, director of the Hong Kong and Macao Affairs Office, held a business roundtable with the special administrative region’s chief executive, John Lee, and senior executives from major Hong Kongese real estate developers.

Xia urged the city’s business community to demonstrate “patriotism” through concrete actions, including investments in innovation and technology. Equating investment with patriotism could put huge political pressure on Hong Kong’s private sector, with the economy — historically defined by a free market — potentially on the verge of a profound transformation.

Expectations vs. reality

In recent years, Hong Kong’s economic performance has been lackluster. The National Security Law and zero-COVID policies have deepened skepticism among foreign investors, while many elite Hong Kongese have emigrated to the West.

The anticipated post-pandemic recovery has not materialized, and declining real estate prices have become a drag on both the economy and government coffers. The property market downturn has been heavily influenced by the real estate slump in mainland China and Hong Kong retail, hit hard by the sharp drop in mainlander shopping sprees, continues to struggle, while office vacancies have risen.

The decline in housing costs may not be all bad for Hong Kong’s population, considering its usually sky-high property prices, but falling land prices could have widespread repercussions for its core real estate industry: Developers have been holding back on land purchases, resulting in a series of failed government auctions and worsening public finances.

Following the recent business roundtable, Lee urged Hong Kong’s business community to invest in the Northern Metropolis Development Strategy, a collaboration with Shenzhen that strives for technological advancement as a tangible expression of patriotism.

This ambitious initiative, which involves large-scale infrastructure development and designated development zones, is a key component of the Guangdong-Hong Kong-Macao Greater Bay Area plan. This national-level strategy, heavily promoted by the Hong Kong government, seeks to economically integrate Hong Kong and the cities in the Pearl River Delta, including Shenzhen, Guangzhou and Macao.

In this vision, Hong Kong would serve as a dual hub: A financial center to the south and a high-tech innovation pole to the north would emerge by linking its northern suburbs to Shenzhen. A development that requires massive funding, with the government seemingly wanting to mobilize the business sector while minimizing public expenditure.

Yet, in the midst of an economic downturn and looming deficits, doubts remain as to how much companies will be inclined to purchase and build up large tracts of land.

There are also questions as to whether the Greater Bay Area project truly benefits Hong Kong. The outflow of consumer spending to Shenzhen, where prices are lower, is already contributing to the retail slump. And while infrastructure development such as bridges and high-speed rail connecting Hong Kong to the Bay Area progresses, there is also a risk of a “straw effect,” whereby resources would be siphoned away from Hong Kong.

Furthermore, economic integration brings increased political influence from mainland China. On Dec. 20, Macao saw the swearing in of its first chief executive hailing from the mainland, potentially setting a precedent for Hong Kong.

Hong Kong’s economy is also subject to international volatility. With the reelection of U.S. President Donald Trump — who once said Hong Kong’s market will “go to hell” under Chinese control — the future is even more uncertain. With the slow pace of the renminbi’s internationalization and the global dominance of the greenback unperturbed, both the Chinese government and Hong Kong’s financial institutions may have no choice but to endure American pressure for the foreseeable future.

Some speculated that Hong Kong might thrive during periods of heightened U.S.-China tensions by replacing New York as the premier bourse for Chinese companies. However, with stock prices stagnant, new listings have not materialized.

Xi Jinping’s vision of Hong-Kong’s transformation along Chinese characteristics, an embodiment of his “Chinese dream,” is confronting the harsh realities of economic and geopolitical conditions.

(Photo Credit: Xinhua/ Aflo)

[Note] This article was posted to the Japan Times on April 7, 2025:

https://www.japantimes.co.jp/commentary/2025/04/07/world/hong-kong-china-economy-overhaul/

Geoeconomic Briefing

Geoeconomic Briefing is a series featuring researchers at the IOG focused on Japan’s challenges in that field. It also provides analyses of the state of the world and trade risks, as well as technological and industrial structures (Editor-in-chief: Dr. Kazuto Suzuki, Director, Institute of Geoeconomics (IOG); Professor, The University of Tokyo).

Author

Toru Kurata

Professor, Rikkyo University

Disclaimer: The opinions expressed in Geoeconomic Briefing do not necessarily reflect those of the International House of Japan, Asia Pacific Initiative (API), the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

-

Fed-Treasury Coordination as Economic Security Policy2026.02.13

Fed-Treasury Coordination as Economic Security Policy2026.02.13 -

Challenges for Japan During the U.S.-China ‘Truce’2026.02.12

Challenges for Japan During the U.S.-China ‘Truce’2026.02.12 -

India and EU Sign Mother of All Deals2026.02.09

India and EU Sign Mother of All Deals2026.02.09 -

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04 -

Trump, Takaichi and Japan’s Strategic Crossroads2026.02.03

Trump, Takaichi and Japan’s Strategic Crossroads2026.02.03

Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07

Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07 Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04 When Is a Tariff Threat Not a Tariff Threat?2026.01.29

When Is a Tariff Threat Not a Tariff Threat?2026.01.29 A Looming Crisis in U.S. Science and Technology: The Case of NASA’s Science Budget2025.10.08

A Looming Crisis in U.S. Science and Technology: The Case of NASA’s Science Budget2025.10.08 Fed-Treasury Coordination as Economic Security Policy2026.02.13

Fed-Treasury Coordination as Economic Security Policy2026.02.13