Will Trump’s tech policies propel U.S. success against China?

However, an increasing emphasis on AI development at the expense of regulation raises concerns, given that rules were being strengthened to mitigate national security, human-rights and safety risks.

A rollback that overlooks these issues could have consequences for the U.S. and the world. It may also put America at odds with Europe, which has prioritized regulation, thereby disrupting international cooperation on AI governance.

As U.S.-China competition for AI supremacy intensifies, government and private interests have aligned in pursuit of maintaining the upper hand. China has called for a “global action plan” to better grow and regulate AI. While U.S. President Donald Trump recently unveiled a new AI Action Plan to “remove red tape and onerous regulation” on AI.

This is consistent with Trump’s message since the start of his second term. As soon as he returned to the White House in January, he revoked an executive order issued by former President Joe Biden that mandated AI safety oversight. Although AI regulations under Biden were designed with corporate interests in mind — at least from an international perspective — Trump’s move signaled a clear shift away from his predecessor’s regulatory focus. Shortly after, Washington announced massive investments, emphasizing its commitment to securing an advantage in AI.

Seizing this opportunity, companies have continued investing heavily in AI to establish technological dominance, with Microsoft allocating $80 billion, Meta $65 billion and Stargate — a new company jointly funded by OpenAI, Oracle and Abu Dhabi-based investment firm MGX — $100 billion for this year.

Moreover, as demonstrated by the shocking emergence of China’s AI upstart DeepSeek and the subsequent launch of Grok 3 by Elon Musk’s xAI, the rapid pace of tech development will play a critical role in shaping innovation.

With the industry increasingly divided between open-source and closed-source development models, the ability to set global standards will be among the key determinants of success, together with technological capability and financial resources. While deregulation efforts may positively impact certain aspects of innovation, they represent only one dimension of a broader picture.

Promoting FDI

Before taking office, Trump announced that his administration would accelerate the approval of over $1 billion in foreign direct investment (FDI) into the U.S. Shortly after his inauguration, Japan’s SoftBank Group unveiled its massive $19 billion investment in the Stargate Project, with Stargate planning to construct data centers across America to respond to generative AI’s explosive growth.

Washington’s tariff hikes are also expected to incentivize foreign companies to invest directly in the U.S. At the same time, Trump has directed the Committee on Foreign Investment in the United States to tighten restrictions on Chinese funding in strategic sectors — continuing the previous governments’ hard-line stance on China.

Increased FDI fuels advanced technology development, which could in turn expand innovation opportunities through network effects, technology transfer, human- and financial-capital accumulation and heightened competition. An increase in domestic manufacturing facilities would also contribute to innovation.

But if U.S. allies and partners perceive tariffs, industrial policies and related actions as nationalistic or protectionist, concerns around business instability could emerge. This in turn might deter foreign companies from investing more in the U.S., potentially capping the growth of inbound FDI.

M&A and Big Tech

Under the Biden administration, the Federal Trade Commission tightened review standards for mergers and acquisitions under antitrust laws to prevent more power being concentrated in the hands of Big Tech.

Concerns emerged that stricter regulations would restrict acquisitions, the primary exit strategy for startups — with Big Tech remaining the dominant buyer — consequently reducing venture-capital investments into startups. This shows that M&A policies are a crucial factor in the American innovation ecosystem.

Although Trump picked Andrew Ferguson, who opposed such regulatory measures, to head the Federal Trade Commission, Washington has clarified that it will maintain current M&A review standards for the sake of stability.

While Big Tech acquisitions that could distort market competition are expected to remain subject to regulatory scrutiny, the current administration seems to take a more balanced approach than its predecessor.

DEI changes

Even prior to Trump’s return to the White House, major Silicon Valley firms such as Google, Amazon and Meta had already begun scaling back their diversity, equity and inclusion initiatives. Once Trump came in, federal DEI programs were dismantled and the Department of Education was ordered to cut related grants.

This rollback can be seen as a move toward meritocracy and cost cutting, as well as a correction of what some viewed as excessive DEI efforts under the Democrats. But the foundation of U.S. innovation lies in the country’s open intellectual network, of which migrants make up a significant part. If the very concept of diversity declines, this could hinder innovation in the medium to long term.

According to one study published in 2023, migrants account for 16% of all U.S. inventors and this group is responsible for approximately 23% of patents. When considering spillover effects, U.S. migrants contribute to 36% of innovations, meaning that the current shift may weaken one of America’s greatest strengths, namely, its heterogeneous talent pool.

U.S. tech hegemony

While deregulating AI, promoting FDI and maintaining M&A review guidelines could stimulate domestic competition, it is debatable whether these policies will lead to true innovation.

Excessive tariffs, FDI incentives and industrial policies combined with restrictions on Chinese investment and export controls could also create inefficiencies that hinder America’s ability to accelerate its innovation cycle faster than China.

Furthermore, for the U.S. to maintain and strengthen its technological hegemony, it must coordinate with allies and like-minded nations. Yet Washington risks complicating technological cooperation and policy alignment — a divide that was evident at the AI Action Summit in Paris in February, where U.S. Vice President JD Vance emphasized the need to focus on AI development rather than safety, refusing to sign the summit’s joint declaration.

Beyond sector-specific regulations, shifts in values — such as a reduced emphasis on diversity — could widen the chasm between Washington and its allies. And if traditional talent flows and collaboration are disrupted, the global capacity for innovation may suffer.

“America First” policies could further strain relationships, weakening the country’s global network of partnerships, one of its greatest strategic advantages. While the Trump administration positions itself as tough on China and advocates for allied cooperation, unilateral actions could erode partners’ support.

Meanwhile, as China mobilizes all its resources for an all-out contest for technological supremacy, the U.S. cannot afford economic inefficiencies and to push its closest partners away.

(Photo Credit: Reuters/Aflo)

[Note] This article was posted to the Japan Times on August 1, 2025:

https://www.japantimes.co.jp/commentary/2025/08/01/world/trumps-tech-policies-and-success-against-china/

Geoeconomic Briefing

Geoeconomic Briefing is a series featuring researchers at the IOG focused on Japan’s challenges in that field. It also provides analyses of the state of the world and trade risks, as well as technological and industrial structures (Editor-in-chief: Dr. Kazuto Suzuki, Director, Institute of Geoeconomics (IOG); Professor, The University of Tokyo).

Disclaimer: The opinions expressed in Geoeconomic Briefing do not necessarily reflect those of the International House of Japan, Asia Pacific Initiative (API), the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

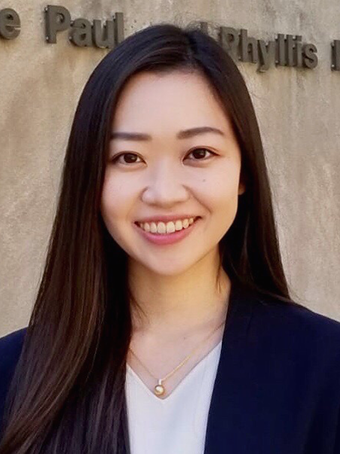

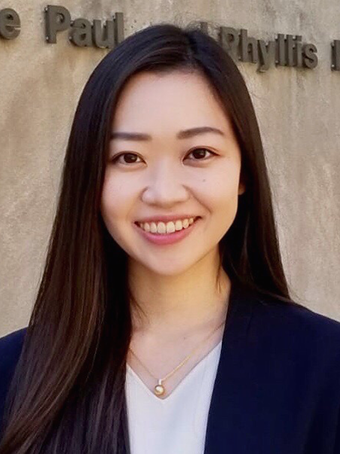

Visiting Research Fellow

Mariko Togashi has been a Visiting Research Fellow at the Institute of Geoeconomics (IOG) since January 2024. Prior to IOG, Mariko was a Research Fellow for Japanese Security and Defence Policy / Matsumoto-Samata Fellow at the International Institute for Strategic Studies (IISS) in London for two years, focusing on Japan’s economic security policy. She also worked as a research assistant to Dr. Kent Calder at Edwin O. Reischauer Center for East Asian Studies, as well as a research intern at CSIS’ Economics Program, focusing on the economic security of the U.S., Japan, and China. Before taking her master’s degree, Mariko worked as an equity analyst in the Japanese machinery sector at Deutsche Bank and Bank of America Merrill Lynch (currently BofA Securities) for more than five years. Mariko earned her master’s degree in international economics and strategic studies from Johns Hopkins University School of Advanced International Studies and her bachelor’s degree in international law from Keio University, Tokyo.

View Profile-

Challenges for Japan During the U.S.-China ‘Truce’2026.02.12

Challenges for Japan During the U.S.-China ‘Truce’2026.02.12 -

India and EU Sign Mother of All Deals2026.02.09

India and EU Sign Mother of All Deals2026.02.09 -

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04 -

Trump, Takaichi and Japan’s Strategic Crossroads2026.02.03

Trump, Takaichi and Japan’s Strategic Crossroads2026.02.03 -

Analysis: When Is a Tariff Threat Not a Tariff Threat?2026.01.29

Analysis: When Is a Tariff Threat Not a Tariff Threat?2026.01.29

Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07

Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07 It’s Now or Never: India’s Ambitious Reform Push2026.01.09

It’s Now or Never: India’s Ambitious Reform Push2026.01.09 Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04 Analysis: When Is a Tariff Threat Not a Tariff Threat?2026.01.29

Analysis: When Is a Tariff Threat Not a Tariff Threat?2026.01.29 Navigating Uncertainty in U.S. Space Policy: Decoding Elon Musk’s Influence2025.04.09

Navigating Uncertainty in U.S. Space Policy: Decoding Elon Musk’s Influence2025.04.09