Looking back 20 years to learn lessons from the U.S.-Japan chip war

The library indeed had a copy of “Chip War” — but it was a yellowed volume from 1989 by Fred Warshofsky. Like the 2022 version, the 1989 book described the geopolitical relevance of technologies like chips and semiconductors. But at that time, the challenge was from Japan.

U.S. concerns

There’s certainly some overlap between the 1989 world that Warshofsky describes and that which Miller writes about today. In both instances, U.S. primacy in these technologies was being eroded by foreign competition, and not entirely “honestly” either. Japan was alleged to have “dumped” semiconductors on world markets (sold at below-market rates to undermine competitors) and kept foreign competitors out of its domestic market.

Today there are concerns about China’s unique state-controlled capitalist model that puts vast subsidies into the system to finance mergers and acquisitions, forced technology transfers as the “cost of doing business” for foreign firms in China, and plain espionage. In both cases, there were acute concerns about (at least) U.S. reliance on foreign technology in applications essential to national security.

There are also some crucial differences. Maybe the most obvious is that Japan never had the military ambition that China now has. The U.S. peer competitor in the 1980s of course wasn’t Japan, but the Soviet Union.

At the time of the first chip war, the Soviet Union had mostly ceased to be a technological competitor of the U.S. and the regime itself was on its last legs. Japan was a treaty ally of the U.S., and while it certainly aspired to economic prominence, it never seriously aspired to competing for global hegemony. The laments of the ’80s had less to do with U.S. hegemony and more to do with the future of American ingenuity as eager and ruthless competitors from Japan, Taiwan and South Korea began to better the U.S. at a game it thought it had perfected.

There was a sense that the work ethic and gumption that propelled America to the top of the global economy had eroded and its place in the world was slipping with it. The biggest military challenge to the U.S. from that situation was that the Defense Department would become too reliant on foreign suppliers of essential components — the idea that Japan (never mind South Korea or Taiwan) might pose a military threat to the U.S. or its allies was the stuff of direct-to-VHS action movies.

In contrast, there’s no question that China sees chips and semiconductors as an essential part of its military modernization and is explicitly linking technological development with military development. It is also fairly clear that these technologies are a key part of the repressive efforts in Xinjiang, Hong Kong and elsewhere in the country under Chinese leader Xi Jinping’s administration.

For all the Sturm und Drang about Japan’s growing semiconductor dominance in the 1980s, domestic oppression or overt threats to neighboring territories like that seen under Xi were never a concern.

Staying ahead is not enough

The question facing the U.S. and its partners is the nature of the challenge to China’s neighbors, the U.S. and the larger international system. U.S. President Joe Biden’s administration believes that the challenge is so profound that it is no longer enough to simply stay ahead of China technologically, but it is vital to hold the nation back, as reflected in the semiconductor export controls that the Biden administration announced on Oct. 7.

These rules appear to be motivated by a genuine desire to staunch China’s development of technologies with military application. But because of the Xi administration’s civil-military fusion initiative, this means that what will actually be staunched is just about everything China can produce, leading toward the narrative that the U.S. is trying to staunch China’s entire economic growth.

While preventing China’s economic growth and therefore its rise as a state may not be the Biden administration’s avowed goal (indeed, officials such as Commerce Secretary Gina Raimondo have made the point that the administration will continue to engage with China on areas consistent with U.S. interests), the point is that the export controls need to be enforced in the service of bigger systemic goals — rather than simply trying to achieve primacy in a particular field — to avoid creating an escalation spiral.

In fact, the Biden administration seems to be emphasizing the military threat despite a certain ambivalence about possible ramifications to the economy. Policy choices like this precipitate long and extended chains of consequences where effects are multiple and unpredictable — and may even be self-defeating. This is especially true in the case of the advanced chip industry, where rapid and cascading innovations, massive capital investments and a disaggregated supply chain structure make it unlike any other commercial sector.

Therefore, there are two reasons why it is essential that the U.S. emphasizes its endgame with its new chip controls.

Realistic diplomacy

The first is diplomatic: it will make it easier for international partners to get on board with the controls if they understand the strategic context of these efforts and understand how the controls are calibrated to achieving those ends.

This isn’t an abstract issue, but a realistic one. According to some reports, the reason the Netherlands has been reluctant to join U.S. export controls is because the two countries have different evaluations of the nature of the threat from China and how export controls can address that threat. Aligning interests among allies requires constant coordination and information sharing, rather than simply “informing” allies of new initiatives.

The second reason is that the U.S. needs to calibrate its finite resources to a finite goal. Coalescing around a foreign threat like China will not return bipartisanship to U.S. politics — even if nostalgics can point to the Cold War as a “golden age” of bipartisanship, the reasons for the current rancor go well beyond the presence or absence of a foreign threat, and it is not China’s job to fix American political dysfunction.

The U.S. simply does not have the material resources or political and administrative cohesion to undertake an expansive, existential ideological struggle like that of the Cold War. Where issues are real and genuine, like the use of U.S. technologies in the Chinese Communist Party’s authoritarian apparatus, the U.S. should do what it can to prevent that from happening.

Yet issue-specific steps like these need to be placed in the context of a broader strategy that aligns resources with goals. Competition with China, on its own, isn’t a strategy. Unless actions are linked to attainable strategic goals, the risk of unintended consequences will multiply and bring further challenges to the U.S. and its partners.

We at least have the benefit of hindsight to know how the competition with Japan turned out. Not long after the 1989 publication of Warshofsky’s book, Japan’s bubble economy burst and along with it any sense of the country offering a geopolitical challenge — even though Japanese companies continue to be among the leaders in these technologies.

What tipped the trade balance

In the end, agreements between Japan and the U.S. to control Japan’s semiconductor exports weren’t what tipped the trade balance in favor of the U.S., it was U.S. innovation (along with the collapse of Japan’s bubble economy). The fact that Japan was an ally and not a hegemonic competitor also helped circumscribe U.S. concerns rather than leading Japan’s semiconductor trade to be seen as a single piece in a larger systemic challenge as the U.S. now sees with China.

That’s why Miller’s book opens in almost the same way as Warshofsky’s, with U.S. technological pre-eminence under threat from a determined foreign challenger despite a publication gap of more than 20 years between the titles.

The good news is that the 1989 chip war with Japan remains a seldom-remembered hiccup in a broader relationship. The U.S. could rely on its innovative capacities, buttressed by its open economy and ability to attract the best talent from anywhere in the world, along with the fact that Japan remained a player in this area.

The bad news is that the U.S. doesn’t have the monopoly on these technologies that it once had, and immigration has slowed. More importantly, the U.S. dodged the turn toward industrial policy during the chip war with Japan but seems more determined to go that route in its chip war with China.

Washington should be careful — even if the primary goal is security-related, the economic effects can be profound. Industrial policy might be well-intentioned, but it is difficult to execute successfully in a supply-chain world, especially one as disaggregated and reliant on innovation as that of advanced chips.

Because innovation can (and does) come from anywhere, the best approach is to let policy step in not at the point of initial inventions, but when potentially successful inventions need to be scaled up to the point where they’re ready for market. If policymakers want to intervene at the initial step, it should be to foster collaboration across borders to allow innovators from anywhere to access and build upon the latest discoveries.

Lessons from Japan

This applies to China as well — the only country with the talent base and ability to make the massive investments to achieve self-sufficiency in this sector will probably still find itself behind without access to innovation or the skill to put its money behind winning companies.

Whether the 2022 chip war with China ends like the one with Japan will depend on learning the right lessons from the first conflict, when openness to talent and innovation were more successful than trying to manage the outcome through direct policy.

(Photo Credit: Shutterstock)

Geoeconomic Briefing

Geoeconomic Briefing is a series featuring researchers at the IOG focused on Japan’s challenges in that field. It also provides analyses of the state of the world and trade risks, as well as technological and industrial structures (Editor-in-chief: Dr. Kazuto Suzuki, Director, Institute of Geoeconomics (IOG); Professor, The University of Tokyo).

Disclaimer: The opinions expressed in Geoeconomic Briefing do not necessarily reflect those of the International House of Japan, Asia Pacific Initiative (API), the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

Visiting Research Fellow

Paul Nadeau is an adjunct assistant professor at Temple University's Japan campus, co-founder & editor of Tokyo Review, and an adjunct fellow with the Scholl Chair in International Business at the Center for Strategic and International Studies (CSIS). He was previously a private secretary with the Japanese Diet and as a member of the foreign affairs and trade staff of Senator Olympia Snowe. He holds a B.A. from the George Washington University, an M.A. in law and diplomacy from the Fletcher School at Tufts University, and a PhD from the University of Tokyo's Graduate School of Public Policy. His research focuses on the intersection of domestic and international politics, with specific focuses on political partisanship and international trade policy. His commentary has appeared on BBC News, New York Times, Nikkei Asian Review, Japan Times, and more.

View Profile-

From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 -

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 -

Harnessing China’s tech giants: The case of Jack Ma2025.06.11

Harnessing China’s tech giants: The case of Jack Ma2025.06.11 -

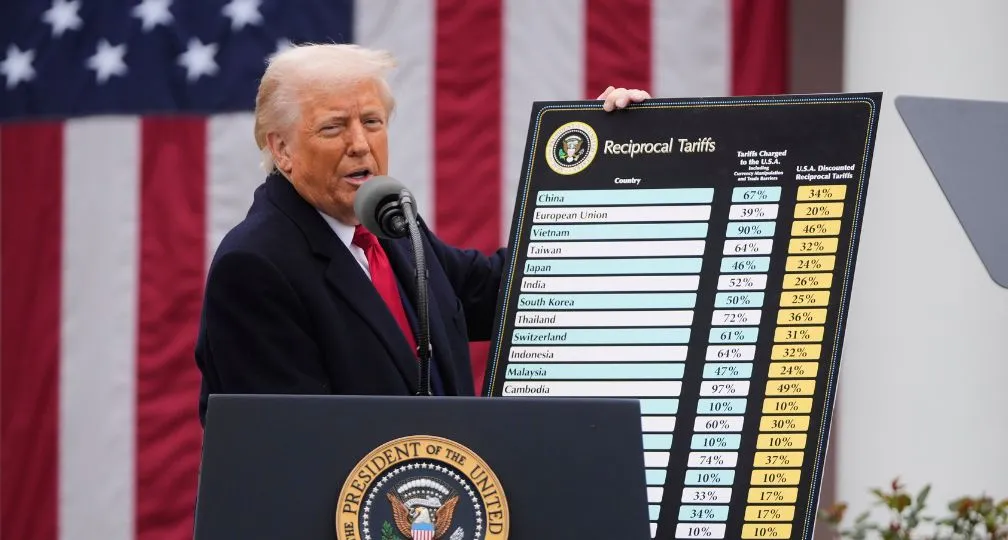

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31 -

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27 Trump’s Major Presidential Actions & What Experts Say2025.02.06

Trump’s Major Presidential Actions & What Experts Say2025.02.06 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25