Why pharmaceuticals are a key issue in the ongoing U.S.-China conflict

“The first step is to restore our supply chains and end critical economic dependencies on China,” the opinion piece said. “China and the U.S. are locked in a cold war. We must win it.”

And on Jan. 7, McCarthy was elected U.S. House speaker after 15 rounds of voting — the first time in 164 years that the House of Representatives had voted 10 times or more to pick a speaker, representing a historic deadlock — as he struggled to gain support from hard-line conservatives in his own party.

Vital supply chains

However, both Republicans, who face internal divisions, and Democrats agree on the need for a tough China policy.

On Jan. 10, Congress decided to set up the Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party, which McCarthy had pledged during the House speaker election campaign after the Republicans won a majority in the House in the midterm elections. Gallagher is heading the committee.

In the opinion piece, McCarthy and Gallagher discuss what the committee should work on, focusing particularly on pharmaceuticals.

“In 2021, the U.S. imported a quarter of its antibiotics from China,” the article said. “India, a key producer of generic drugs, depends on China for 80% of the underlying active pharmaceutical ingredients — demonstrating that even ostensibly friendly sources of lifesaving drugs oftentimes ultimately trace back to China.”

India, the world’s largest producer of pharmaceuticals, including vaccines and low-priced generic drugs, has been dubbed “the pharmacy of the world.”

However, production costs of active pharmaceutical ingredients in China are roughly 20% lower than in India, according to a joint report by the financial advisory firm KPMG India and the Confederation of Indian Industry released in 2020.

India has also depended on China for raw materials to produce active pharmaceutical ingredients.

In other words, China has control over the chokepoints — active pharmaceutical ingredients and raw materials — of pharmaceutical supply chains. This is because most of the raw materials are chemical substances.

Most chemical substances are commodities that can be produced without cutting-edge technology or facilities.

There are safety issues regarding the production of the substances, however, including the risk of explosions at factories.

In 2019, a major explosion occurred at a chemical plant in China’s Jiangsu province, prompting many factories that produce active pharmaceutical ingredients to halt operations.

Moreover, the manufacturing of chemical substances can seriously impact the environment.

Environmental restrictions have also been strengthened in China, but Chinese-made active pharmaceutical ingredients and raw materials remain low-priced.

Global pharmaceutical supply chains have developed by pursuing economic rationality while leaving their main chokepoint — China — unresolved.

Poison and medicine

Why is the United States so focused on pharmaceutical products and active pharmaceutical ingredients, even though there are several critical products whose supply chains are vulnerable?

There are two reasons.

First, there is widespread recognition that China could create biological threats, thereby national security threats.

In the U.S., strong suspicions remain about the origin of the COVID-19 pandemic. Particularly, some Republicans suspect that the virus escaped from the Wuhan Institute of Virology in Wuhan, China.

Moreover, it is not only the Republicans who are concerned. U.S. President Joe Biden’s administration compiled its National Biodefense Strategy in October, and the National Security Strategy released in the same month had a section dedicated to pandemics and biodefense, describing how the U.S. government will tackle those challenges.

Whether pathogens arise spontaneously or intentionally, U.S. policymakers see both threats as one. Government departments and agencies, such as the Centers for Disease Control and Prevention, usually go through the same process for biological threats: quickly detecting threats and pathogens, identifying them, isolating and treating infected people, and identifying and developing vaccines and treatment drugs.

Furthermore, China has now cast aside its stringent “zero-COVID” policy, and although the policy shift set off an explosive COVID-19 outbreak, Beijing is relaxing border controls and letting people move across national borders.

In consideration of China’s moves, a joint statement issued by Biden and Prime Minister Fumio Kishida following their meeting on Jan. 13 called on China to report adequate, transparent epidemiological and viral genomic sequence data regarding the spread of COVID-19.

Secondly, biotechnology has high potential as an industry, filled with possibilities to bring prosperity to society and the economy.

Amid the pandemic, mRNA vaccines supplied by Pfizer and Moderna not only helped protect the lives and health of people around the world, but also brought large revenues to several pharmaceutical firms involved.

Such revenues have become a resource with which those firms can develop new pharmaceutical products.

Biomanufacturing is also attracting attention from the perspective of carbon neutrality and decarbonization.

In September, the Biden administration issued an executive order on advancing biotechnology and biomanufacturing innovation. The White House said industry analysis suggests that bioengineering could account for more than a third of the global output of manufacturing industries before the end of the decade — almost $30 trillion in terms of value.

The public and private sectors in the U.S. are quickly expanding investments in biotechnology.

Synthetic-biology startups raised a total of nearly $18 billion in private-sector investments in 2021, the amount soaring five times from 2019.

Hence, biotechnology can be both poison and medicine to the U.S.

Lessons from trade friction

Japan is also keeping pace with the U.S. in putting effort into nurturing and protecting biotechnology.

However, there is a difference between Japan and the U.S. in the areas of national interest they are trying to protect.

Both governments are trying to strengthen the resilience of supply chains, but they need to agree on which supply chains should be strengthened and through what measures as part of their agenda for alliance management.

A typical example is the U.S. export control rules announced in October, targeting advanced computing semiconductor chips and China.

Looking back on history, Japan and the U.S. butted heads in the 1980s over supercomputers and semiconductors.

Mitoji Yabunaka, a former foreign vice minister who was at the forefront of Japan-U.S. trade frictions at the time — working at the Japanese Embassy in Washington, then at the Foreign Ministry’s Economic Affairs Bureau and the North American Affairs Bureau — points to two lessons that can be learned from the Japan-U.S. trade frictions, in his memoir detailing his 40 years of diplomatic negotiations.

The first lesson is that when trade issues break out in Washington, they always start in the U.S. Congress.

This is because Congress holds the power to raise tariffs. The Office of the U.S. Trade Representative was created under the 1974 Trade Act passed by Congress.

The second lesson is that policymakers in Washington tend to have a preconception that the U.S. is always “fair” and other countries that have a different way of doing things are “unfair.”

The same thing can be said about the ongoing confrontations between the U.S. and China.

There seems a feeling among members of the U.S. Congress that Beijing is unfair for sending Chinese Communist Party members to the U.S. to study, stealing critical and emerging technologies, and using government subsidies to put state-owned companies at an advantage.

Unlike with Japan, which is a U.S. ally, China is described by Washington in the 2022 National Security Strategy as “the only competitor with both the intent to reshape the international order and, increasingly, the economic, diplomatic, military, and technological power to do it.”

It is likely that export controls on shipments to China will become even stricter in the future, extending beyond semiconductors to include pharmaceuticals and active pharmaceutical ingredients, as well as emerging biotechnologies and related data.

Supply-chain mapping

Geoeconomic competition between the U.S. and China is continuing to become more severe, and supply chains for strategic supplies are the main battlefield.

Ever since its launch, the Biden administration has been aiming to strengthen the resilience of supply chains and work to create an environment for American-style fair competition.

While cooperating with the U.S., Japan should at the same time further enhance the policy framework for economic security — something that the Kishida administration has pushed to achieve — based on “national interests to be preserved and developed,” as described in its National Security Strategy.

In 2022, in an effort to reveal vulnerabilities and chokepoints in supply chains, the Japanese government conducted supply-chain mapping — tracing each product component and ingredient to its source — and designated 11 key areas, including semiconductors, storage batteries and critical minerals, as strategically important goods for which the government must ensure a stable supply.

Among pharmaceuticals, antibacterial products were designated. Japan has been nearly 100% dependent on China regarding raw materials and active pharmaceutical ingredients for beta-lactam antibiotics, major antibacterial products that are used in all kinds of surgeries to prevent infection.

In 2019, supplies of cefazolin sodium, one of the beta-lactam antibiotics, were disrupted due to troubles at a facility in China manufacturing raw materials, prompting cases of surgeries being postponed.

Still, in the three years since that shortage took place, measures have been taken at medical facilities, including building inventories.

Beta-lactam antibiotics make up only a part of the pharmaceuticals for which Japan’s supply chains are vulnerable.

Since 2019, the health ministry has been working with the pharmaceutical industry and experts to create a list of “stable supply medicines” deemed to be essential in clinical practices and designate 21 products with the highest priority, including not only antibiotic preparations such as cefazolin but also general anesthetics, anticoagulants and hormone drugs.

Moreover, chokepoints change dynamically according to multiple factors, including demand, research and development, processing and distribution.

Supply-chain mapping will become increasingly important from now in order to cope with the dynamism of economic security.

So what move might the U.S. make next regarding its China policy?

To gain a hint, observers are paying attention to the U.S.-China Economic and Security Review Commission’s annual report to the U.S. Congress.

The 2022 report by the commission recommends that the Biden administration create a new office tasked with ensuring resilient supply chains, with one of its major roles being the continuous mapping of the most critical supply chains, including those for semiconductors, rare earths, and life-saving and life-sustaining medications and their active pharmaceutical ingredients.

Japan’s challenges

The Japanese government should consider conducting supply-chain mapping throughout the year, and precisely target truly critical products, taking into account Japan’s own national security threats and national interests.

If the targeting is too narrow, Japan will not be prepared for possible contingencies, but if it is too wide, government assistance will be dispersed. And excessive protection over industries could hamper innovations.

It is crucial for politicians, bureaucrats, businesses and academics to work together as a task force and narrow down the list of key products and resources to be designated and updated precisely and dynamically.

Japan must extract the “poison” — vulnerabilities in pharmaceutical supply chains — and develop “medicines” by strengthening the resilience of supply chains and nurturing the biotechnology industry for the prosperity of the Japanese economy.

And Japan should come up with its own ideas on how to do that.

Geoeconomic Briefing

Geoeconomic Briefing is a series featuring researchers at the IOG focused on Japan’s challenges in that field. It also provides analyses of the state of the world and trade risks, as well as technological and industrial structures (Editor-in-chief: Dr. Kazuto Suzuki, Director, Institute of Geoeconomics (IOG); Professor, The University of Tokyo).

Disclaimer: The opinions expressed in Geoeconomic Briefing do not necessarily reflect those of the International House of Japan, Asia Pacific Initiative (API), the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

Senior Research Fellow

Yoshiyuki Sagara is a senior research fellow at the Asia Pacific Initiative (API), where he focuses on economic security, sanctions, health security policy including COVID-19 response, international conflicts, and Japan’s foreign policy. Before joining API in 2020, Mr. Sagara had 15 years of career experience working in the United Nations system and the Japanese government, as well as in the tech industry. From 2018 to 2020, he served as Assistant Director of the Second Northeast Asia Division (North Korea desk) at the Ministry of Foreign Affairs of Japan. From 2015 to 2018, he served in the Guidance and Learning Unit within the Policy and Mediation Division of the UN Department of Political Affairs in New York, where he analyzed and disseminated best practices and lessons learned from UN preventive diplomacy and political engagements, such as in Nigeria, Iraq, and Afghanistan. From 2013 to 2015, he served in the International Organization for Migration Sudan, based in Khartoum. As a project development and reporting officer in the Chief of Mission’s Office, he developed and implemented peacebuilding and social cohesion projects in conflict-affected areas of Sudan, especially Darfur. While serving in the Japan International Cooperation Agency (JICA) Headquarters from 2012 to 2013, he managed rural and fishery development projects in Latin America and the Caribbean region. From 2005 to 2011, he worked at DeNA Co., Ltd. in Tokyo and engaged in expanding tech businesses. Mr. Sagara has been widely published and spoke on public policy, including in the Japan Times. He coauthored a report, The Independent Investigation Commission on the Japanese Government’s Response to COVID-19 (API/ICJC): Report on Best Practices and Lessons Learned (Discover 21, 2021). He holds a Master of Public Policy from the Graduate School of Public Policy at the University of Tokyo, and a BA in law from Keio University.

View Profile-

From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 -

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 -

Harnessing China’s tech giants: The case of Jack Ma2025.06.11

Harnessing China’s tech giants: The case of Jack Ma2025.06.11 -

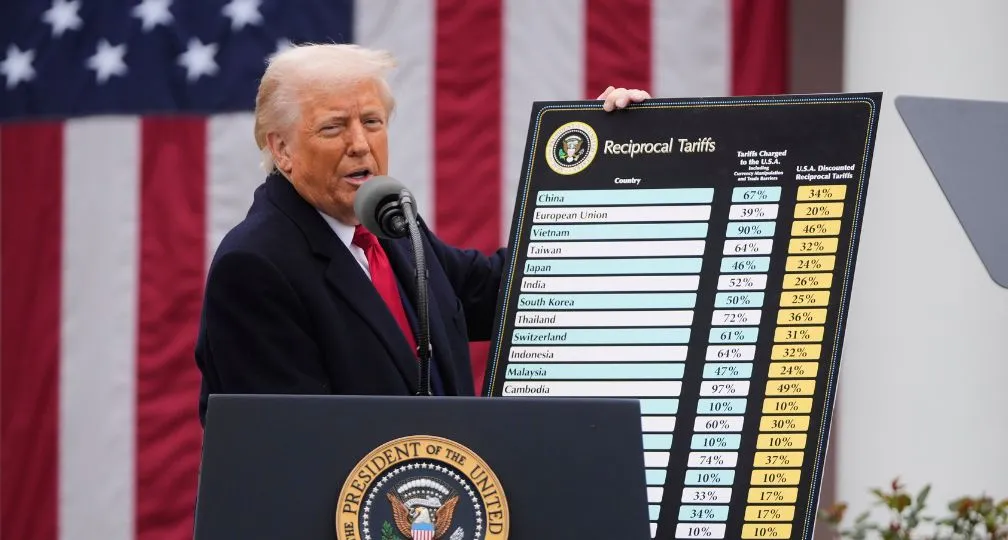

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31 -

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

The Big Continuity in Trump’s International Economic Policy2025.06.11

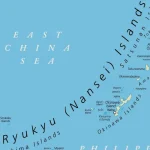

The Big Continuity in Trump’s International Economic Policy2025.06.11 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 Trump’s Major Presidential Actions & What Experts Say2025.02.06

Trump’s Major Presidential Actions & What Experts Say2025.02.06