New challenges have forced Japanese companies to address economic security

Those were the key takeaways from a survey conducted by the Institute of Geoeconomics from mid-November to early January, covering 79 Japanese companies that it believes play an essential role in national economic security and are susceptible to changing economic security dynamics.

It was the second such survey, following one carried out by the Asia Pacific Initiative, the institute’s predecessor, in December 2021, covering 100 Japanese firms and research organizations.

The first survey revealed the risk of being caught between the U.S. and China, as well as the difficulty of balancing economics and national security. But the latest survey showed that global geoeconomic risks have become increasingly uncertain for Japanese companies due to the Russia-Ukraine war and the uncertainty of a potential Taiwan Strait crisis.

Sanctions on Russia

Since Russia invaded Ukraine on Feb. 24, 2022, the international situation surrounding Japan has changed drastically.

In the survey, up to 82.1% of the respondents said they had been affected by Russia’s invasion of Ukraine and subsequent imposing of sanctions on Russia, greatly overwhelming the 17.9% who said they were not affected.

Among those affected, half of the companies said their sales had dropped, followed by those who said their supply chains had to be reorganized — 41.8% saying they had suspended operations at or closed some facilities and 38.8% saying they had examined their business partnerships. About one-third — 37.3% — said they had faced increased costs due to sanctions on Russia.

The results highlight the fact that companies have been hit by both sales declines and cost increases because of the Ukraine crisis.

Taiwan contingency

While it was revealed that the Ukraine crisis had a huge impact on Japanese companies, 72.2%, the largest percentage of respondents, said one of the challenges facing their efforts to address economic security issues was uncertainty in U.S.-China relations.

This issue topped the list of challenges in the previous survey and was rated high on the list again in the latest survey, with the percentage dropping only slightly, reflecting the fact that there remains a huge gap between Washington and Beijing over sanctions on Russia.

Gathering information on international affairs was cited as a challenge by 65.8% of respondents, up by 10% from the previous survey, followed by 63.3% who said risk assessment was a challenge.

It was noteworthy that 50.6% of respondents cited a possible Taiwan contingency as a challenge for them to deal with, nearly double the percentage that chose the uncertainty of sanctions on Russia amid the Ukraine crisis, which stood at 22.8%.

The results show that half of the responding companies have a growing sense of crisis over a future Taiwan contingency — more than over the Ukraine crisis, over which various sanctions on Russia have already been imposed.

In predicting a Taiwan contingency, the biggest hints come from U.S.-China relations and moves by Japanese companies doing business overseas.

Confrontations between the U.S. and China intensified under the administration of U.S. President Donald Trump, and 63.2% of the respondents, up slightly from the previous survey, said they are affected by the situation.

Asked in what way, 64.4%, up slightly from the previous survey, responded that they are facing higher costs due to the tighter regulations imposed by the U.S.

This was followed by 37.3% who said they’d had to change suppliers and 27.1% who said their sales had dropped, about the same percentages as in the previous survey.

The survey also showed that 27.1% of the respondents said their costs had increased due to sanctions on Russia in response to the situation in Ukraine; 27.1% said their costs rose to respond to a possible Taiwan contingency; and 13.6% said their costs went up because of the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act of 2022 and the Inflation Reduction Act of 2022, which came into effect in summer in the U.S. The three options were newly added for the latest survey.

Nearly 12% said they experienced delays or cancellations in transactions due to a reduced appetite for investment, up by 3.8 percentage points from the previous survey.

Supply-chain resilience

A bill to promote economic security was passed into law in Japan in May, and two of the four pillars in the law — securing a stable supply of strategically important materials and assisting development of crucial advanced technologies — were put into force in August.

The ratio of firms with strong awareness of economic security rose 12.7 percentage points from the 2021 survey to 74.7%.

Nearly half the firms said economic security issues are often discussed at board meetings, up 14.3 percentage points from the previous survey.

The latest survey also asked them how they had worked to address economic security issues before and after the enactment of the law.

Nearly 90% of the companies said they had been preparing to cope with economic security issues before the law was enacted. As for specific actions they are taking, 72.9%, the largest percentage, said they strengthened information management, followed by 50% who said they had changed and diversified suppliers, and 25.7% who said they changed their investment plans — the same order of ranking as in the previous survey.

A question on strengthening the resilience of supply chains was newly added to the latest survey and 80% of respondents were found to be working to make their supply chains more resilient.

To do so, 80% gave as their top priority changing and diversifying suppliers, followed by 63.6% who said gathering information on international affairs, 52.7% who said obtaining appropriate information at home and abroad, and 29.1% going as far as relocating their production base.

Competition between the U.S. and China has been intensifying over advanced technologies such as semiconductors and electric vehicle batteries, and the U.S. has been more eager than ever about pushing like-minded countries that respect freedom, democracy and human rights to decouple from China.

The European Union and South Korea have been criticizing U.S. demands to reshore production as protectionist, but Japanese companies have been expanding sales in the U.S. market.

The survey showed that the percentage of firms whose sales in the U.S. occupy between 30% and 50% of total sales increased from 8.1% in the previous survey to 16.2%, and the proportion of firms whose sales in the U.S. occupy between 10% and 50% rose 7.8 percentage points from the previous survey.

However, the percentage of firms with a medium- to long-term goal of increasing the ratio of sales in the U.S. in their total sales stood at 42.4%, increasing only slightly.

Security clearance

Security clearance, the introduction of which Japan is currently debating, is a system of certifying individuals, including government and private-sector officials eligible for handling secret information.

It is believed that the system will enable Japan to take part, for instance, in projects for the joint research and development of cutting-edge technologies with other countries that require the obtaining of security clearance.

While strengthening the resilience of supply chains is more of a defensive measure for economic security, security clearance is of a more offensive nature.

According to the Upper House Standing Committee’s special investigation office’s report in October, such systems have been used by people in the private sector in countries like the U.S., the United Kingdom, Canada, Australia, New Zealand and South Korea. However, a clear prospect for the system to be legislated in Japan is yet to be seen.

In the latest survey, 1 in 4 respondents said a security-clearance system is urgently needed. The more that firms had already suffered damage through being denied access to the latest information because Japan lacks such a system, the more they saw an urgent necessity.

A majority of the respondents believe that the system will be necessary in the future, meaning a total of 78.7% expressed support for introduction of the system.

On the other hand, 1 in 5 firms responded that they have no opinion or knowledge of such systems.

It is necessary to raise understanding of such system systems, including having a clear grasp of costs and the burdens for employees that would come with the introduction of a security-clearance system.

Japanese companies must be aware of the possibility that by the time they become widely aware of the damage caused by the lack of such a system, they would be far behind in accessing state-of-the-art technology.

Merits and risks concerning China

China’s population fell in 2022 and is likely to be overtaken by that of India in 2023, but the country still remains a gigantic market.

On the other hand, China’s risks as a production base have been even clearer as a result of the COVID-19 pandemic and the Ukraine crisis.

The issue of a possible Taiwan contingency has been newly added alongside the existing issue of strengthening information management, leading to a situation in which two geoeconomic issues coexist.

The percentage of respondents who said their sales in China occupy between 10% and 30% of total sales dropped from 40.2% in the previous survey to 34.8%, while the percentage of firms whose ratio of production in China stood between 10% and 50% of total output rose slightly.

However, only 6.7% said they have a medium- to long-term goal of increasing the sales ratio, and 2.6% said they plan to keep the status quo — both figures dropping from the previous survey. The percentage of those who said they intend to decrease the sales ratio was zero in the previous survey, but 4.7% said they intended to this year, indicating that the investment mindset is cooling down.

Regarding concerns over the Chinese market, the business survival risk due to changes in the Chinese government’s policy — selected by the largest percentage of respondents in the 2021 survey — came second in the latest survey.

Instead, geopolitical risk — which came third in the previous survey at 63.6% — topped the list this time at 84.5%.

Response to a possible Taiwan contingency, a newly added answer option taking into account the situation in Ukraine, came third with 71.8%. Information leaks, including technological information, which came second in the previous survey, came fourth in the latest survey at 64.8%.

Balancing between China and the U.S.

The 2021 survey concluded that the key economic security strategy was to balance between government regulations and competitive growth in the private sector, as well as between economics and national security.

The latest survey revealed an even higher geoeconomic risk and growing protectionism triggered by U.S.-China confrontations.

A typical example was the semiconductor-related industry, for which strengthening of regulations was prioritized over free competition, including involving China, as well as national security — securing superiority in military technology — being given a higher priority than economics.

As Kazuto Suzuki, director of the Institute of Geoeconomics and a professor at the University of Tokyo, pointed out in his article in this series, Taiwan and South Korea have strength in manufacturing advanced chips that can also be used for military purposes, while the U.S. is superior in designing such products. Japan, the U.S. and the Netherlands together hold a dominant position in semiconductor production equipment.

Although China lags in all of these areas, other countries depend on China for most of the raw materials. If confrontations between Washington and Beijing intensify further, supply chains could fail to work in the worst case.

Several respondents in different industrial sectors wrote in the survey that the situation of being forced to choose between the U.S. and China should be avoided, and many expressed hopes for issues to be resolved through diplomatic negotiations between governments.

It is necessary for politicians, business circles and academics to share ideas to come up with a strategy to prevent Japan from being caught between the U.S. and China or having to choose between the two countries.

At the same time, Japanese firms have to note that there is a possibility that the ongoing situation in Ukraine is signalling the need for Japan to assume the worst-case scenario will occur in the future.

(Photo Credit: Nikada)

Geoeconomic Briefing

Geoeconomic Briefing is a series featuring researchers at the IOG focused on Japan’s challenges in that field. It also provides analyses of the state of the world and trade risks, as well as technological and industrial structures (Editor-in-chief: Dr. Kazuto Suzuki, Director, Institute of Geoeconomics (IOG); Professor, The University of Tokyo).

Disclaimer: The opinions expressed in Geoeconomic Briefing do not necessarily reflect those of the International House of Japan, Asia Pacific Initiative (API), the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

Senior Research Fellow,

COO, LLC future mobiliTy research

SUZUKI Hitoshi (PhD) was Associate Professor at the Graduate School of International Studies and Regional Development, University of Niigata Prefecture, Japan. He received his Ph.D. in History and Civilization from the European University Institute in December 2007 and has focused on Japan’s relations with the EC/EU, as well as Japan’s auto and aero-space industry in Europe. He was visiting fellow at the Monash European and EU Centre, the London School of Economics and Political Science, and was Deputy Director of the Economic Partnership Agreement Division of the Ministry of Foreign Affairs Japan. As of December 2021, he serves as a Visiting Fellow & Staff Director, CPTPP Project, Asia Pacific Initiative. His publications include Thatcher and Nissan Revisited in the Wake of Brexit (Palgrave Macmillan), “The New Politics of Trade: EU-Japan” Journal of European Integration 39(7), “Post-Brexit Britain, the EU and Japan” Europe and the World 4(1), and Suzuki et.al. “Japan and the European Union,” Oxford Encyclopedia of European Union Politics

View Profile-

From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 -

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 -

Harnessing China’s tech giants: The case of Jack Ma2025.06.11

Harnessing China’s tech giants: The case of Jack Ma2025.06.11 -

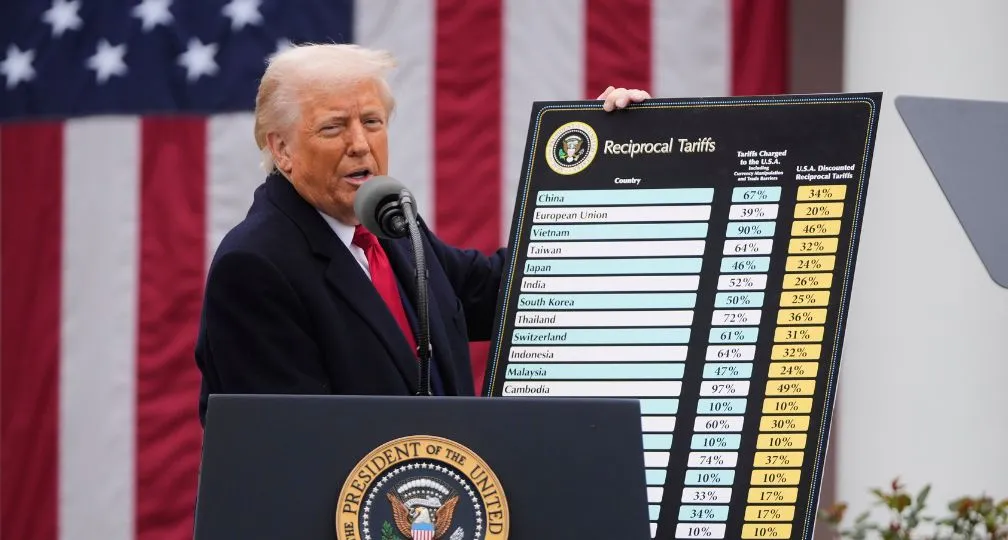

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31 -

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27 Trump’s Major Presidential Actions & What Experts Say2025.02.06

Trump’s Major Presidential Actions & What Experts Say2025.02.06 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25