Europe’s vulnerability in the EU-China-U.S. geoeconomic triangle

Yet this level of interdependence is both an asset and a risk. While it has allowed Brussels to punch above the weight of individual European capitals vis-a-vis Washington and Beijing, it also leaves the EU dangerously exposed to the fallout from heightened U.S.-China economic tensions. Europe now faces unique challenges within the context of what I call the EU-China-U.S. “geoeconomic triangle,” whose sides represent the three bilateral economic relationships. Other states attempting to navigate U.S.-China competition also find themselves in a similar dynamic, including Japan, India and several Southeast Asian nations.

However, the size of the EU market and economic conflicts of interest between the bloc and some of its member governments make this stand out as perhaps the most consequential triangle in the emerging era of geoeconomics. On the one hand, there are indications that the EU is moving in a direction similar to the United States’. The bloc’s economic security strategy was announced last June, then enhanced in January, and the European Commission published a 700-page report in April outlining “distortions” in China’s economy.

On the other hand, the American response to China’s state-driven ascendancy risks undermining the very international economic order that enabled the EU’s past successes, with tariffs and industrial policy reemerging as central components of a new “Washington Consensus.”

For now, these policies are mainly directed at China, but once they become normalized, they could theoretically target European competitors as well. In that case, some EU member states might find that deeper economic ties with Beijing better suit their national interests. The alternative would be for the EU to seek strategic autonomy and lessen its dependence on both the American and Chinese economies, as French President Emmanuel Macron suggested in a recent speech.

Regardless, how the EU responds to U.S.-China competition may have a measurable effect on the rivalry’s trajectory, just as the rivalry will have an outsized impact on Europe.

China as the pivot?

A triangular dynamic between the three powers had emerged clearly by 2013, the year EU-U.S. talks for a Transatlantic Trade and Investment Partnership (TTIP) began and when Chinese leader Xi Jinping launched the Belt and Road initiative.

Initially, Europe did not adequately appreciate the BRI’s geoeconomic logic. But in hindsight, this represented (and represents) Beijing’s attempt to restructure the global economy with China at its center.

Part of China’s strategy was to divide Europe and America. If these two poles became dependent on China’s domestic market and supply chains, Beijing could become the pivot of a new economic order that would emerge out of the U.S.-led economic institutions in which the EU was a key player. Thus, Brussels was considered a critical target: If it aligned with Beijing’s approach, this would force Washington to either adapt to the new Eurasian system or engage in a losing gambit to maintain economic hegemony.

Importantly, while China entered into talks with the EU for a Comprehensive Agreement on Investment (CAI) in 2013, it also made advances toward individual European states. For example, in 2019, China and Italy signed a memorandum of understanding to cooperate under the BRI’s auspices. However, its most significant moves were toward Germany. Under former Chancellor Angela Merkel, Berlin often prioritized enhanced bilateral ties with Beijing over EU policy — such as when Merkel opposed Brussels’ tariffs on Chinese solar panels in 2013.

A high point was reached the following year, when Merkel and Xi signed a comprehensive strategic partnership and welcomed a tangible symbol of the BRI project together: a cargo train bringing Chinese exports from Chongqing, in southwestern China, to Duisburg, in western Germany. Though China succeeded in enhancing economic relations with Europe, subsequent events prevented it from achieving its aim of dividing the EU from the U.S.

Geoeconomic triangle recast

When Donald Trump ran in the 2016 presidential election on a platform opposing trade deficits with China (and trade agreements in general), Beijing’s opportunity to exploit its pivotal position seemed to have arrived. Trump’s election was thought to mean the end of American global economic leadership and a rupture in the transatlantic relationship — allowing China to fill the vacuum.

In January 2017, days before the Trump inauguration, Xi delivered a keynote speech to the World Economic Forum positing China as a defender of globalization. Trump’s administration signaled the end of the TTIP talks, much to the EU’s dismay, but, at the same time, its “trade war” rhetoric publicly exposed Chinese geoeconomic strategy. The EU became more attuned to China’s ambitions, branding it a “systemic rival” in 2019. In addition, the U.S.-China trade war motivated the EU to boost its strategic autonomy and economic security.

The COVID-19 pandemic proved to be the real inflection point. By withholding information and medical supplies, China tarnished its image in Europe as a responsible power, exposing the tradeoff between the benefits of interdependence and the risks of reliance on Chinese supply chains. Other factors combined to further damage the relationship. In December 2020, the CAI deal was finally completed, but following U.S. pressure and tit-for-tat sanctions over China’s policies in Xinjiang, the deal stalled in the European Parliament just five months later. Simultaneously, the EU announced that it would reduce its dependence on China in strategic sectors.

The EU also found some alignment with the Biden administration’s approach to economic security. Biden opted to retain Trump’s tariffs on China and advanced new policies striving for a common transatlantic position. For instance, since 2021, deeper cooperation has been fostered under the EU-U.S. Trade and Technology Council.

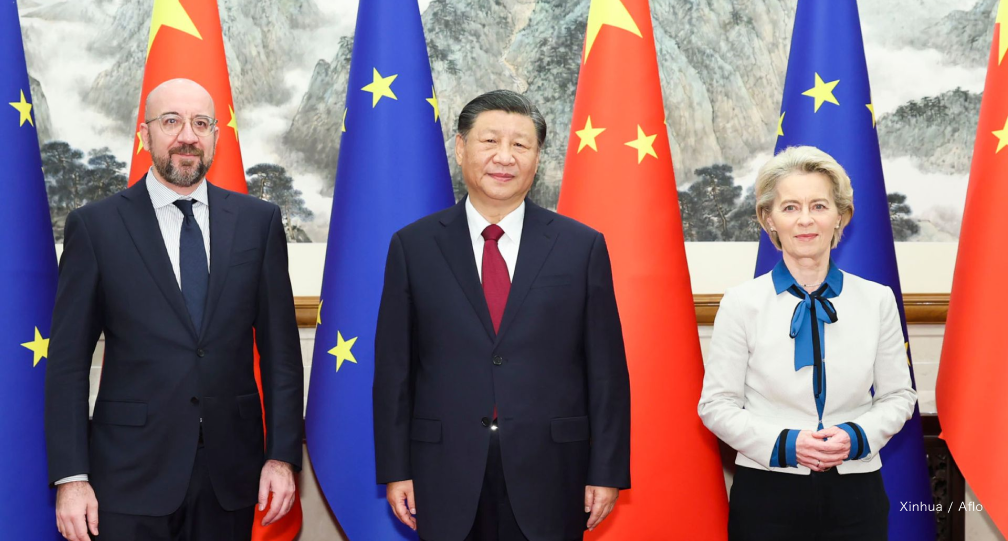

Similarly, rather than “decoupling” from China, the Biden administration has borrowed European Commission President Ursula von der Leyen’s terminology of “de-risking,” first used in March 2023, which focuses on dual-use and national security technologies. U.S. Secretary of State Antony Blinken explicitly used this term during his June 2023 meeting with Xi. The following day, the EU released its economic security strategy, signaling an aligned EU-U.S. view of the Chinese challenge.

Another marked shift began in early 2023, caused by the Ukraine war and a closer Sino-Russian partnership, as well as growing dissatisfaction in Europe with the returns from engaging with China — for example, Italy exited BRI in December. But China’s economic strategy has also changed: Its response to diminishing returns from housing and infrastructure investments has been to reorient state capital toward manufacturing and advanced technologies, reducing the global market share for European firms. The overall effect of these developments has recast the geoeconomic triangle, strengthening the transatlantic side.

EU economic security

If decoupling means severing economic ties, the precision implied in de-risking entails more complex tradeoffs. It is difficult for democracies to align national security priorities with companies’ and workers’ economic interests. Therefore, in both the EU and U.S., a midpoint between geopolitical necessities and economic realities must be found.

Yet one-party states like China do not face the same tradeoffs. They can direct state-owned enterprises to allocate vast resources to geoeconomic projects and absorb the costs without suffering electoral consequences. And despite a similar economic security perspective on both sides of the Atlantic, the EU and U.S. are not completely aligned — and the geoeconomic triangle remains. This will hamper coordination. For example, American export controls on dual-use technologies give European competitors an opportunity to increase their market share in China, and U.S. firms can likewise be expected to capitalize on European policies.

Furthermore, regardless of who wins the U.S. election in November, tariffs and industrial policy will remain part of the American economic security profile. Europe may follow suit, driving a wedge in the triangle’s transatlantic side. But the chief impediment to a European economic security strategy is that a common market does not mean common national interests. There may be a consensus to protect the EU market from Chinese overcapacity when it comes to inbound trade, but the same is not true for outbound trade, as individual states and firms still want greater access to the Chinese market.

One illustrative example came in April, when the EU was releasing its report detailing China’s nonmarket economy while German Chancellor Olaf Scholz was in Beijing seeking new business opportunities.

As global business conditions are transformed by the U.S.-China rivalry, European governments and companies will find it difficult to adjust. That is unless they can better coordinate their policies as a supranational bloc and leverage their position in the geoeconomic triangle.

[Note] This article was posted to the Japan Times on May 31, 2024:

https://www.japantimes.co.jp/commentary/2024/05/31/world/eu-china-us-economic-security-triangle/

Geoeconomic Briefing

Geoeconomic Briefing is a series featuring researchers at the IOG focused on Japan’s challenges in that field. It also provides analyses of the state of the world and trade risks, as well as technological and industrial structures (Editor-in-chief: Dr. Kazuto Suzuki, Director, Institute of Geoeconomics (IOG); Professor, The University of Tokyo).

Disclaimer: The opinions expressed in Geoeconomic Briefing do not necessarily reflect those of the International House of Japan, Asia Pacific Initiative (API), the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

Visiting Research Fellow

Andrew Capistrano is Director of Research at PTB Global Advisors, a Washington DC-based geopolitical risk consulting firm. Specializing in economic competition between the US/EU and China, he analyzes how trade, national security, and industrial policies impact markets, and his firm’s clients include Japanese corporations and government agencies. He previously worked in Tokyo at the US Embassy’s American Center Japan and as a research associate at the Rebuild Japan Initiative Foundation / Asia-Pacific Initiative. Dr Capistrano holds a BA from the University of California, Berkeley; an MA in political science (international relations and political economy) from Waseda University; and a PhD in international history from the London School of Economics. His academic work focuses on the diplomatic history of East Asia from the mid-19th to the mid-20th centuries, applying game-theoretic concepts to show how China's economic treaties with the foreign powers created unique bargaining dynamics and cooperation problems. During his doctoral studies he was a research student affiliate at the Suntory and Toyota International Centres for Economics and Related Disciplines (STICERD) in London.

View Profile-

From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 -

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 -

Harnessing China’s tech giants: The case of Jack Ma2025.06.11

Harnessing China’s tech giants: The case of Jack Ma2025.06.11 -

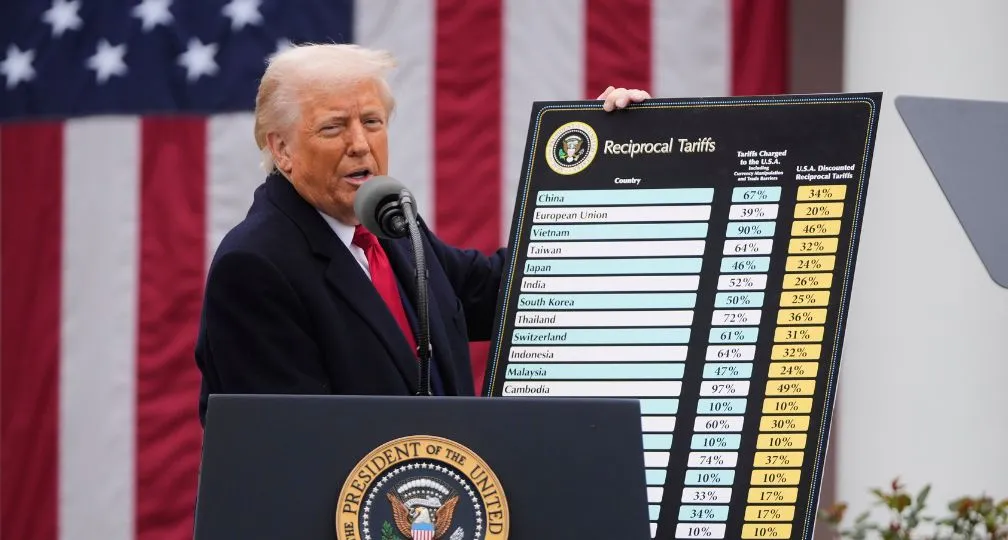

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31 -

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27 After tariffs: Is there a plan to restructure the global economic system?2025.04.03

After tariffs: Is there a plan to restructure the global economic system?2025.04.03