IOG Economic Intelligence Report (Vol. 3 No. 10)

The latest regulatory developments on economic security & geoeconomics

By Paul Nadeau, Visiting Research Fellow, Institute of Geoeconomics (IOG)

New Tariffs on China to Come: U.S. President Joe Biden is expected to announce tariffs of as much as 102.5 percent on electric vehicle (EV) imports from China and raise tariffs on other imports from China as well. The tariffs are intended to head off an anticipated flood of EV imports from China, but are also believed to be mostly symbolic since the United States is not a major destination for EV exports from China following earlier tariff programs under the Trump administration that help keep imports out of the United States. The upcoming tariffs are being framed by the Biden administration as a “defense of American workers”. Key sectors to be targeted include electric vehicles, batteries, solar cells, steel, and aluminum, which some parts relevant to solar panel production will be spared.

Blinken Visits China: U.S. Secretary of State Anthony Blinken visited China from April 24-26. During his visit he met with Xi Jinping, Foreign Minister Wang Yi, Minister of Public Security Wang Xiaohong, and Shanghai Party Secretary Chen Jining. Secretary Blinken said that beyond messages of “responsibly managing” the relationship, he raised issues related to China’s support for Russia’s invasion of Ukraine through its supply of materials like tools and electronics, Taiwan, the South China Sea, human rights, and the production and exports of opioids. The sides also agreed to establish a dialogue on reducing risks from emerging technologies.

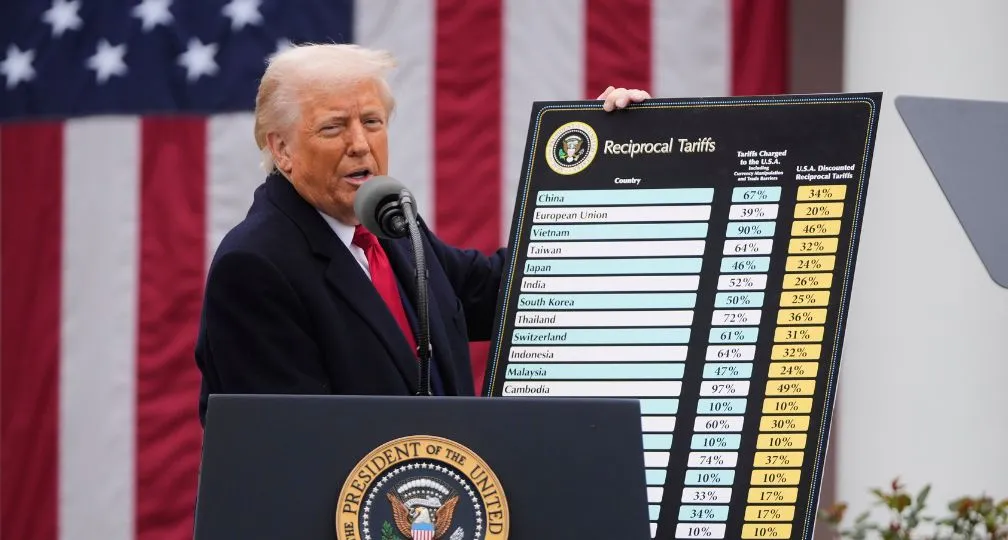

China Strengthens its Ability to Retaliate: On the day of Secretary Blinken’s visit, China passed a law that gives it the ability to retaliate against countries that renege on trade agreements or impose tariffs on China. The law, which has been under consideration since 2022, will take effect on December 1 and sets out how China can use the “principle of reciprocity” against markets it has signed a preferential trade deal with, and allows Chinese officials to apply equivalent tariffs on goods from the countries in question. China has repeatedly accused the United States of violating its agreements with China, beginning with Donald Trump’s invocation of Section 301 tariffs in 2018.

UN Launches Panel on Critical Minerals: The United Nations launched a panel of almost 100 countries in order to establish a set of principles for governments and companies for producing critical minerals. The panel’s goal is to best promote cooperation for accessing critical minerals and to ensure equitable economic growth from the mining and development of critical minerals and is expected to provide a list of voluntary best practices and recommendations by September.

WTO Appoints New Leadership for Dispute Settlement Talks: The World Trade Organization appointed Usha Dwarka-Canabady, Mauritius’s ambassador to the WTO, to lead negotiations on reforming the organization’s dispute settlement system with the goal of reaching an agreement on dispute settlement reform by the end of the year. She replaces Marco Molina, Guatemala’s former deputy permanent representative, who was fired by his government shortly before the WTO’s ministerial conference in February. Additionally, outgoing WTO Dispute Settlement Body chair Petter Ølberg told members that a decision has been made to “formalize” the negotiations, bringing them under formal WTO structures and with records kept of discussions.

Nippon Steel Delays Closing Date of U.S. Steel Acquisition: Nippon Steel announced on May 3 that it will postpone the closing of its acquisition of U.S. Steel by three months following the U.S. Justice Department’s request for additional documentation related to the deal. The delay pushes the likely closing date from September to December, potentially placing it after the U.S. presidential election in November.

Another Round for U.S.-Taiwan Talks: The United States and Taiwan held a negotiating round for the U.S.-Taiwan Initiative on 21st-Century Trade in Taipei, Taiwan, from April 29 through May 3. The two sides exchanged views and reviewed proposed texts on agriculture, labor, and the environment.

U.S. Opens Application for Twin Tech Research: The Biden administration is opening applications for $285 million from the $11 billion Chips and Science Act to help establish an institute focused on digital twin technology which leverages artificial intelligence innovations to develop more advanced semiconductors. Awards are limited to institutions that are incorporated in the United States and have their principal base of operations in the country.

Analysis: Critical raw materials: Europe’s strategic autonomy and the green transition

By Andrew Capistrano, Visiting Research Fellow, Institute of Geoeconomics (IOG)

Advanced economies have entered a period of rapid adjustment, one the World Economic Forum has termed the ‘twin transition’. On the one hand, a ‘digital transition’ has opened up new frontiers for economic growth through increased efficiency and productivity, driven by the development of more powerful computers with ever-smaller semiconductors. On the other hand, a ‘green transition’ could create further opportunities by using advanced technologies to decrease fossil fuel dependence and support more environmentally friendly growth models. The EU has put this ‘twin transition’ at the forefront of the common market’s future growth strategy, intended to ensure that European firms remain competitive in the coming age of ‘sustainable technology’.

However, both the digital and green transitions are reliant on critical raw materials (CRMs). From advanced batteries powering electric vehicles (EVs) to strategic technologies with defense and space applications, CRMs (including rare-earth minerals) are set to be the key inputs for the next industrial revolution. They are also essential for producing smartphones and consumer appliances used in everyday life. This puts EU member states in a risky strategic dependency: China, the undisputed world leader in mining rare earths, accounts for around 60 percent of global CRM production and 100 percent of the EU’s supply of heavy rare-earth elements. There are clear geoeconomic implications from such a dependency. Demand around the world is skyrocketing for CRMs, as all major economies seek to diversify their supply chains and shore up their economic security amid the ‘twin transitions’.

When the US-China trade war heated up in 2017, the EU’s Competitiveness Council began to recognize its over-reliance on Chinese and other non-EU CRM suppliers. It therefore put forward conclusions urging for a comprehensive, long-term EU industrial policy that created a “strong, resource-efficient, and competitive European industrial base”. The European Council (EUCO) adopted these conclusions in 2018 and called on the European Commission (EC) to produce an “ambitious” industrial policy that supported the EU’s strategic autonomy and economic security. Over the next few years an EU strategy directly referencing the ‘twin transitions’ coalesced into a concrete policy platform, and in 2023 the EC released its “Green Deal Industrial Plan for the Net-Zero Age”.

One of the three proposals required to actualize this plan was a Critical Raw Materials Act (CRMA), aiming to “increase and diversify the EU’s critical raw materials supply; strengthen circularity, including recycling; and support research and innovation on resource efficiency and the development of substitutes”. On 18 March 2024 the EUCO gave its final approval for the CRMA, meaning it will soon become EU law.

The CRMA applies to 34 CRMs; of these, 17 were identified as Strategic Raw Materials (SRMs)—including copper, natural graphite, nickel, silicon, tungsten, and the light and heavy rare-earth elements—since they have more complex production requirements and thus present higher risks of supply disruption. It also established benchmarks for the EU to reach by 2030: 10 percent of annual EU CRM consumption will be extracted from EU member states; 40 percent will be processed in the EU; 25 percent will come from recycled materials; and no more than 65 percent of SRMs (at any stage of processing) will come from any single non-EU country. Finally, the CRMA introduced new regulations, such as setting clear deadlines and permit procedures for EU extracting projects, allowing the EC to recognize a project as “strategic”, requiring supply-chain risk assessments, and mandating that member states have national exploration plans.

EC President Ursula von der Leyen explicitly identified the 34 CRMs as “vital for manufacturing key technologies for our twin transition”. She added that it would bring the EU closer to its “climate ambitions”. But there could be a challenge ahead in aligning the goals of strategic autonomy and the ‘green transition’. While the EU may now have a directive to diversify its supply chains for CRMs to ensure it has the capability to produce EV batteries, wind turbines, and hydrogen storage technology, it is unclear if reaching the CRM benchmarks can be done in sustainable way. Mining and processing raw materials is energy intensive—using fossil fuels—and may contradict EU environmental regulations as part of the net-zero strategy. Furthermore, the goal of obtaining 25 percent of EU CRMs from recycled materials by 2030 may be unrealistic. So far there are few indications that technologies capable of sorting that amount of CRMs from other alloys can be developed in such a short timeframe.

Regardless of these challenges, the fact the EC approved a CRMA is a step forward, since it creates a comprehensive set of policies that will foster a predictable regulatory environment. Whether or not the CRMA is able to help create the conditions necessary to reach the EU’s goal of being the first net-zero continent by 2050, it has a better chance of enhancing EU economic security by diversifying CRM supply chains and incentivizing cooperation with reliable trading partners. If Europe can actually create a “strong, resource-efficient, and competitive industrial base”, this would spur economic growth and support the goal of strategic autonomy, even if this means accepting less-than-sustainable mining and industrial processing. In other words, as 2030 (and 2050) approaches, the EU may need to choose between prioritizing its strategic autonomy or its green ambitions.

Disclaimer: The views expressed in this IOG Economic Intelligence Report do not necessarily reflect those of the API, the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

API/IOG English Newsletter

Edited by Paul Nadeau, the newsletter will monthly keep up to date on geoeconomic agenda, IOG Intelligencce report, geoeconomics briefings, IOG geoeconomic insights, new publications, events, research activities, media coverage, and more.

Visiting Research Fellow

Paul Nadeau is an adjunct assistant professor at Temple University's Japan campus, co-founder & editor of Tokyo Review, and an adjunct fellow with the Scholl Chair in International Business at the Center for Strategic and International Studies (CSIS). He was previously a private secretary with the Japanese Diet and as a member of the foreign affairs and trade staff of Senator Olympia Snowe. He holds a B.A. from the George Washington University, an M.A. in law and diplomacy from the Fletcher School at Tufts University, and a PhD from the University of Tokyo's Graduate School of Public Policy. His research focuses on the intersection of domestic and international politics, with specific focuses on political partisanship and international trade policy. His commentary has appeared on BBC News, New York Times, Nikkei Asian Review, Japan Times, and more.

View Profile-

From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 -

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 -

Harnessing China’s tech giants: The case of Jack Ma2025.06.11

Harnessing China’s tech giants: The case of Jack Ma2025.06.11 -

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31 -

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27 Trump’s Major Presidential Actions & What Experts Say2025.02.06

Trump’s Major Presidential Actions & What Experts Say2025.02.06 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25