What will it take for China to regain market confidence?

China’s growth rate of 5.3% in the first quarter of this year may have beaten expectations, but the country’s leader Xi Jinping continues to struggle with overall economic management. Many once thought that it was only a matter of time before China’s economy overtook that of the United States, but the post-pandemic slowdown has raised doubts about this trajectory. China is facing a prolonged real estate recession, hidden local debt problems and low business and household confidence as well as concerns about deflation and overcapacity.

It would be unfair to blame the Xi administration alone for these problems, as it inherited several negative legacies from preceding governments. In response to the global financial crisis of 2008, the previous administration led by Hu Jintao implemented a major stimulus package. While this helped stop the economy from entering a recession, it increased already serious investment biases and caused property prices to soar. Local governments used their own financing vehicles to stimulate the economy, which exacerbated the accumulation of hidden local government debt.

In the wake of the financial crisis, state-owned enterprises took over several private firms, leading to fears captured by the Chinese idiom “the state advances, the private sector retreats.” Inequality and environmental problems also worsened. When Xi came to power in 2012, he set his sights on moving away from the traditional excessive focus on growth, aiming for “high-quality development.” According to a speech he gave in 2017, this is equal to “innovative, coordinated, green, and open development that is for everyone.” However, the process of reducing the excessive emphasis on growth and generating shared wealth has not been smooth, with some problems becoming more apparent in the wake of the pandemic.

First, China’s investment-oriented economic structure has not been corrected: The rate of investment to GDP fell from 46.2% to 43.2% between 2012 and 2022, while private consumption rose from 35.4% to 37.5%. This signals marginal change and that the underlying trend of a high investment rate and low consumption rate has not been altered. The property market has also been a thorn in the leadership’s side. Despite periods of stricter regulation to control the rise in property prices, once economic conditions deteriorated, the government turned to stimulating property demand through monetary easing in response to the pandemic, causing price hikes. Strong new regulations were therefore introduced to curb property developers’ debt financing, leading, in turn, to an unprecedented property recession.

The issue of hidden local government debt has also not been fundamentally resolved. The revised Budget Law of 2014 allowed local governments to issue local government bonds with central government approval and most of the past debt was refinanced into local government bonds. However, a structural shortage of financial resources for local governments remains. When local governments needed to increase investment to stimulate the economy, they resorted to raising funds through loan pledges — causing debt to build. According to estimates by the International Monetary Fund, the ratio of local government financing vehicle’s debt to nominal GDP was 48% in 2023, higher than in 2013 (32%), before reforms were implemented.

Economic problems under Xi

In addition, new problems have emerged due to the Xi administration’s economic management. Stronger micromanagement by the government and Chinese Communist Party (CCP) of business activities has led to worsening business sentiment. At the time of Xi’s inauguration, the third plenary session of the party’s 18th Central Committee stated that the administration “should let the market play a decisive role in (the) allocation of resources and the government better serve its duty.”

In practice, however, since the administration’s second term starting in 2017, more emphasis has been placed on the government’s role. Increased regulation and control have become more prominent in the platforming, property development, education and gaming industries, among others. Most important to Xi is maintaining a one-party system and CCP guidance has been strengthened in all areas, including the economy. This micromanagement is justified if the administration thinks certain business activity is not favorable to high-quality development. Regulations have been tightened to reduce inequality, prevent the uncontrolled expansion of capital and create shared wealth.

Another point is that emphasis on supply-side policy has raised concerns about deflation and overcapacity. When COVID-19 struck, the government focused on policies to support the recovery of supply capacity rather than on spending to sustain consumption, including cash transfers. Under the “dynamic zero-Covid” policy, several houses, offices and factories were suddenly sealed off. Year-on-year private investment, down 0.4%, became negative for the first time in 2023.

In addition, a policy was set out to strengthen advanced and future industries’ productive capacity in the form of “new quality productive forces.” The aim is to increase total factor productivity and halt the slowdown in growth by promoting advanced and future industries in the face of a declining labor force and decelerating investment. The move also aims to improve “self-reliance and strength” in scientific and technological fields as the U.S. and other Western countries clamp down on the transfer of advanced technology to China.

However, emphasizing the quality and quantity of supply in the face of weak demand has exacerbated overcapacity. This in turn has led to deflationary concerns domestically while, externally, it has fueled trade friction as Chinese companies have channeled excess capacity into exports.

Possible solutions

First, to resolve fundamental issues, renewed emphasis should be put on the market’s role in allocating resources. To this end, micromanagement of corporate activities should be discouraged as much as possible. At the same time, the areas where private firms can operate should be expanded — including those where state-owned enterprises form oligopolies or monopolies. Even if the market turmoil can be suppressed in the short term through government interference, market-enabling policies will be key to regaining market confidence in the long run.

Second, instead of micromanaging individual businesses’ activities, the government should focus on solving underlying problems. That is, creating and reforming institutions that will help correct investment biases, curb property speculation and reduce inequality. For example, one of the reasons behind investment bias and property speculation is that local government revenue has been heavily leaning toward land transfer payments. And the problem of hidden debt also stems from the structural shortage of financial resources for local governments. Therefore, the allocation of financial resources between central and local governments needs to be reviewed and the latter’s resources should be increased.

In addition, a property tax — the equivalent of Japan’s fixed asset tax — should be introduced to curb property speculation. To boost private consumption, rural dwellers should be allowed to obtain urban household registrations and receive equal access to public services. This would eliminate the gap between the population of people living in cities (65% in 2022) and those with urban household registration (48% in 2022). The consequent boost in consumption would also help alleviate concerns about deflation and overcapacity.

The fundamental response to the problem of inequality should not be to tighten the screws or demand donations, but to strengthen institutional redistribution mechanisms, including reviewing the progressive income tax rate, creating an inheritance tax and improving social security. The third plenary session of the 20th CCP Central Committee will be held in July and is expected to set out the reform path to achieve Xi’s vision of “Chinese-style modernization.” There are concerns about how far this course will leverage the power of the market, but first, attention should be paid to the reforms’ substance.

[Note] This article was posted to the Japan Times on June 27, 2024:

https://www.japantimes.co.jp/commentary/2024/06/27/world/china-xi-jinping-economy-issues/

(Photo Credit: CFoto / Aflo)

Geoeconomic Briefing

Geoeconomic Briefing is a series featuring researchers at the IOG focused on Japan’s challenges in that field. It also provides analyses of the state of the world and trade risks, as well as technological and industrial structures (Editor-in-chief: Dr. Kazuto Suzuki, Director, Institute of Geoeconomics (IOG); Professor, The University of Tokyo).

Disclaimer: The opinions expressed in Geoeconomic Briefing do not necessarily reflect those of the International House of Japan, Asia Pacific Initiative (API), the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

-

From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 -

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 -

Harnessing China’s tech giants: The case of Jack Ma2025.06.11

Harnessing China’s tech giants: The case of Jack Ma2025.06.11 -

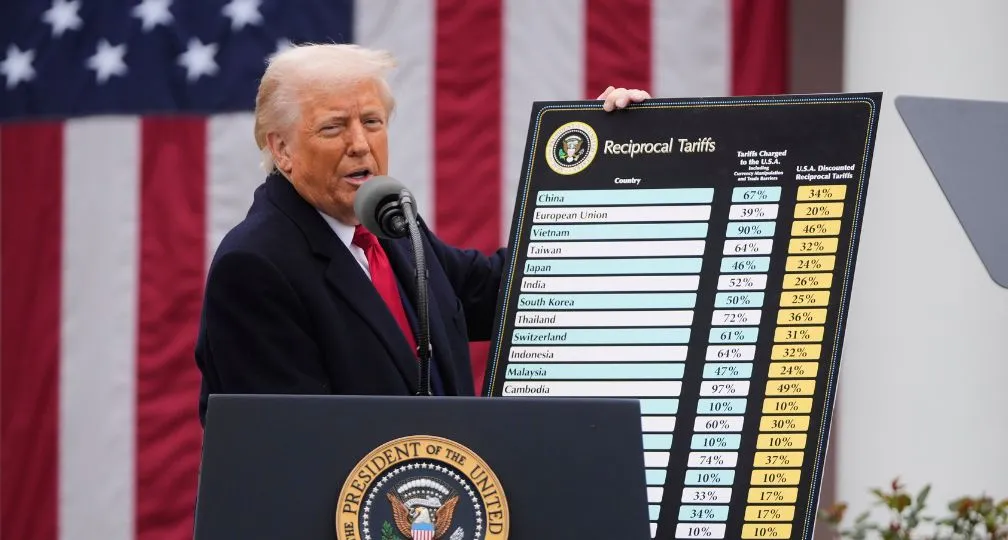

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31

The Courts Rule Trump’s April 2 Tariffs Illegal – What Happens Next?2025.05.31 -

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

Tariff Tracker: A Guide to Tariff Authorities and their Uses2025.05.29

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27 Trump’s Major Presidential Actions & What Experts Say2025.02.06

Trump’s Major Presidential Actions & What Experts Say2025.02.06 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25