India’s Geoeconomic Options in a Trumpian World

The second Trump administration has not only doubled down on its "America First" economic agenda but also sharpened its demands for total alignment from friends and rivals alike. Japan, the European Union, Canada, South Korea and Brazil have all faced tariffs, threats and diplomatic browbeating. India, despite its democratic credentials and shared anxieties about China, has been treated no differently. The tone is unmistakable. Washington wants total capitulation.

A Shock to Strategic Assumptions

For nearly two decades, successive U.S. administrations treated India as a long-term strategic partner. The logic was clear: India’s size, democratic identity and geostrategic position made it a natural counterweight to China. India benefited from this alignment without surrendering its prized strategic autonomy. Multialignment (engaging the U.S., Russia, Europe and the Global South simultaneously) became the cornerstone of Indian foreign policy.

Trump’s second term has ruptured this comfortable equilibrium. The quiet courtship of India has been quickly replaced by public rebukes and ultimatums to open sensitive sectors and sign trade concessions that privilege U.S. exporters or risk access to the American market. When India refused to give the U.S. political credit for the ceasefire with Pakistan or resisted opening its agricultural sector, the Trump administration’s patience snapped. But to blame the current rupture on these proximate disputes is to miss the larger point: Trump’s style is one of across-the-board coercion. What India is experiencing is part of a broader U.S. strategy of demanding submission from partners, not dialogue among equals.

Tariff Policy — Short-Term Pain and Long-Term Risk

At present, the macroeconomic impact of Trump’s tariffs on India is limited. Total merchandise exports to the U.S. constitute about 2% of Indian gross domestic product as the country’s growth model rests primarily on domestic consumption. By contrast, Vietnam — where exports to the U.S. dominate the economy — cannot afford even minor trade frictions. India’s relative insulation explains its ability to absorb tariff shocks without sliding into crisis.

Yet the more serious risk lies in the long-term rupture. The U.S. is India’s single largest export destination and an important source of technology and capital. If access to the U.S. market remains constrained, the risks of lower exports will be compounded by diminished appeal as an investment destination. Multinationals consider market access heavily in their location decisions. An India cut off from U.S. demand would be less attractive relative to Southeast Asian competitors.

Historical Memory and Red Lines

Why, then, does India resist bending under pressure when accommodation might seem economically expedient? Two reasons stand out.

The first is structural. India’s GDP is mainly driven by domestic demand. Private consumption contributes about 60% of output. Unlike export-driven economies, India can weather external shocks without economic collapse. This affords New Delhi a firmer hand in negotiation than countries that are deeply reliant on the global demand.

The second reason is emotional. India’s memory of colonial exploitation remains vivid. Two centuries of British rule transformed one of the largest economies into one of the poorest. This legacy has created a deep, cross-partisan reluctance to be seen as succumbing to foreign diktats. Any move that hints at surrendering sovereignty over critical sectors (such as agriculture and dairy) or its Pakistan policy risks igniting domestic backlash.

This is especially true regarding Pakistan. New Delhi has long considered its relationship with Islamabad an internal and bilateral matter not open to third-party mediation. Trump’s rhetoric, which has occasionally suggested credit-taking for ceasefires or offered unsolicited comments on Kashmir, strikes a particularly raw nerve. No Indian government, regardless of political orientation, can publicly concede ground on this issue without appearing weak.

Trump’s barrage of rhetorical attacks and policy demands has thus produced an unusual effect. Not compliance, but resistance. Within India’s strategic establishment, there is now visible determination to signal that New Delhi will not be cowed. The government appears willing to bear near-term economic pain to preserve its red lines. This does not mean India will abandon its relationship with the U.S.; rather, it underscores that India insists on being treated as an autonomous actor, not a subordinate ally.

Navigating Through the Storm

India’s response to the fluctuating vicissitudes of Trump 2.0 can be summed into a careful balance of three acts: selective accommodation, strategic patience and accelerated diversification.

Selective accommodation has meant identifying areas where modest concessions can generate goodwill without touching politically sensitive ground. Defense acquisitions are a prime example. Purchases of American military platforms serve dual purpose. It strengthens India’s own capabilities while producing the kind of “jobs and exports” headlines that appeal to Trump’s domestic narrative. Energy imports offer another safety valve. Expanding the intake of U.S. energy provides tangible benefits to American producers without undermining core Indian constituencies. These tactical offers are calculated efforts to avoid rupture while keeping the essence of autonomy intact.

Strategic patience rests on the recognition that India’s horizons extend beyond the lifespan of a single American presidency. Trump’s tenure, however disruptive, is finite. India’s development arc, by contrast, stretches across decades. The logic here is not to undertake fundamental restructuring under temporary duress, but to ride out the turbulence while keeping long-term priorities intact. The calculus is that future administrations in Washington may rediscover the value of treating India as a strategic partner.

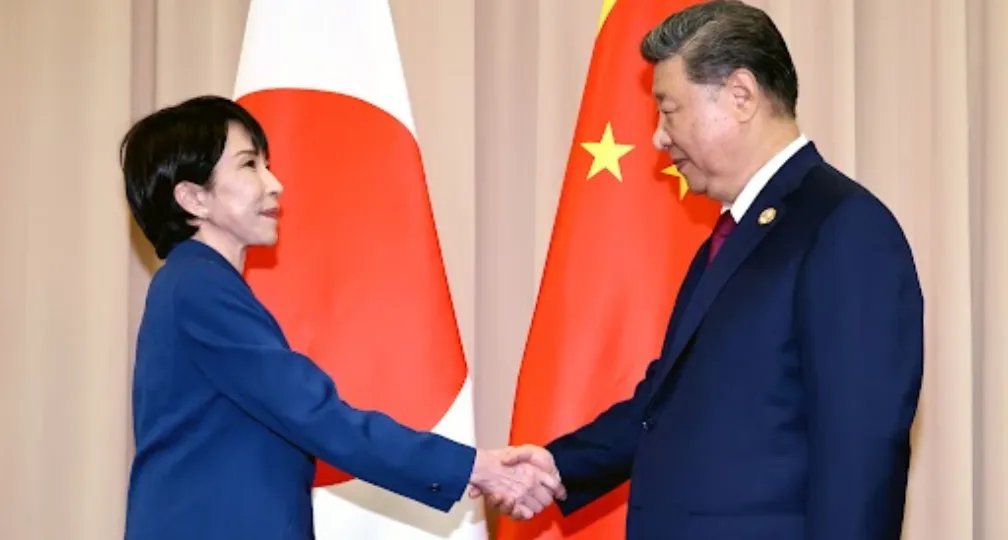

Accelerated diversification represents the most consequential pillar. New Delhi has redoubled efforts to strengthen ties with Japan, deepen trade negotiations with the European Union while carefully calibrating relations with China and broadening economic partnerships in Africa and Latin America.

In August, Prime Minister Modi’s visit to Japan led to a flurry of consequential agreements. The scheduling of the visit immediately before the Shanghai Cooperation Organization summit signaled the importance India attaches to its relationship with Japan. “The Quad” — conceived by former Japanese Prime Minister Shinzo Abe — remains the clearest expression of Tokyo-New Delhi alignment: a nonalliance platform for balancing China while preserving India’s strategic flexibility. Yet “the Quad’s” future is uncertain as U.S. priorities shift.

India’s external posture is being reinforced by domestic initiatives. Infrastructure investment and innovation to reduce the structural costs of doing business have gathered urgency.

Strategic Balance

The deeper lesson of Trump 2.0 for India is that assumptions about permanent U.S. indulgence were misplaced. American strategy has shifted from courting India as a counterweight to China to demanding economic alignment on U.S. terms. India cannot and will not accept this bargain. Its economic resilience, domestic political culture and historical memory all point toward a willingness to bear costs in order to preserve sovereignty.

India’s first prime minister, Jawaharlal Nehru, declared on the midnight of independence that the nation had made a “tryst with destiny.” Today that destiny demands not only growth and prosperity, but also dignity in the face of external pressure.

(Photo Credit: The Washington Post/Getty Images)

[Note] This article was posted to the Japan Times on Oct 29, 2025:

https://www.japantimes.co.jp/commentary/2025/10/29/world/indias-options-in-a-trumpian-world/

Geoeconomic Briefing

Geoeconomic Briefing is a series featuring researchers at the IOG focused on Japan’s

challenges in that field. It also provides analyses of the state of the world and trade risks, as well as

technological and industrial structures (Editor-in-chief: Dr. Kazuto Suzuki, Director, Institute of

Geoeconomics (IOG); Professor, The University of Tokyo).

Visiting Research Fellow

Manish Sharma is an ex-investment banker, with over two decades of experience spanning academia, consulting, think tank and corporate finance. His academic journey includes research and teaching positions at renowned institutions including Jawaharlal Nehru University, University of Tokyo, London School of Economics, and Doshisha Business School. Currently, he is an associate professor of economics, at Hosei University in Tokyo. Until 2012, Dr. Sharma served as Director (M&A) in the Corporate Finance Department at Daiwa Capital Markets' Tokyo headquarters, providing strategic financial guidance to major corporations. He subsequently transitioned to full-time academia, bringing his extensive practical knowledge to universities across Asia. His other notable experiences include 13 years of radio newscasting with NHK World, and running an investment advisory. His teaching and research interests cover Indian/ASEAN markets, tech sector, corporate finance, investments, valuation, geoeconomics and day-trading. Dr. Sharma holds a Ph.D. in Financial Economics.

View Profile-

Fed-Treasury Coordination as Economic Security Policy2026.02.13

Fed-Treasury Coordination as Economic Security Policy2026.02.13 -

What Takaichi’s Snap Election Landslide Means for Japan’s Defense and Fiscal Policy2026.02.13

What Takaichi’s Snap Election Landslide Means for Japan’s Defense and Fiscal Policy2026.02.13 -

Challenges for Japan During the U.S.-China ‘Truce’2026.02.12

Challenges for Japan During the U.S.-China ‘Truce’2026.02.12 -

India and EU Sign Mother of All Deals2026.02.09

India and EU Sign Mother of All Deals2026.02.09 -

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04

Orbán in the Public Eye: Anti-Ukraine Argument for Delegitimising Brussels2026.02.04 Fed-Treasury Coordination as Economic Security Policy2026.02.13

Fed-Treasury Coordination as Economic Security Policy2026.02.13 When Is a Tariff Threat Not a Tariff Threat?2026.01.29

When Is a Tariff Threat Not a Tariff Threat?2026.01.29 Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07

Oil, Debt, and Dollars: The Geoeconomics of Venezuela2026.01.07 India and EU Sign Mother of All Deals2026.02.09

India and EU Sign Mother of All Deals2026.02.09